Is Lithia Shares a Bargain After Recent Volatility and Earnings Forecasts for 2025?

If you have Lithia Motors on your watchlist, you are probably wondering whether now is the right time to make a move. After all, the stock has proven it can deliver impressive gains, surging nearly 20% over the past year and climbing an eye-catching 54.7% across five years. But it is not all up and to the right. More recently, the shares are down a modest 1.6% in the last week, while bouncing back 11.0% over the past month. Year-to-date, the story is more mixed, with the stock down 4.2%. This swingy performance has kept investors guessing about what comes next and whether Lithia is set up for long-term growth or facing fresh risks as market conditions evolve.

Behind these numbers are evolving trends in the automotive retail sector and broader economic signals. As one of the largest auto retailers in North America, Lithia Motors is sensitive to demand shifts and changing consumer preferences, especially as buyers adjust to higher interest rates and lingering supply chain questions. All of this makes it a particularly interesting stock from a valuation perspective right now. Our analysis rates its value score as a 3 out of 6, meaning it is considered undervalued according to three of the six major metrics commonly used to evaluate companies.

To give you a clearer picture, let’s break down those valuation methods one by one. If you are looking for an even more actionable way to cut through the noise, stay with us until the end for a practical approach to decision-making that could give you an extra edge.

Lithia Motors delivered 19.7% returns over the last year. See how this stacks up to the rest of the Specialty Retail industry.Approach 1: Lithia Motors Discounted Cash Flow (DCF) Analysis

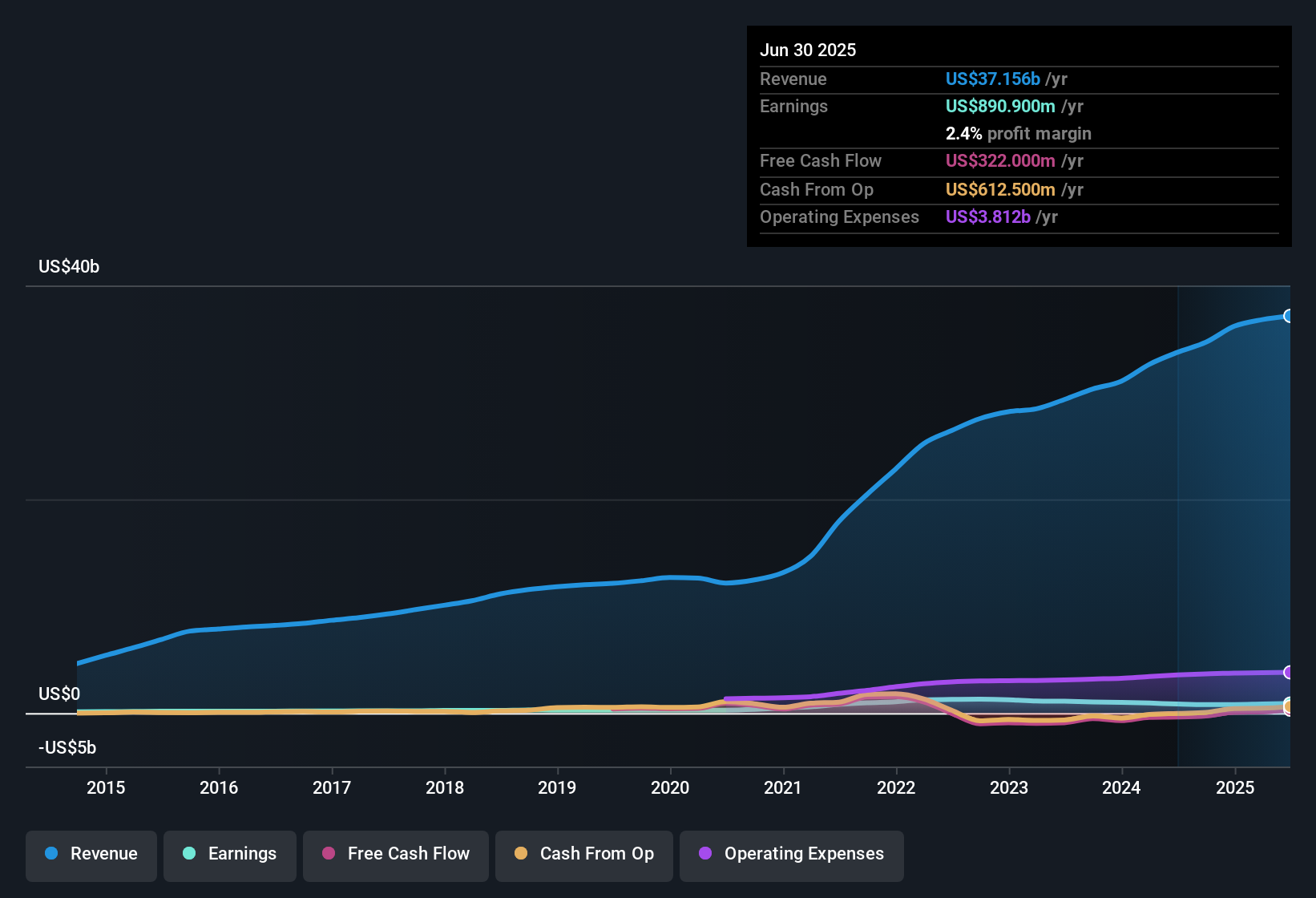

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and then discounts them back to today’s value, offering an estimate of what the business is truly worth right now. DCF analysis is especially useful for businesses like Lithia Motors, where cash flow trends play a central role in long-term value.

Currently, Lithia Motors is generating $280 million in free cash flow, according to its latest reported figures. Looking out over the next decade, analysts estimate this number will grow steadily and reach roughly $989 million by 2035. For the next few years, projections are based on analyst research. After five years, projections rely on extended forecasts by financial data providers. These projections factor in both specific analyst inputs and generalized growth rates based on industry trends.

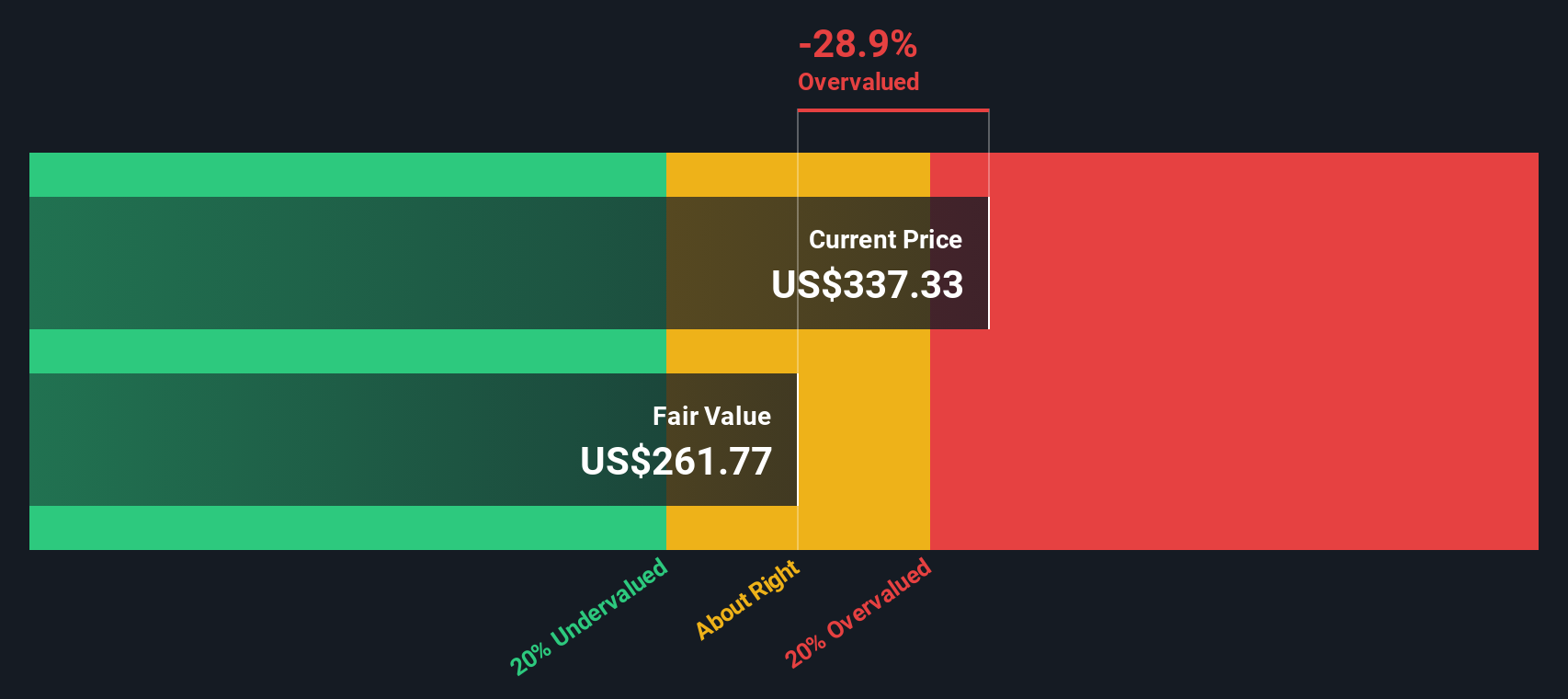

At present, the DCF model estimates Lithia Motors’ fair intrinsic value at $261.77 per share. When compared to its current trading price, this suggests the stock is 27.6% overvalued. Investors should note that while DCF is a thorough valuation approach, it is only as reliable as the underlying projections, and market conditions can shift quickly.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Lithia Motors.

Approach 2: Lithia Motors Price vs Earnings

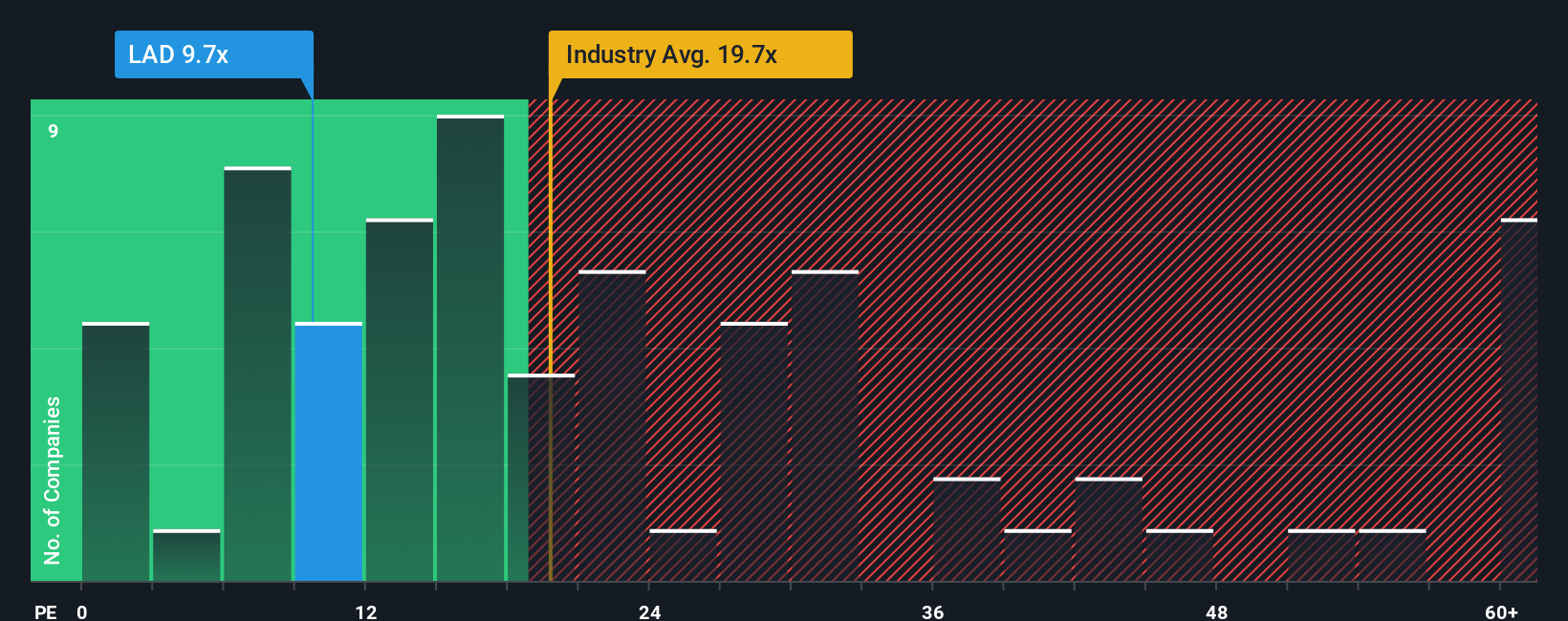

For profitable companies like Lithia Motors, the Price-to-Earnings (PE) ratio is a widely recognized and practical valuation metric. This ratio makes it easy to compare how much investors are willing to pay for each dollar of earnings, providing a quick sense of market expectations about the company’s future growth and risk compared to others in its sector.

Growth prospects and potential risks play a big role in what qualifies as a “normal” or “fair” PE ratio. Companies with strong earnings growth potential or more stable business models can sustain higher PE multiples, while those facing headwinds or more cyclical earnings often trade at lower ratios.

Lithia Motors currently trades at a PE ratio of 9.6x. Compared to the Specialty Retail industry average of 18.7x and a peer average of 13.5x, Lithia’s valuation seems modest. However, rather than just comparing to industry or peers, Simply Wall St uses a “Fair Ratio” set at 16.6x for this case. This figure blends factors like company growth, industry trends, profit margins, market size, and risk. This tailored benchmark helps highlight whether the stock’s current valuation properly reflects its prospects and challenges and provides a more comprehensive picture than simple one-to-one comparisons.

Comparing Lithia’s current PE to its Fair Ratio, the stock appears significantly undervalued based on this holistic standard.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Lithia Motors Narrative

Earlier we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. In simplest terms, a Narrative is your own story about a company. It is your perspective on where the business is heading, paired with your assumptions for key numbers like fair value, future revenue, earnings, and margins.

Narratives connect a company’s story with a financial forecast and use that to estimate what the business is truly worth. They offer a dynamic, accessible way to inform your decisions, available right on Simply Wall St’s Community page, where millions of investors share and compare their views.

This approach lets you track how Fair Value compares to the current share price and decide if a stock like Lithia Motors aligns with your investing strategy, all based on your own logic and expectations. Narratives are updated automatically as new information comes in, such as earnings reports or industry news, so your view stays relevant without extra work.

For example, some investors’ Narratives see Lithia’s fair value as high as $500, driven by faith in its aftersales and digital expansions. Others are more cautious and estimate it at just $310, focusing on risks like regulatory change and competitive pressure.

Do you think there's more to the story for Lithia Motors? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal