Is BXP's (BXP) Dividend Cut a Strategic Shift in Capital Allocation Priorities?

- Earlier this month, BXP, Inc.’s Board of Directors declared a quarterly cash dividend of US$0.70 per share for the third quarter of 2025, payable on October 31, 2025, to shareholders of record as of September 30, 2025.

- This reduction in BXP’s dividend signals management’s effort to conserve cash, which can influence investor confidence and expectations for future capital allocation.

- We’ll look at how BXP’s lowered dividend payout could influence analyst expectations for growth, earnings, and cash flow resilience.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

BXP Investment Narrative Recap

To be a BXP shareholder today, you need to believe in the resilience of premier office and life sciences real estate in top-tier markets, as well as the company's ability to weather leasing and rent challenges. The recent dividend reduction to US$0.70 per share signals a conservative shift in capital allocation, but this move does not appear to fundamentally alter the key near-term catalyst, demand for prime, highly amenitized workspace, or the biggest risk, which remains weak leasing trends and ongoing occupancy pressure.

Among recent company news, the Board's affirmation of a higher quarterly dividend in June stands out for context, underlining how this new dividend reduction marks a clear change in payout policy. This development comes as BXP pursues high-profile development projects and asset recycling strategies that could drive future growth, but which also heighten near-term scrutiny on cash preservation and balance sheet strength.

By contrast, investors also need to keep an eye on how stubbornly low occupancy in newly delivered developments could affect future...

Read the full narrative on BXP (it's free!)

BXP's outlook anticipates $3.7 billion in revenue and $368.8 million in earnings by 2028. This scenario is based on a 2.5% annual revenue growth rate and an increase in earnings of about $364 million from the current $4.9 million.

Uncover how BXP's forecasts yield a $77.11 fair value, in line with its current price.

Exploring Other Perspectives

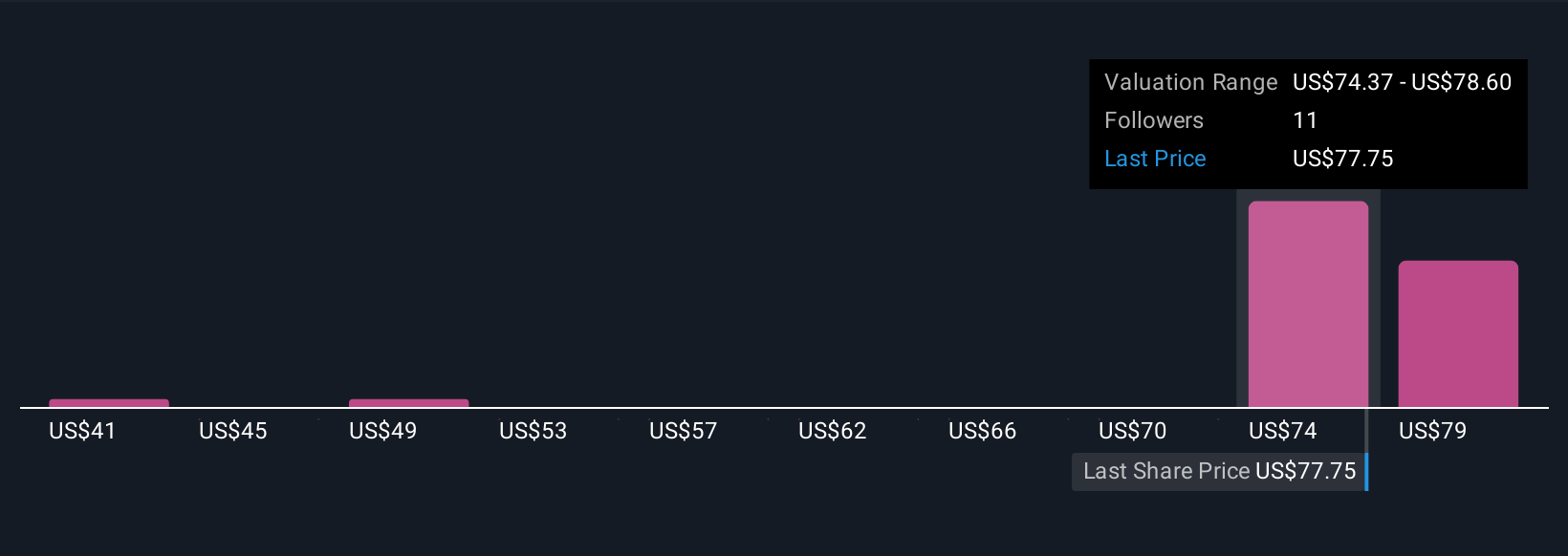

Simply Wall St Community participants offered US$40.50 to US$82.80 fair value estimates, revealing a wide range across four different outlooks. With occupancy trends still a pressing risk highlighted by analysts, your own view on future leasing momentum could make a big difference in assessing BXP’s prospects.

Explore 4 other fair value estimates on BXP - why the stock might be worth as much as $82.80!

Build Your Own BXP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BXP research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free BXP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BXP's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal