Howmet Aerospace (HWM): Assessing Valuation as Analyst Optimism Rises on Defense and Commercial Aerospace Strength

Howmet Aerospace (HWM) is attracting investor attention this week as recent news highlights the company’s ability to benefit from momentum in the commercial aerospace market. Additionally, government defense spending is supporting its outlook. With analysts widely endorsing the stock and defense budget allocations expected to increase, many are watching Howmet’s next moves as a possible indicator for the sector. This situation puts the focus on both near-term catalysts and longer-term value.

This wave of optimism comes after a year in which Howmet Aerospace’s share price nearly doubled, with a 99% gain over the past twelve months. Momentum has continued, with the stock up almost 10% over the past month and strong multi-year returns supporting its growth profile. Alongside revenue and profit growth driven by aerospace and defense demand, investor sentiment has shifted as the latest developments raise new possibilities for the future.

After a year of strong gains and significant optimism already reflected in the price, the question is whether this represents an opportunity to participate in Howmet’s ongoing growth or if the market has already incorporated all the positive factors.

Most Popular Narrative: 8.2% Undervalued

The most popular narrative considers Howmet Aerospace to be undervalued by just over 8%, with recent revisions supporting a higher fair value than previously estimated.

Major capacity expansions in high-margin engine products and industrial gas turbines, backed by customer agreements, are set to ramp in 2026 and 2027. These projects should deliver significant revenue growth and incremental margin expansion as initial launch costs normalize.

Want to know what’s driving this bullish valuation? The secret sauce of this narrative is based on a handful of bold financial forecasts that could dramatically shape future cash flows. What combination of growth rates and margin targets might push Howmet’s value well beyond recent market highs? The answer could surprise even seasoned investors.

Result: Fair Value of $204.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, elevated capital expenditures without immediate returns and reliance on major aerospace customers could quickly challenge these optimistic forecasts if market momentum reverses.

Find out about the key risks to this Howmet Aerospace narrative.Another View: Are the Shares Actually Expensive?

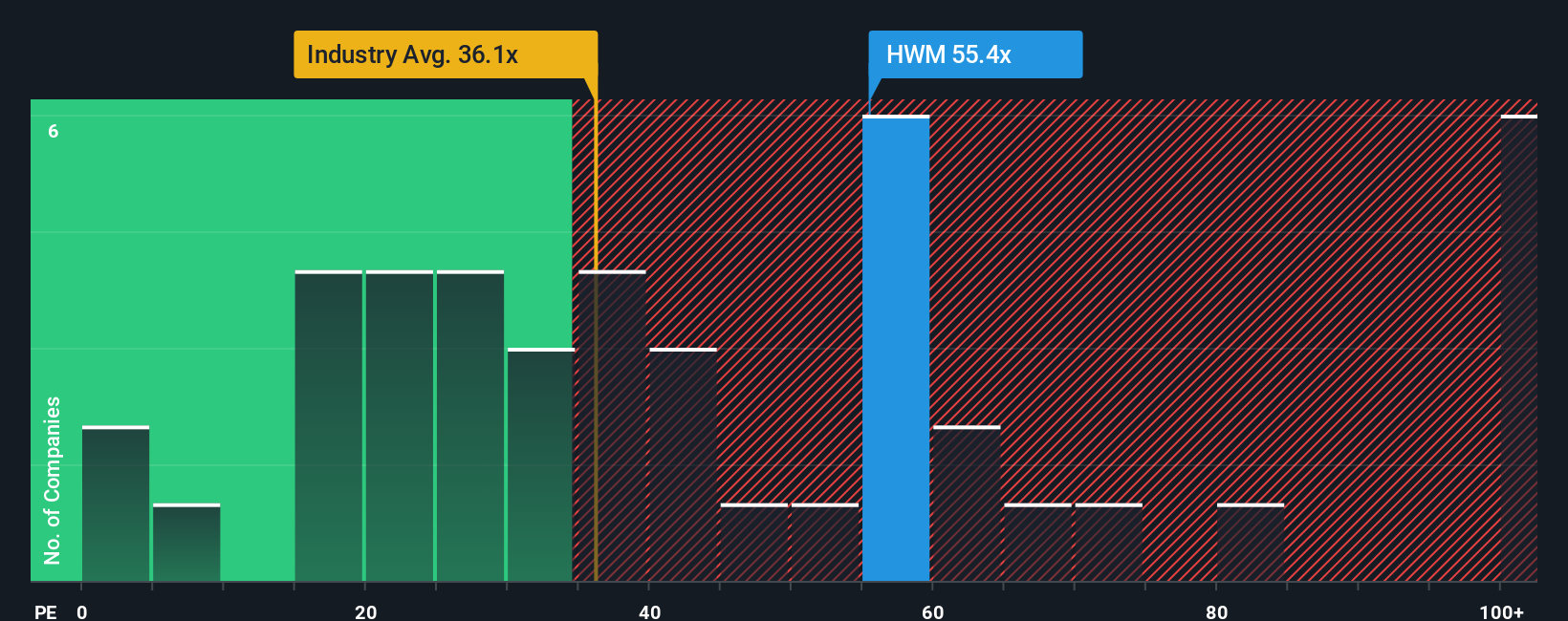

Looking at Howmet Aerospace’s valuation from a different perspective, the company's current price appears high compared to similar businesses in the industry. This approach suggests the stock could be overvalued right now. Is the market pricing in too much optimism, or is there more growth still to come?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Howmet Aerospace Narrative

If you want to explore the data for yourself and come to your own conclusions, you can quickly put together a personalized view in just a few minutes. Do it your way.

A great starting point for your Howmet Aerospace research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by keeping an eye on fresh opportunities. Don’t let the market move without you. Here are three standout trends waiting for your attention:

- Capture value by targeting strong financials in up-and-coming markets. Check out penny stocks with strong financials for promising opportunities beyond the mainstream.

- Ride the wave of healthcare transformation and pinpoint innovation leaders by starting your research with healthcare AI stocks.

- Boost your income strategy and prioritize long-term compounding with stocks offering attractive yields. See which companies pass the test through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal