Iron Mountain (IRM): Valuation in Focus After €1.2 Billion Senior Notes Refinance and Debt Restructuring

If you are holding or watching Iron Mountain (IRM) right now, the company’s newest move is likely to have caught your eye. On September 10, Iron Mountain completed a €1.2 billion senior notes offering, upsized from an earlier proposed amount. The proceeds are earmarked to redeem existing GBP-denominated senior notes and strengthen the balance sheet. This step could influence how investors judge Iron Mountain’s capital flexibility going forward.

Zooming out, it has been a mixed ride for the stock. After a lengthy stretch of strong long-term gains, Iron Mountain shares have slid about 11% over the past year, with momentum fading in recent months even as the company executed on strategic financings like this debt raise. Despite a rebound of nearly 10% in the past month, the stock remains 4% lower year-to-date, reminding investors that both growth prospects and risk perceptions can shift quickly in this market environment.

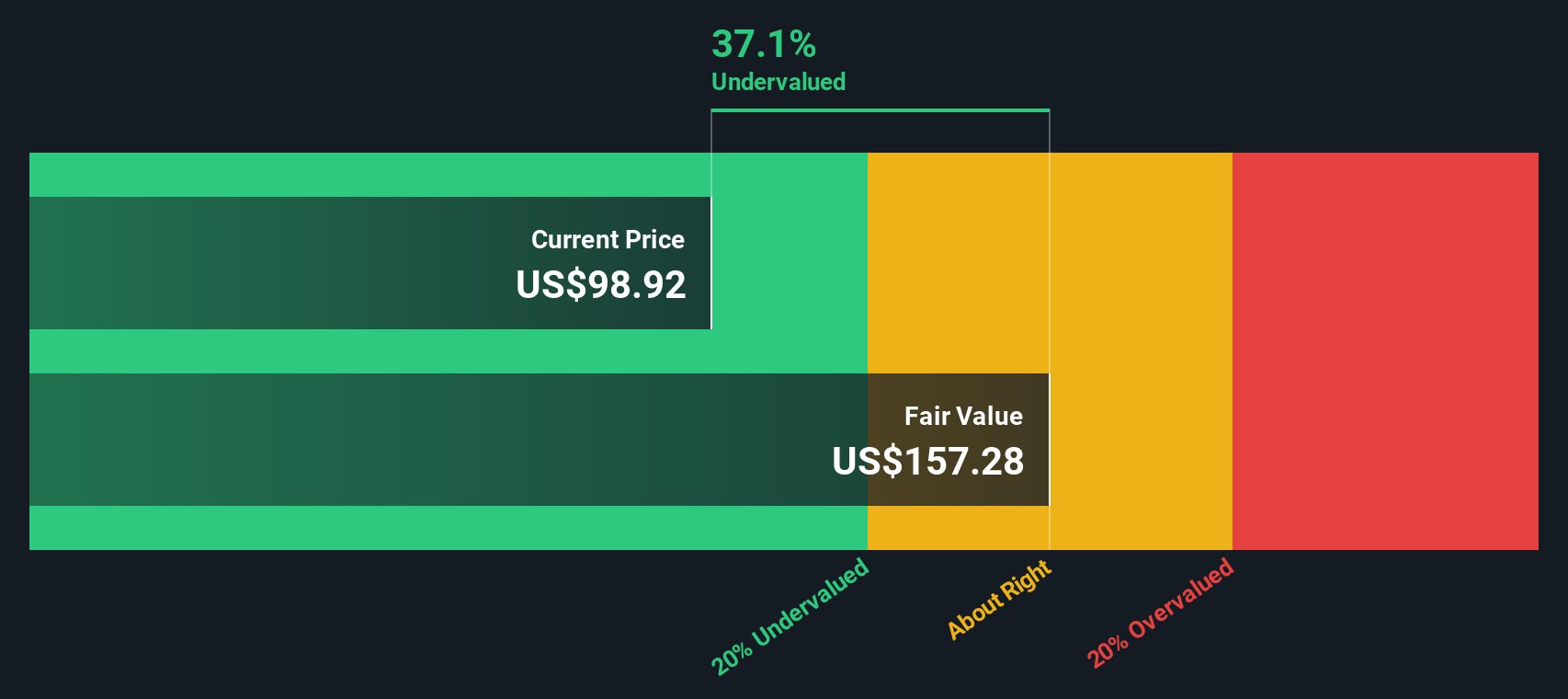

With all these moving parts, investors may be asking whether the recent dip presents an opportunity to acquire Iron Mountain at a discount, or if the market has already reflected the financial benefits from its debt restructuring.

Most Popular Narrative: 12.4% Undervalued

The dominant narrative sees Iron Mountain as undervalued by more than 12 percent, pointing to sizeable headroom relative to consensus fair value estimates.

The highly fragmented market for Asset Life Cycle Management and data center decommissioning presents a significant runway for further organic and cross-sell growth. Iron Mountain can leverage its global footprint and trusted reputation, which should support long-term revenue and EBITDA acceleration.

Curious how analysts arrive at such a bullish fair value? There is a mix of future growth assumptions and bold projections for earnings and margins. The future multiple assigned here might surprise you. Want to see which key numbers power this optimistic outlook, and if they pass your own scrutiny?

Result: Fair Value of $114.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, mounting debt and fierce competition in digital solutions could put pressure on Iron Mountain’s future margins and test the optimism behind its current valuation story.

Find out about the key risks to this Iron Mountain narrative.Another View: Discounted Cash Flow Puts the Spotlight on Value

Taking a different approach, our DCF model also points to Iron Mountain being undervalued. This method, which projects future cash flows, provides a fresh angle for evaluating whether the market is overlooking something important. Which framework do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Iron Mountain Narrative

Of course, if you have a different perspective or want to take a hands-on approach, building your own narrative from scratch takes just a few minutes. Do it your way

A great starting point for your Iron Mountain research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Ready for Your Next Winning Stock Idea?

Don’t limit yourself to just one opportunity. Let Simply Wall Street help you pinpoint smart moves that match your ambitions and your appetite for growth.

- Uncover overlooked value by targeting companies trading below their potential with our list of undervalued stocks based on cash flows.

- Capitalize on tomorrow’s healthcare breakthroughs by browsing top contenders identified among healthcare AI stocks.

- Boost your portfolio’s income stream by seeking out consistent performers paying over 3 percent, highlighted in dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal