DigitalBridge Group (DBRG) Is Up 5.8% After Vantage Data Centers Secures $1.6B APAC Expansion Funding

- Vantage Data Centers, a portfolio company of DigitalBridge Group, announced it has secured a US$1.6 billion investment led by GIC and the Abu Dhabi Investment Authority to expand its operations in the Asia-Pacific region.

- This significant capital infusion highlights sustained confidence in global digital infrastructure, particularly as AI and cloud computing accelerate demand for data center capacity and technology services.

- We’ll explore how this major expansion into Asia-Pacific through Vantage Data Centers could impact DigitalBridge Group’s investment narrative and growth prospects.

Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

DigitalBridge Group Investment Narrative Recap

To be a DigitalBridge Group shareholder, one must believe in the enduring global need for digital infrastructure, particularly as AI and cloud computing drive new demand for data center assets. The recent US$1.6 billion infusion into Vantage Data Centers underscores this demand and represents a positive, near-term catalyst. However, increasing competition from other asset managers and infrastructure funds remains the biggest risk to margins and fee-related earnings; this news does not materially change that risk for now.

Among recent company developments, DigitalBridge’s presentations at major industry conferences, including the Goldman Sachs Communacopia + Technology Conference and Citi’s TMT Conference, are highly relevant. These appearances bring additional investor attention to DigitalBridge’s growth efforts in the data center sector and highlight the company’s focus on scaling digital infrastructure platforms, a key catalyst for future earnings growth.

By contrast, investors should keep an eye on funding costs and capital inflows, as a sudden shift in credit markets could...

Read the full narrative on DigitalBridge Group (it's free!)

DigitalBridge Group's narrative projects $493.7 million revenue and $197.3 million earnings by 2028. This requires 41.7% yearly revenue growth and a $195.6 million earnings increase from $1.7 million today.

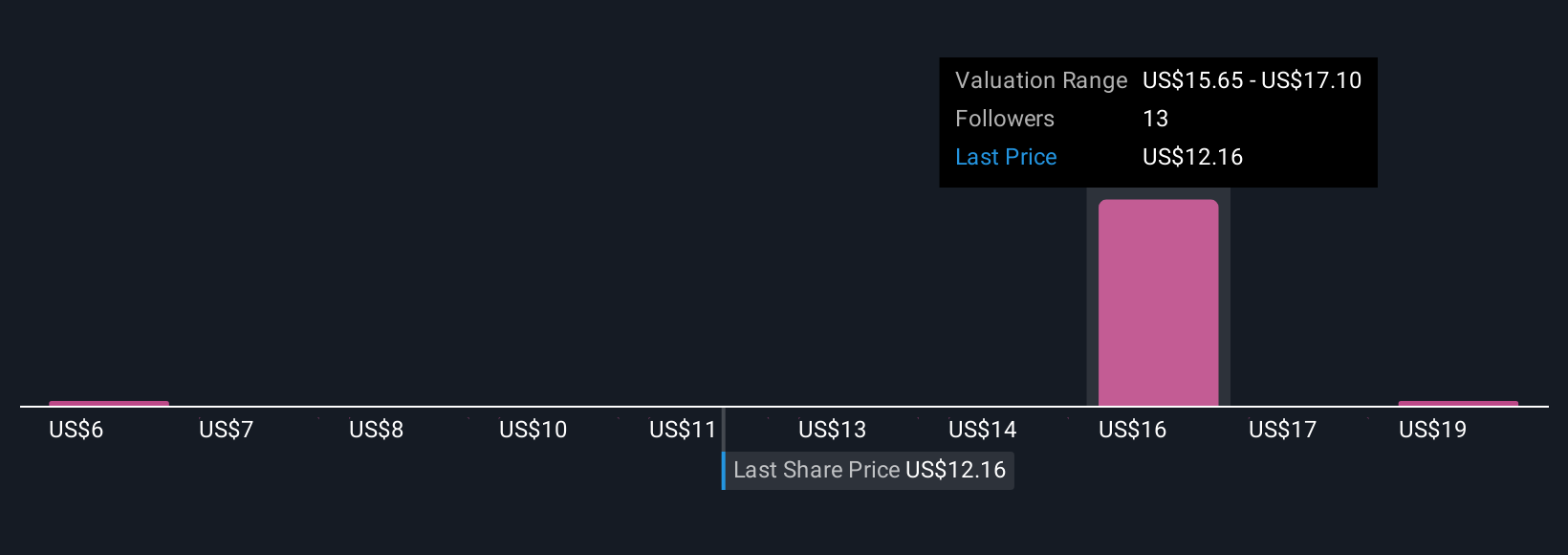

Uncover how DigitalBridge Group's forecasts yield a $16.50 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have estimated a wide fair value range for DigitalBridge Group from US$5.52 to US$20, across three different analyses. While investors offer varied assessments, many are watching whether global digital infrastructure expansion can outweigh competition and margin pressure.

Explore 3 other fair value estimates on DigitalBridge Group - why the stock might be worth less than half the current price!

Build Your Own DigitalBridge Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DigitalBridge Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free DigitalBridge Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DigitalBridge Group's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal