A Fresh Look at O'Reilly Automotive (ORLY) Valuation as Same-Store Sales Streak, Buybacks, and Stock Split Drive Interest

If you have been watching O'Reilly Automotive (ORLY), this summer brought a series of events that turned more heads than usual. Management announced the company is on pace for its 33rd straight year of same-store sales growth. This figure speaks to O'Reilly’s ability to keep customers coming in, even as the retail landscape shifts. In addition to this consistency, O'Reilly’s leadership also executed an aggressive share buyback over the past year, while a 15-for-1 stock split caught the attention of both longtime shareholders and a wave of new investors. The result? Shares quickly climbed to new highs not long after the split.

Momentum seems to be building on several fronts. In the past year alone, O'Reilly has delivered more than a 42% bump in stock price, and its returns over three and five years show strong long-term performance. Even recent gains hint at fresh enthusiasm, with a solid upward trend continuing into the past month. Yet, beyond the headlines and share price moves, O'Reilly’s strategy of pairing consistent sales growth with buybacks continues to help boost earnings per share, suggesting a strong foundation beneath the rally.

But after such a strong run and a share price at record levels, is there still room for upside, or are the markets already pricing in everything O'Reilly can deliver next?

Most Popular Narrative: Fairly Valued

The prevailing narrative sees O'Reilly Automotive trading close to fair value, with the current share price essentially matching the average analyst price target.

O'Reilly's strategic emphasis on inventory and distribution capabilities, including a plan to increase average inventory per store by 5% in 2025, positions the company to maintain high availability and service levels. This approach is likely to lead to sustained or increased revenue growth.

Think the recent price run-up is the whole story? Not quite. The most widely-followed valuation narrative relies on unexpected profit potential, a premium earnings multiple, and bold future estimates of growth to justify today's price. Can these bullish projections withstand scrutiny? Or are they setting the bar sky-high? Find out which powerful assumptions shape the calculation behind this fair value. Sometimes, the details reveal more than the headline number.

Result: Fair Value of $106.95 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, uncertainty around tariffs or spikes in store-level expenses could quickly shift the outlook and put pressure on O'Reilly’s growth assumptions in the months ahead.

Find out about the key risks to this O'Reilly Automotive narrative.Another View: SWS DCF Model Suggests a Different Story

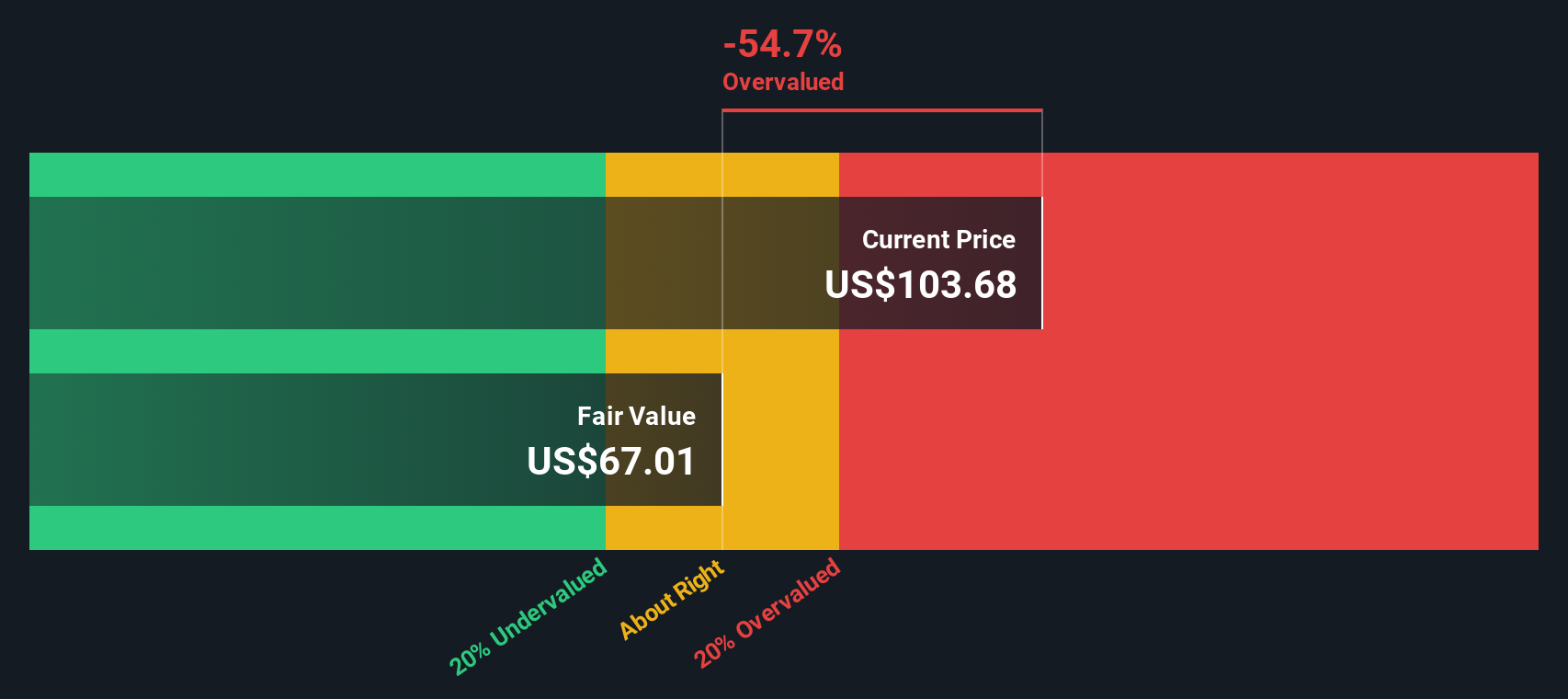

While analysts see O'Reilly Automotive as fairly valued, our SWS DCF model indicates the stock could be overvalued based on forecast cash flows. Does this model highlight flaws in the bullish consensus, or are the assumptions too cautious?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own O'Reilly Automotive Narrative

If you think there's more to the story, or want to dive deeper into the numbers yourself, it's easy to chart your own narrative in just a few minutes. Do it your way.

A great starting point for your O'Reilly Automotive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for fresh investment opportunities?

Smart investors never settle for obvious picks. Give yourself an edge by targeting high-potential niches where emerging trends and value front-runners could boost your portfolio. Don’t let these strategic opportunities pass you by.

- Capture steady income and compounding power when you tap into dividend stocks with yields > 3%. This approach can offer reliable yields for long-term growth.

- Lead the charge into tomorrow’s frontiers by sizing up quantum computing stocks. These advancements are pushing boundaries in advanced computing and breakthrough science.

- Uncover real value plays with game-changing upside as you scan for undervalued stocks based on cash flows. These opportunities may still be flying under the radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal