Ryman Hospitality Properties (RHP): Exploring the Current Valuation Behind Its Recent Quiet Market Momentum

Ryman Hospitality Properties (RHP) has been moving quietly on the market, catching the attention of investors who are always on the hunt for hints about what might come next. While there hasn't been a single headline-grabbing event or announcement to explain this recent movement, the subtle shifts in the price may have some wondering if this signals an opportunity hiding in plain sight or something investors are already pricing in.

Looking at the bigger picture, Ryman Hospitality Properties has posted gains of just under 4% over the past year, keeping pace with the steady performance of its sector. Momentum seems to be building again after a flat start to the year, highlighted by a 6% bump over the past month and a more tempered trend since the spring. Recent annual growth in both revenue and net income, hovering around 7% and 6% respectively, supports a narrative of steady expansion without dramatic surprises.

So with RHP's stock edging upward recently, is the market underestimating the company's long-term potential or is any upside already reflected in the price?

Most Popular Narrative: 13.5% Undervalued

According to the prevailing narrative, Ryman Hospitality Properties is currently seen as undervalued, with the market price trailing analyst projections of its intrinsic worth. This stance hinges on optimism about the company's ability to drive recurring growth across its core segments and capitalize on momentum in the experiential travel and entertainment sectors.

Recent acquisitions and ongoing capital investments (for example, JW Marriott Desert Ridge and meeting space upgrades at Gaylord properties) put Ryman in a strong position to capitalize on renewed appetite for large-scale experiential travel and gatherings, supporting revenue growth and long-term cash flow.

Want to know what is fueling Ryman’s bullish outlook? There is a quantitative story at the heart of this valuation—a bold forecast for future growth, profit margins, and a premium earnings multiple. What are the specific assumptions about revenue momentum and profitability that justify the analysts' price target? Uncover the financial projections and surprising calculations that drive this narrative’s fair value estimate.

Result: Fair Value of $115.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Ryman's reliance on large group bookings and exposure to rising labor costs could quickly challenge its current growth assumptions if conditions change.

Find out about the key risks to this Ryman Hospitality Properties narrative.Another View: How Does Ryman Stack Up on Price?

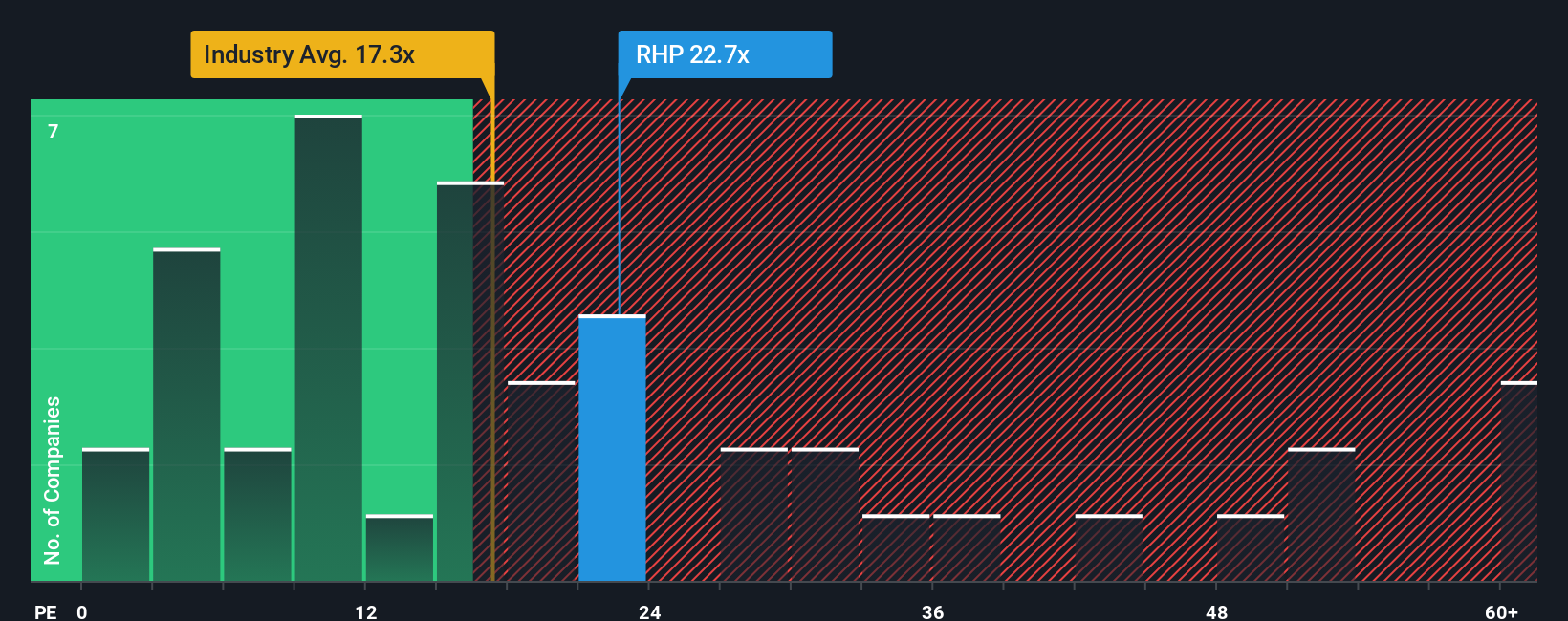

Taking a step back from future earnings, some investors look at the current valuation compared to other hotel REITs. From this perspective, Ryman appears more expensive than the average for its industry. This raises a question: is the growth outlook strong enough to justify a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ryman Hospitality Properties Narrative

If you would rather dig into the numbers yourself or see the story differently, you have the tools to build your own in just a few minutes. Do it your way.

A great starting point for your Ryman Hospitality Properties research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize your edge by steering your research into some of today's most promising market themes. These hand-picked opportunities could be exactly what your portfolio needs next.

- Capture fresh income by targeting established companies offering attractive yields through dividend stocks with yields > 3%.

- Jump ahead of the curve with companies advancing medical innovation and breakthrough healthcare technology by using healthcare AI stocks.

- Spot high-potential companies trading below their true worth before the crowd catches on by exploring undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal