Does Skyward Specialty Insurance Group Offer Value After Recent 8% Share Price Slide?

If you are trying to decide what to do next with Skyward Specialty Insurance Group stock, you are definitely not alone. This stock has caught the attention of both cautious and growth-oriented investors recently, with a mix of price action that raises interesting questions. Over the past week, shares have slipped by 8.3%, which might catch some holders off guard. Yet, zoom out even a bit, and you will see the stock is still up 17.8% over the past year. That kind of move can signal changing market perceptions about risk, growth, or value, especially in the insurance sector where trends can shift quickly as new opportunities or threats emerge.

So what is driving these moves? Part of the story is the broader financial sector’s shifting outlook, as investors reassess what companies like Skyward Specialty Insurance Group are actually worth in today’s fast-moving environment. Despite recent price dips, the company is scoring a perfect 6 out of 6 on a widely used set of valuation checks, meaning every indicator currently says the shares are undervalued. That does not happen every day, which is why investors are watching closely.

To help you make sense of where Skyward’s valuation really stands, we will break down what goes into those six valuation checks and how the numbers stack up. But stick around, because after covering those standard approaches, I will walk you through a smart, often-overlooked way to judge whether this stock is truly a bargain or something more.

Skyward Specialty Insurance Group delivered 17.8% returns over the last year. See how this stacks up to the rest of the Insurance industry.Approach 1: Skyward Specialty Insurance Group Excess Returns Analysis

The Excess Returns valuation model centers on measuring how much profit a company generates above its cost of equity. In other words, it compares what shareholders actually earn from their invested capital to what they could expect from a risk-free alternative. This method is particularly relevant for companies in the insurance sector, where returns on equity and capital discipline set leading firms apart.

Based on the available data, Skyward Specialty Insurance Group currently shows the following key metrics:

- Book Value: $22.23 per share

- Stable EPS: $4.52 per share

(Source: Weighted future Return on Equity estimates from 6 analysts.) - Cost of Equity: $1.79 per share

- Excess Return: $2.73 per share

- Average Return on Equity: 17.12%

- Stable Book Value: $26.42 per share

(Source: Weighted future Book Value estimates from 7 analysts.)

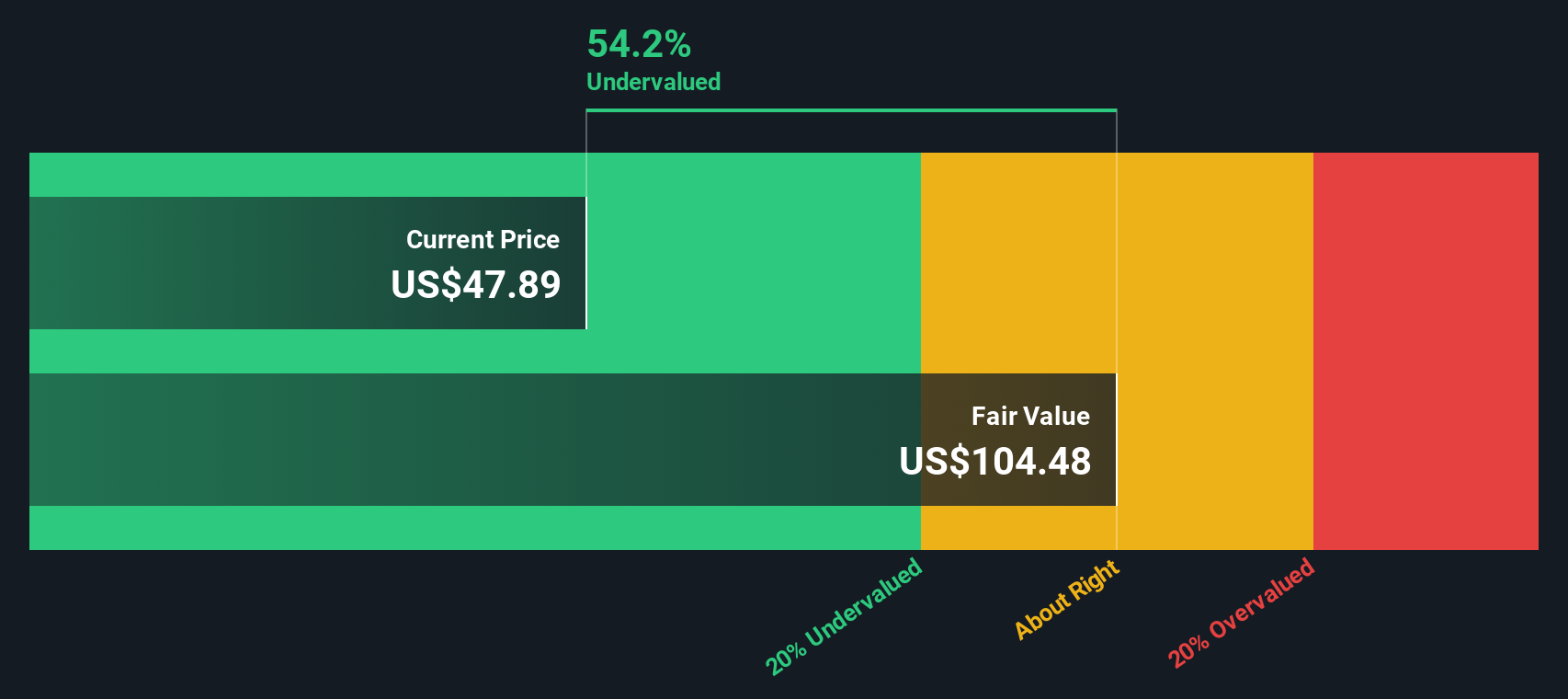

These figures indicate that Skyward’s return on equity is not only considerably above its cost of equity, but also that the company is projected to sustain and grow its book value per share. According to the Excess Returns framework, the estimated intrinsic value per share represents a substantial 54.1% discount to the stock’s current price. That suggests the market may be underestimating Skyward’s ability to consistently generate economic profits in the years ahead.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Skyward Specialty Insurance Group.

Approach 2: Skyward Specialty Insurance Group Price vs Earnings

For companies that are steadily profitable, the Price-to-Earnings (PE) ratio remains one of the most widely used ways to assess value. It provides a direct measure of how much investors are willing to pay for each dollar of current earnings, which is especially relevant for insurance companies like Skyward with consistent profits.

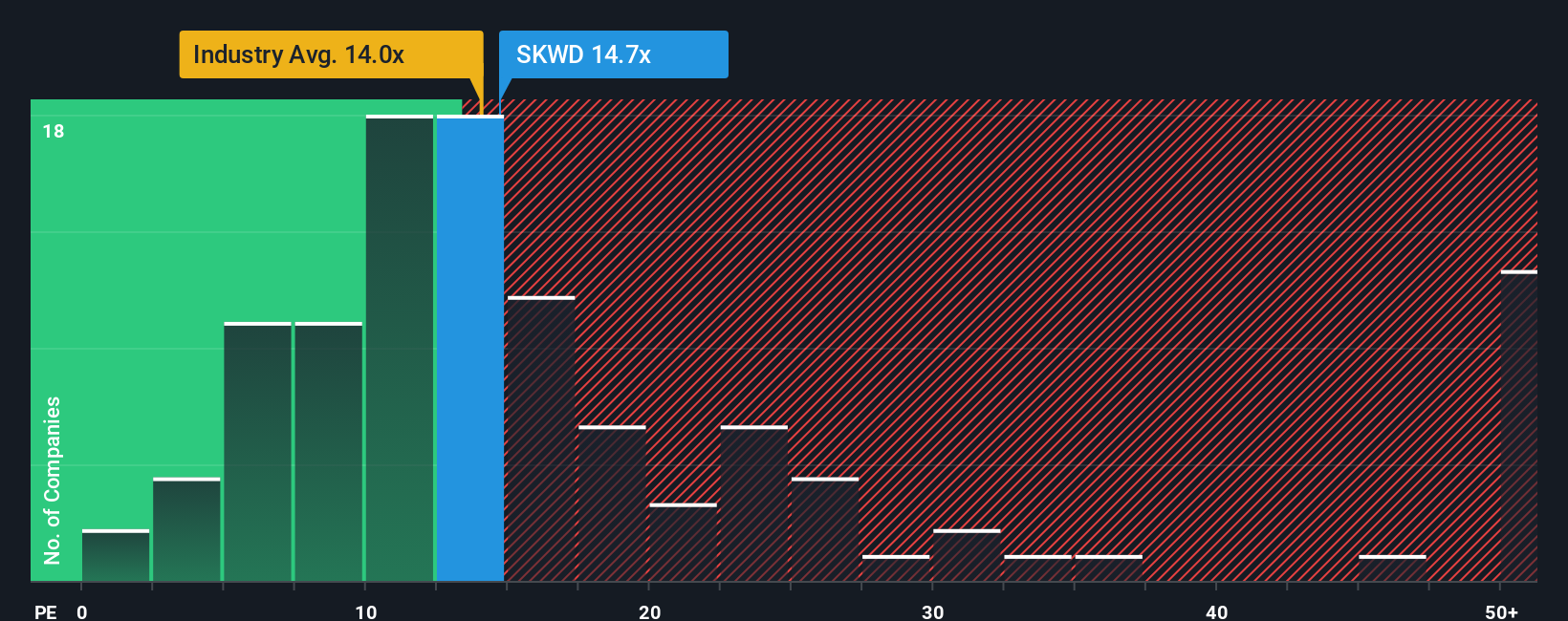

When determining what a fair or normal PE should be, it is important to remember that higher expected growth rates usually justify a higher PE, while higher risks or weaker margins tend to drag it down. Skyward Specialty Insurance Group currently trades at a PE ratio of 14.1x, which is just below the industry average of 14.4x and well below the average of close peers at 53.5x.

Simply Wall St's proprietary "Fair Ratio" for Skyward is calculated at 14.3x. Instead of relying solely on peer or industry comparisons, this Fair Ratio captures a more nuanced picture by blending the company's unique outlook, growth prospects, profit margins, risk profile, industry positioning, and market cap. This approach sets a more comprehensive benchmark for evaluating whether a stock is undervalued or overvalued.

Comparing Skyward’s actual PE of 14.1x to the Fair Ratio of 14.3x indicates the stock is valued almost exactly where it should be based on its current fundamentals and risk profile.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Skyward Specialty Insurance Group Narrative

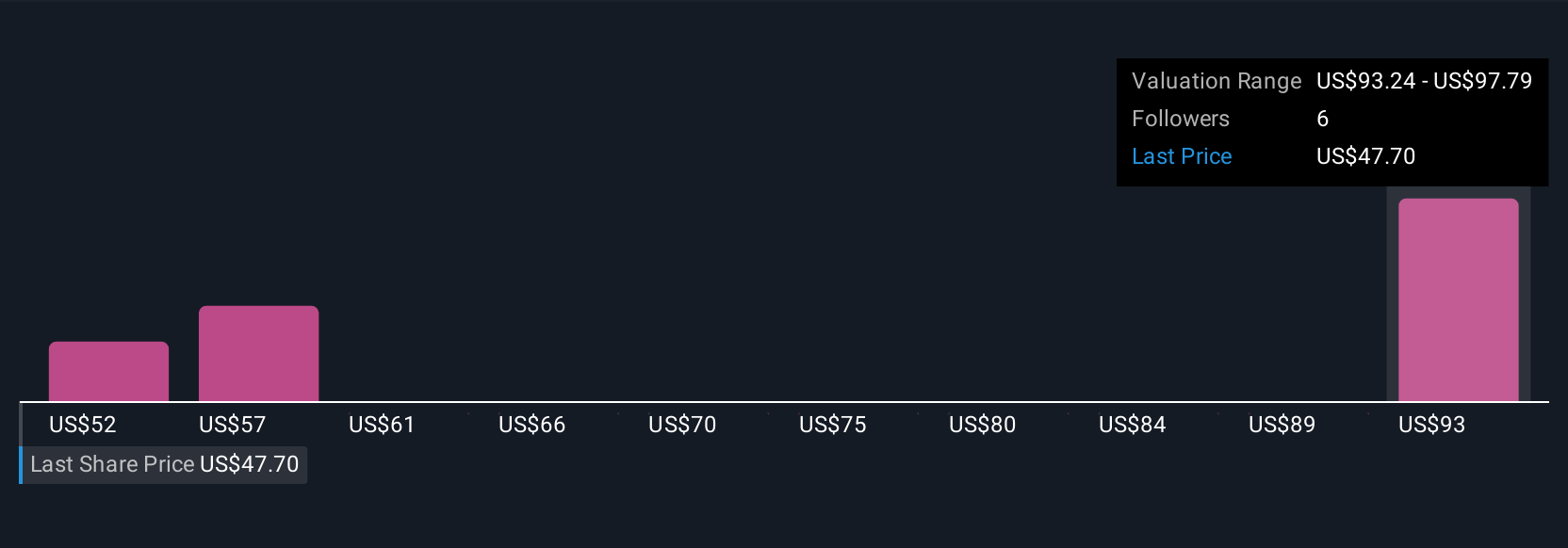

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple way to express your perspective on a company: the story you believe lies behind the numbers, including your own estimates for fair value, revenue, earnings, and margins. Rather than focusing only on static metrics, Narratives guide you from a company’s story and outlook to a tailored financial forecast, and finally to what you judge as a fair value for the shares.

Narratives are an easy, interactive tool available right on Simply Wall St’s Community page, used by millions of investors. By creating or following a Narrative, you can instantly see if you believe the stock is a buy or sell as you compare your personalized Fair Value to the current market price. The best part is that Narratives update automatically when new information, such as earnings results or breaking news, is released. This helps you quickly refine your view as the facts evolve.

For example, with Skyward Specialty Insurance Group, some investors see big gains ahead based on technology investments and a growing market, setting Fair Values as high as $70 per share, while others warn about underwriting or market risks and set theirs closer to $49. You can easily choose and follow the story that fits your outlook.

Do you think there's more to the story for Skyward Specialty Insurance Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal