Netflix (NFLX) Valuation in Focus as Landmark Boxing Event Signals Broadening Live Sports Strategy

If you have been watching Netflix (NFLX) lately, you are not alone. More than 41 million viewers tuned in for the recent historic men's championship boxing match. The event, distributed in partnership with Joe Hand Promotions, quickly became the most-watched boxing match of the century and underscores Netflix’s leap into live sports. For investors, this milestone is worth a close look, as it not only signals growing demand for live events on the platform but also strengthens Netflix’s push to diversify its content and revenue streams.

This entry into major sporting events comes on the back of several strategic changes, including the rollout of ad-supported subscription tiers that have added a new dynamic to its business model. While competitive pressures remain high in the streaming space, with rivals eyeing similar moves into live sports, the momentum appears to be building for Netflix. Its shares have climbed 70% over the past year and remain well ahead on a year-to-date basis. It's a sharp contrast to the slight pullback after last quarter’s earnings, suggesting the market is reacting positively to recent developments and growing confidence in Netflix’s evolving strategy.

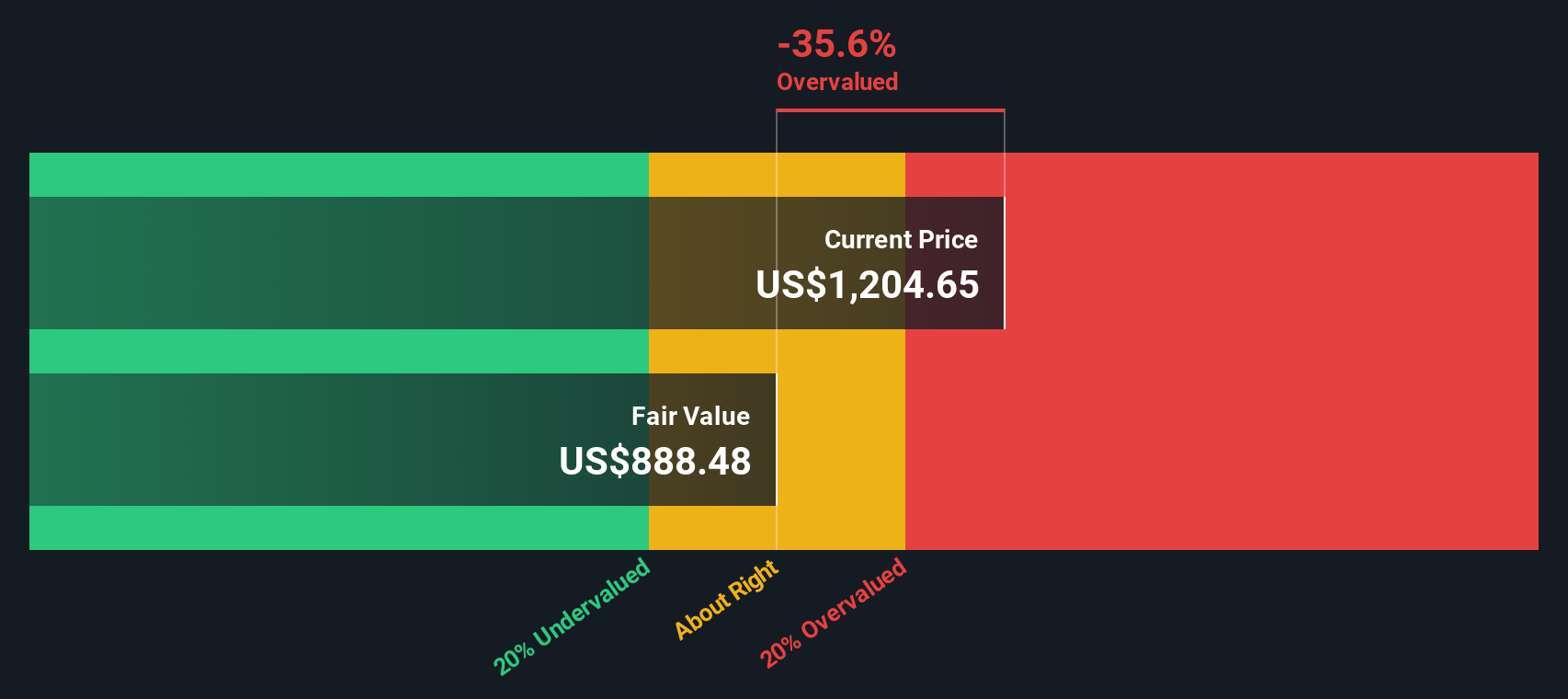

After such a strong run and with Netflix breaking into new territory, the real question now is whether the current price reflects the company’s future growth or if, perhaps, there is still value for investors looking to buy in.

Most Popular Narrative: 50% Overvalued

According to MichaelP, the current Netflix share price is trading well above what the narrative considers fair value. This reflects the market’s optimism and perhaps heightened expectations for future growth.

"I believe there is a greater chance than not, where due to the lack of profitable scale from their DTC offerings, these smaller streaming players may consider re-leasing more of their content library back to the likes of bigger streamers to generate a good return on the content and IP. We’re already seeing some of this occur. Smaller streaming platforms will likely realise there’s no point in owning great content and IP if you can’t monetise it profitably with your own smaller streaming platforms. So Netflix now holds the leverage over smaller content owners who don’t have the same scale."

Curious why this narrative values Netflix so much lower than the market? Discover which unexpected financial drivers, beyond subscriber numbers, shape this bold valuation call. The analysis challenges the consensus with unique, quantitative growth and margin assumptions that could signal major shifts. Want the full inside story? Keep reading for the critical projections and see what could be missing from the market’s euphoric pricing.

Result: Fair Value of $797 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing strikes within the entertainment industry and unexpected shifts in global competition could quickly challenge Netflix’s current growth outlook and market leadership.

Find out about the key risks to this Netflix narrative.Another View: SWS DCF Model

While the user-driven valuation suggests Netflix is trading well above fair value, our SWS DCF model comes to a similar conclusion, indicating the shares are also overvalued based on future cash flow projections. However, does either approach truly capture the full growth story ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Netflix Narrative

If these perspectives do not quite fit your own, or you want to dive deeper into the numbers yourself, you can easily craft a narrative based on your findings in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Netflix.

Looking for More Standout Investment Opportunities?

Don't let great potential slip by. Unlock fresh stock ideas right now using tools savvy investors rely on. Get ahead by targeting what matters to you most.

- Snap up vital income streams and pursue reliable returns by checking out dividend stocks with yields > 3%, spotlighting companies with robust yields over 3%.

- Seize the chance to invest early in cutting-edge industries by tapping into AI penny stocks, featuring innovators powering the artificial intelligence boom.

- Catch bargain opportunities in today's volatile market by leveraging undervalued stocks based on cash flows, where leading stocks based on solid cash flows await your review.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal