AutoNation (AN): Exploring Valuation After Strong Momentum and Recent Gains

Most Popular Narrative: 0.9% Undervalued

According to the most widely followed narrative, AutoNation’s current share price stands just below estimated fair value, suggesting modest undervaluation based on future earnings and margin projections.

AutoNation's robust growth in After-Sales (service, parts, and collision), which delivered record revenue and expanding gross margins, positions the company to benefit from the long-term increase in vehicle age and a growing car parc in the U.S. This secular shift is likely to underpin resilient, recurring high-margin revenue and support future earnings stability and growth.

Curious what’s driving this razor-thin valuation gap? There’s a hidden formula at play here, blending optimistic growth assumptions and unexpected margin shifts. Intrigued by which future projections tip the scale just enough to call this stock undervalued? The numbers behind this consensus might surprise you. Find out what’s fueling the analysts’ math in the full narrative.

Result: Fair Value of $221.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising competition from digital-first retailers and the growing adoption of electric vehicles could still disrupt AutoNation's margin growth story in the future.

Find out about the key risks to this AutoNation narrative.Another View: Checking with Our DCF Model

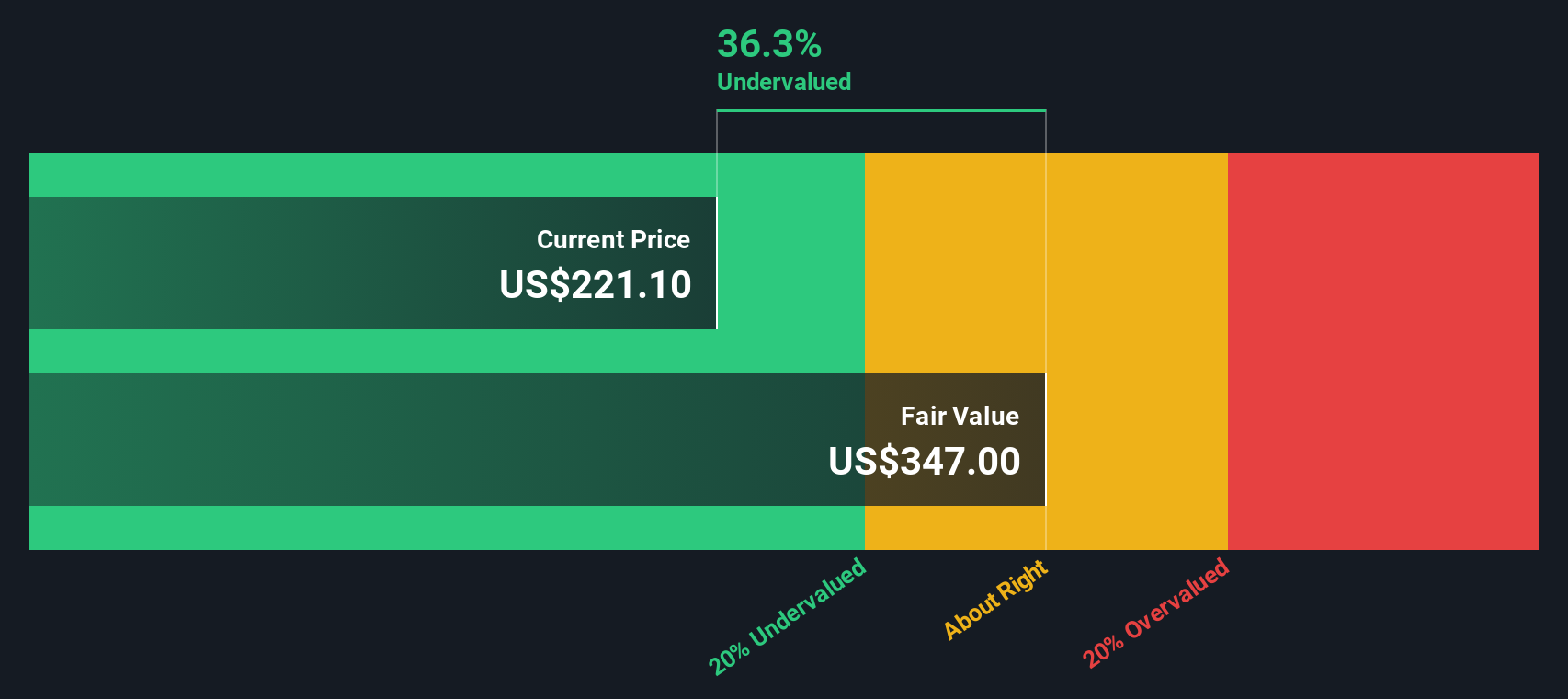

Taking a fresh look using the SWS DCF model, we see a very different picture compared to traditional metrics. This method suggests the stock is actually undervalued. Could this gap signal untapped potential, or is something being missed?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own AutoNation Narrative

If you are not convinced by these takes or want to chart your own path, you can dive into the data and build a narrative of your own in just a few minutes. Do it your way.

A great starting point for your AutoNation research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t leave potential gains on the table. Level up your research by targeting stocks with standout financials, exceptional yields, or future-focused themes using tailored screeners.

- Jumpstart your portfolio with penny stocks that have strong financial foundations by checking out penny stocks with strong financials.

- Boost your passive income with companies offering healthy dividend yields by exploring dividend stocks with yields > 3%.

- Tap into the next wave of medical breakthroughs by finding innovators in healthcare AI through healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal