Century Aluminum (CENX): Assessing Valuation After New Tariffs and Mt. Holly Restart Potential

Century Aluminum (CENX) just gave investors a lot to think about. The company’s shares jumped 6.4% in the last session, fueled by a spike in trading volume after news of fresh 50% tariffs on aluminum imports. With U.S. prices poised to climb, Century Aluminum stands to benefit, especially as it restarts the Mt. Holly smelter at full production and bolsters its financial position with a $395 million debt financing package. All these moves could reshape its growth prospects and earnings potential in the months ahead.

Stepping back, it has already been a standout year for Century Aluminum. Since the start of the year, the stock has surged over 45% and is up nearly 80% over the past twelve months. Recent initiatives, like restarting operations in South Carolina and securing new funding, suggest momentum is building as the company capitalizes on favorable regulatory and market shifts.

But with the stock riding high, how much upside is left? Is the market accurately valuing future growth, or does Century Aluminum present a rare buying opportunity at this stage?

Most Popular Narrative: 3.5% Undervalued

According to the most widely followed narrative, Century Aluminum is currently trading at a slight discount to its fair value. Analysts see upside potential based on robust future growth projections and improved profitability.

The expansion and restart of Mt. Holly, along with progress on a new U.S. smelter, positions Century Aluminum to meaningfully increase U.S. primary aluminum production. This enables the company to capture rising domestic demand driven by reshoring of supply chains and incentivized by government tariffs and trade protections. These factors support future revenue growth and improved fixed cost absorption, thus enhancing net margins.

Curious what is behind this bullish outlook? Discover why a series of aggressive growth targets and profitability assumptions set the stage for a valuation few expected. Think accelerating revenues, expanding margins, and a profit forecast that turns heads. Which critical figures are propelling this premium? Unlock the details and see how the numbers stack up against market expectations.

Result: Fair Value of $27.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts in U.S. trade policy or unexpected spikes in energy costs could quickly challenge Century Aluminum's bullish outlook and place pressure on future returns.

Find out about the key risks to this Century Aluminum narrative.Another View: SWS DCF Model Perspective

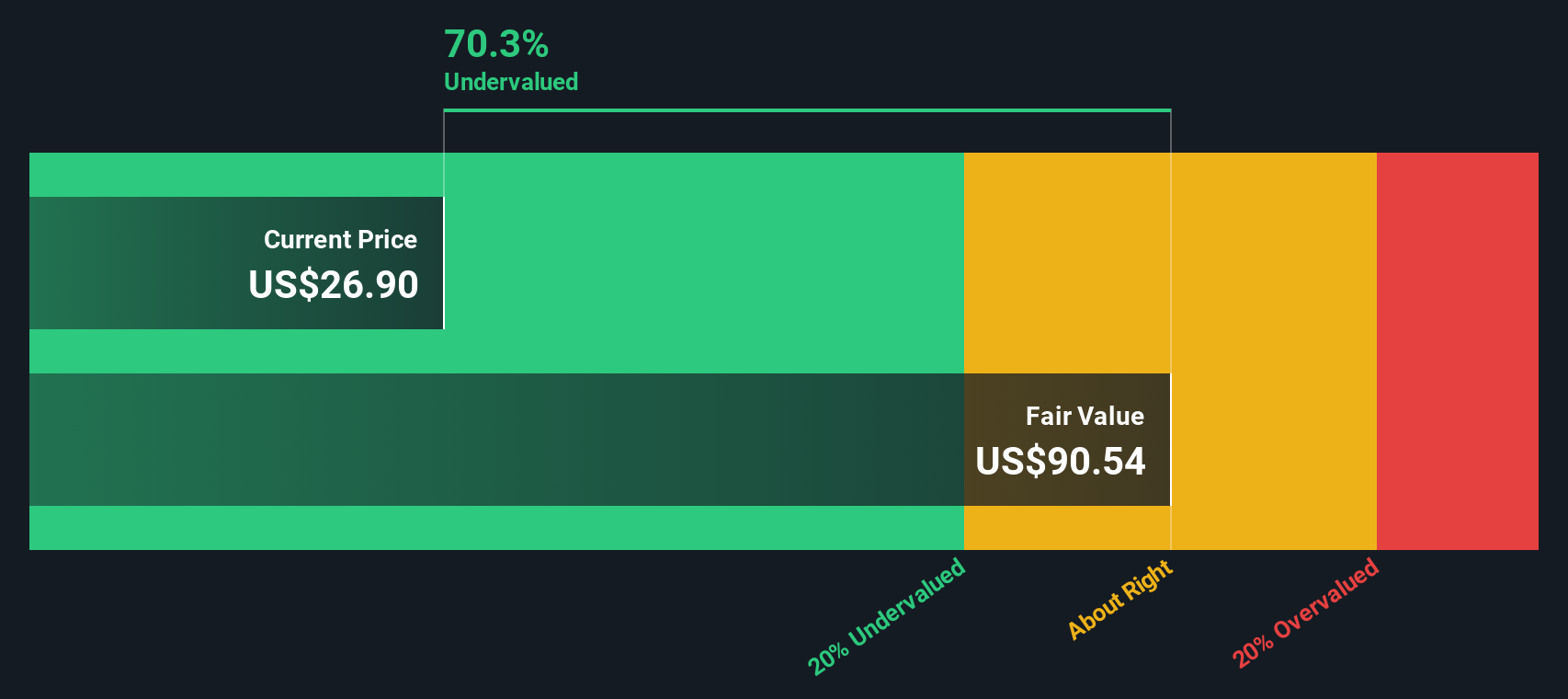

While analysts see Century Aluminum as undervalued due to earnings growth forecasts, our DCF model paints an even more bullish picture. This approach values future cash flows and offers a very different take on the company’s true worth. Could the real opportunity be even bigger than what price targets suggest?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Century Aluminum Narrative

If you see the story unfolding differently or want to run your own numbers, you can easily craft your own narrative from scratch in just a few minutes using our tools, and Do it your way.

A great starting point for your Century Aluminum research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more smart investment angles?

Uncover opportunities beyond Century Aluminum. Don’t miss your chance to get ahead of the crowd by tapping into fresh ideas that savvy investors are using right now.

- Boost your portfolio’s income stream by targeting the latest dividend stocks with yields > 3%, which are powering consistent yields above 3%.

- Get in early on game-changing companies making breakthroughs in AI by checking out AI penny stocks that are set to lead tomorrow’s markets.

- Strengthen your value playbook by zeroing in on undervalued stocks based on cash flows trading below their cash flow potential and presenting compelling upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal