Will New Leadership at Skyward Specialty Insurance Group (SKWD) Signal a Shift in Growth Ambitions?

- Skyward Specialty Insurance Group recently appointed Christopher Zitzmann as President of Inland Marine and Transactional Property, bringing his 20 years of industry expertise to the leadership team.

- This move highlights the company’s intention to strengthen its specialized insurance lines and leverage experienced talent for business innovation and market expansion.

- To understand the effects of Zitzmann’s appointment on Skyward’s investment case, we’ll examine how leadership expertise could accelerate targeted business growth.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Skyward Specialty Insurance Group Investment Narrative Recap

To be a shareholder in Skyward Specialty Insurance Group, you need to believe in the company’s ability to use experienced leadership and targeted innovation to drive growth across niche insurance markets. The hiring of Christopher Zitzmann as President of Inland Marine and Transactional Property may strengthen Skyward’s positioning in specialized lines but is unlikely to offset the most important near-term catalyst, continued expansion in complex markets like aviation and life sciences, or meaningfully reduce the risk from underperformance in the legacy alternative investment portfolio, which remains a source of earnings volatility as it is run off.

One recent development that stands out is Skyward’s June 2025 entry into the aviation insurance segment through the acquisition of Acceleration Aviation Underwriters, marking its commitment to diversify and expand into underserved, complex markets. This aligns closely with the company’s main growth catalyst: capturing premium growth in specialized sectors by leveraging both leadership expertise and innovative product offerings, a strategy that could gain additional momentum following Zitzmann’s arrival.

Yet, in contrast to the company’s operational advances, investors should also be aware that volatility tied to the transition from alternative investments continues to present...

Read the full narrative on Skyward Specialty Insurance Group (it's free!)

Skyward Specialty Insurance Group's outlook anticipates $1.7 billion in revenue and $208.3 million in earnings by 2028. This projection is based on a forecasted annual revenue growth rate of 11.1% and an increase in earnings of $76.3 million from the current $132.0 million.

Uncover how Skyward Specialty Insurance Group's forecasts yield a $61.00 fair value, a 30% upside to its current price.

Exploring Other Perspectives

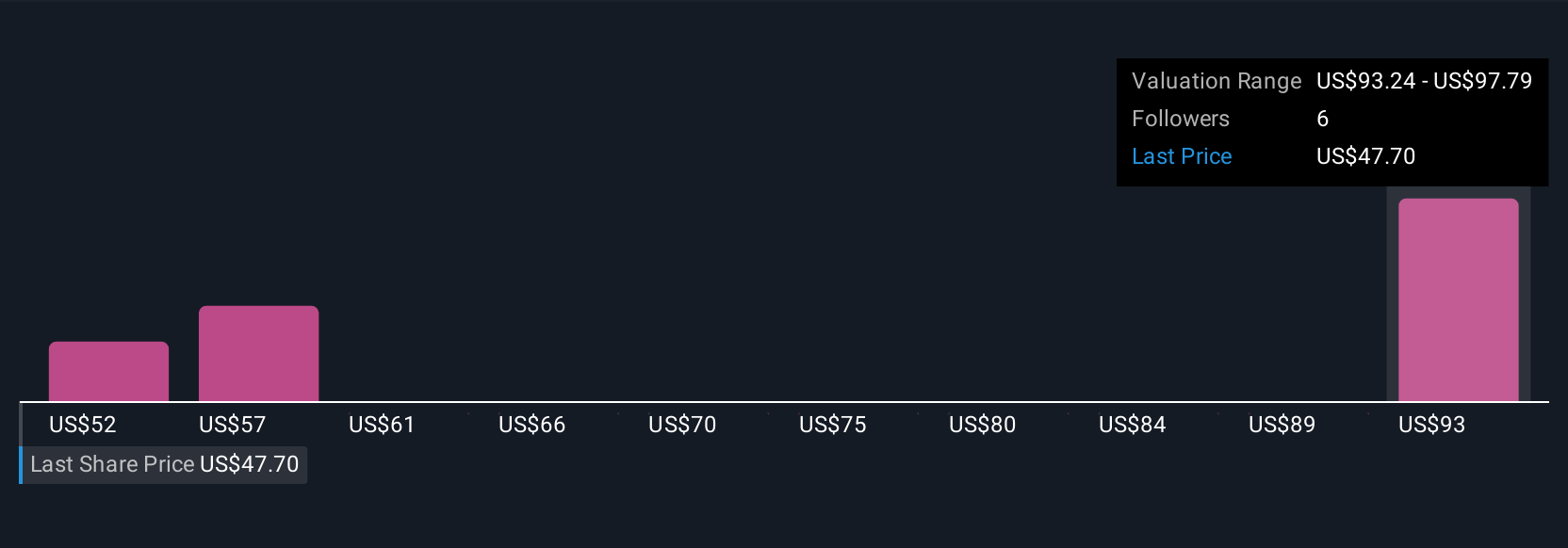

The Simply Wall St Community’s four fair value estimates for Skyward Specialty Insurance Group range widely from US$52.26 to US$104.48 per share. While the community reflects a broad spectrum of outlooks, the persistent risk from the company’s legacy investment portfolio remains a key issue that could influence future earnings quality and share price performance.

Explore 4 other fair value estimates on Skyward Specialty Insurance Group - why the stock might be worth over 2x more than the current price!

Build Your Own Skyward Specialty Insurance Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Skyward Specialty Insurance Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Skyward Specialty Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Skyward Specialty Insurance Group's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal