How Shifting Fed Rate Expectations Have Influenced Universal Technical Institute's (UTI) Investment Story

- In the past week, Universal Technical Institute experienced active trading following softer-than-expected US inflation data, which shifted market focus toward potential interest rate cuts by the Federal Reserve.

- This market response highlights how education service providers like Universal Technical Institute can be sensitive to broader monetary policy shifts that affect affordability and enrollment trends.

- We'll explore how renewed investor optimism about easier Fed policy may influence Universal Technical Institute's long-term outlook and business drivers.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Universal Technical Institute Investment Narrative Recap

To have conviction as a Universal Technical Institute (UTI) shareholder, you need to believe that sustained demand for skilled trades and allied health education will keep driving enrollment and revenue, even as the company expands offerings beyond legacy auto and diesel programs. The recent market rally following softer inflation and rising interest rate cut hopes briefly supported UTI’s share price, but the most important short-term catalyst, securing student demand for new campus and program launches, remains unchanged right now; the biggest near-term risk is if these investments don’t translate into proportional growth. The impact of last week's macro news on these fundamentals appears limited for now.

Among recent announcements, UTI’s launch of four new electrical programs in July stands out as a key move aligned with the push into skilled trades and diversification. These offerings are designed to position the company for demand across a broader set of trades and align with the enrollment trends that may benefit from supportive monetary policy or expanding student aid. As the company pursues further program and campus expansion, keeping an eye on how these rollouts connect to actual enrollment uptake is crucial.

However, in contrast to short-term optimism, investors should also consider the potential risk if rapid expansion outpaces real student demand or if regulatory hurdles...

Read the full narrative on Universal Technical Institute (it's free!)

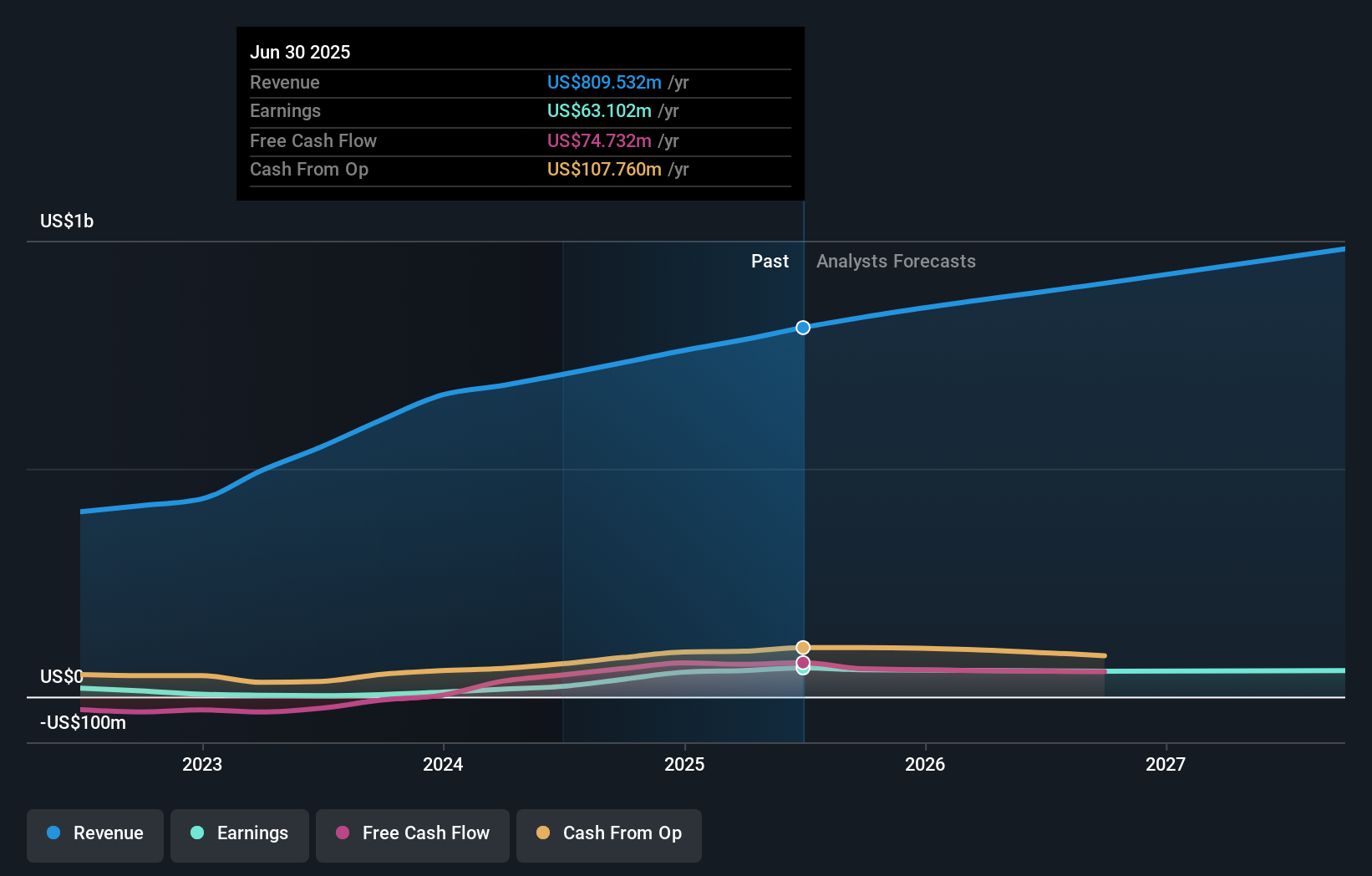

Universal Technical Institute's outlook anticipates $1.0 billion in revenue and $54.0 million in earnings by 2028. This hinges on an annual revenue growth rate of 8.9% but a decrease in earnings of $9.1 million from current earnings of $63.1 million.

Uncover how Universal Technical Institute's forecasts yield a $37.60 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see fair values for UTI ranging from US$19.03 to US$37.60 across two distinct viewpoints. While expectations for expanding short-course and skilled trade offerings are a major catalyst, these diverse opinions reveal just how differently investors assess future growth potential and risk.

Explore 2 other fair value estimates on Universal Technical Institute - why the stock might be worth 30% less than the current price!

Build Your Own Universal Technical Institute Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Universal Technical Institute research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Universal Technical Institute research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Universal Technical Institute's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal