Brown & Brown (BRO): Evaluating Valuation After Leadership Shift in International Operations

Brown & Brown (BRO) just made a move that’s got investors leaning in. COO Steve Hearn has been tapped to take charge of all operations outside North America, spanning the Retail and Specialty Distribution segments. Executive shifts like this might sound like a simple org chart update, but for a company eyeing global growth, putting a seasoned leader at the international helm could signal bigger ambitions or a fresh approach to global strategy. It’s a reminder that even subtle changes at the top can ripple through a business as diverse and dispersed as Brown & Brown.

Looking at the stock’s performance over the past year, it’s clear the market has been recalibrating expectations amid internal changes and wider macro trends. Shares are down nearly 10% for the year, with pressure intensifying recently. Momentum has faded after a period of strong multi-year gains. Notably, Brown & Brown’s multi-year track record remains impressive, though the past few months have seen a shift in sentiment as investors assess risks around growth and execution. The management update arrives at a time when the company’s story seems at an inflection point.

Given the new leadership overseas and a lukewarm share price, is Brown & Brown setting the stage for a comeback, or are investors already factoring in any future upside?

Most Popular Narrative: 14.9% Undervalued

According to the most followed analyst narrative, Brown & Brown currently trades below its consensus fair value, reflecting optimism about future earnings and strategic growth initiatives.

The company's effective cost management and debt repayment strategies have led to reduced interest expenses and an improved EBITDAC margin by 110 basis points. This focus on managing financial liabilities could enhance future net margins and earnings.

Curious how Brown & Brown could outpace sector expectations? The explanation behind this undervalued call combines sharp financial discipline and ambitious profit projections. Want to see the aggressive numbers included in the market’s target? The full story uncovers the bold assumptions behind this valuation.

Result: Fair Value of $109.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, tightening CAT property rates and unexpected shifts in medical or pharmacy costs could put pressure on Brown & Brown’s future earnings and reduce growth optimism.

Find out about the key risks to this Brown & Brown narrative.Another View: Is the Market Overlooking a Key Signal?

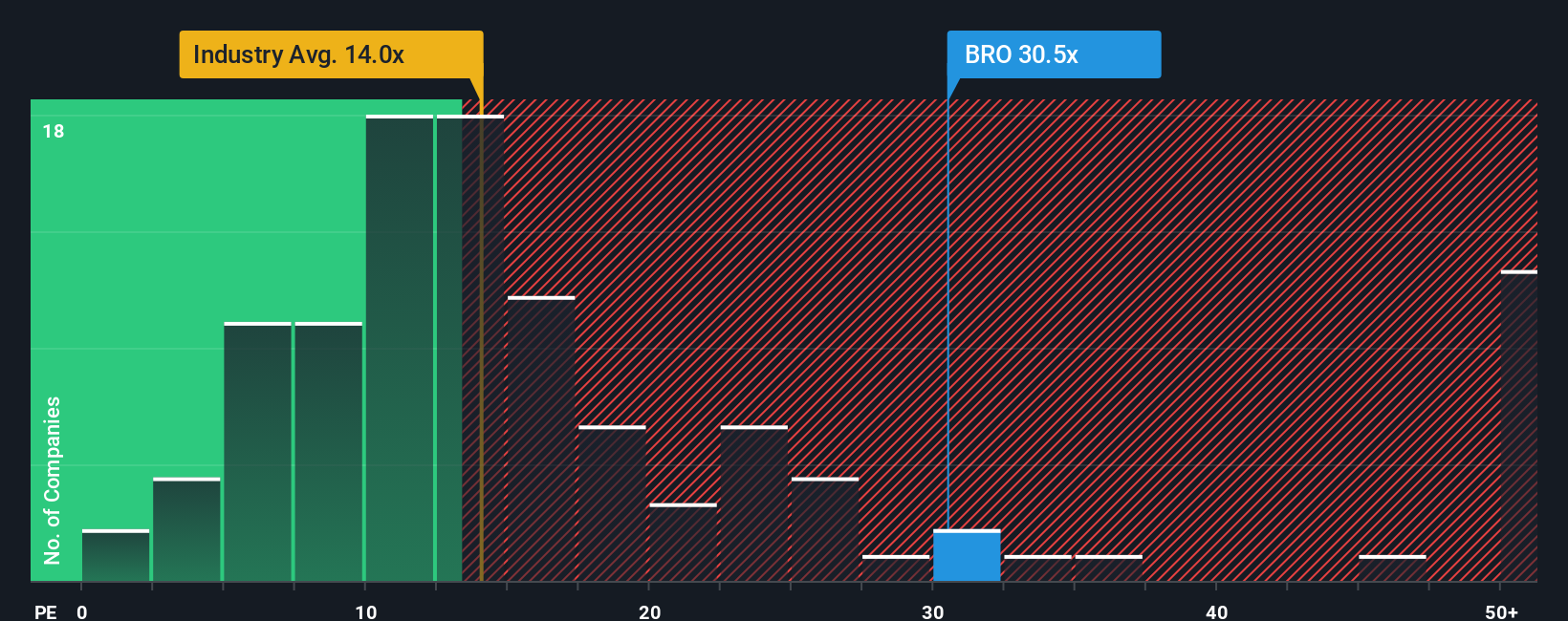

While analysts see Brown & Brown as undervalued based on future profit growth, a look at how the business is currently valued against the wider insurance industry tells a different story. Could the market be pricing in more risk than expected?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Brown & Brown Narrative

If you see things differently or want to dig into the numbers your own way, you can lay out your own take on Brown & Brown’s story in just a few minutes. Do it your way

A great starting point for your Brown & Brown research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit themselves to just one story. Take control of your portfolio’s future by screening for stocks that match your strategy and risk appetite right now.

- Spot income opportunities that can strengthen your cash flow with dividend stocks with yields > 3% offering reliable yields above 3%.

- Get ahead of the curve and tap into the rapid growth of artificial intelligence with AI penny stocks powering tomorrow’s breakthroughs.

- Uncover potential bargains before the rest of the market catches on. Find companies trading well below their value with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal