Does CarMax's (KMX) Digital Push Reinforce Its Competitive Edge After Strong Quarterly Results?

- CarMax reported strong second-quarter results, showcasing positive comparable retail sales and double-digit growth in earnings per share, and discussed its outlook at Morgan Stanley’s Annual Laguna Conference in Dana Point, California.

- The company's focus on expanding digital sales channels and enhancing digital tools signals its commitment to capturing greater market share amid evolving industry trends.

- We’ll explore how CarMax’s continued digital sales growth and positive quarterly performance shape its investment outlook and future prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

CarMax Investment Narrative Recap

To be a CarMax shareholder today is to believe in the company's ability to grow market share through digital innovation and improved customer experience, despite industry headwinds. The recent presentation at Morgan Stanley's Laguna Conference reaffirms CarMax’s focus on digital channel expansion, an ongoing catalyst, yet it does not materially impact the most pressing short-term risk: margin pressure from declining wholesale gross profit per unit and persistent competition in vehicle sourcing.

Of the company’s recent announcements, the update on its share buyback program stands out, particularly as CarMax repurchased nearly 2.95 million shares between March and May 2025. Against a backdrop of positive quarterly results, this move reinforces management’s confidence in its business fundamentals, serving as a key signpost for investors evaluating near-term catalysts supporting share value.

However, despite digital sales momentum, investors should also be aware of the potential for ongoing margin challenges that could arise if wholesale profit per unit continues to ...

Read the full narrative on CarMax (it's free!)

CarMax's outlook anticipates $29.8 billion in revenue and $919.9 million in earnings by 2028. This is based on a projected 1.3% annual revenue growth rate and a $361.4 million increase in earnings from the current $558.5 million.

Uncover how CarMax's forecasts yield a $81.44 fair value, a 36% upside to its current price.

Exploring Other Perspectives

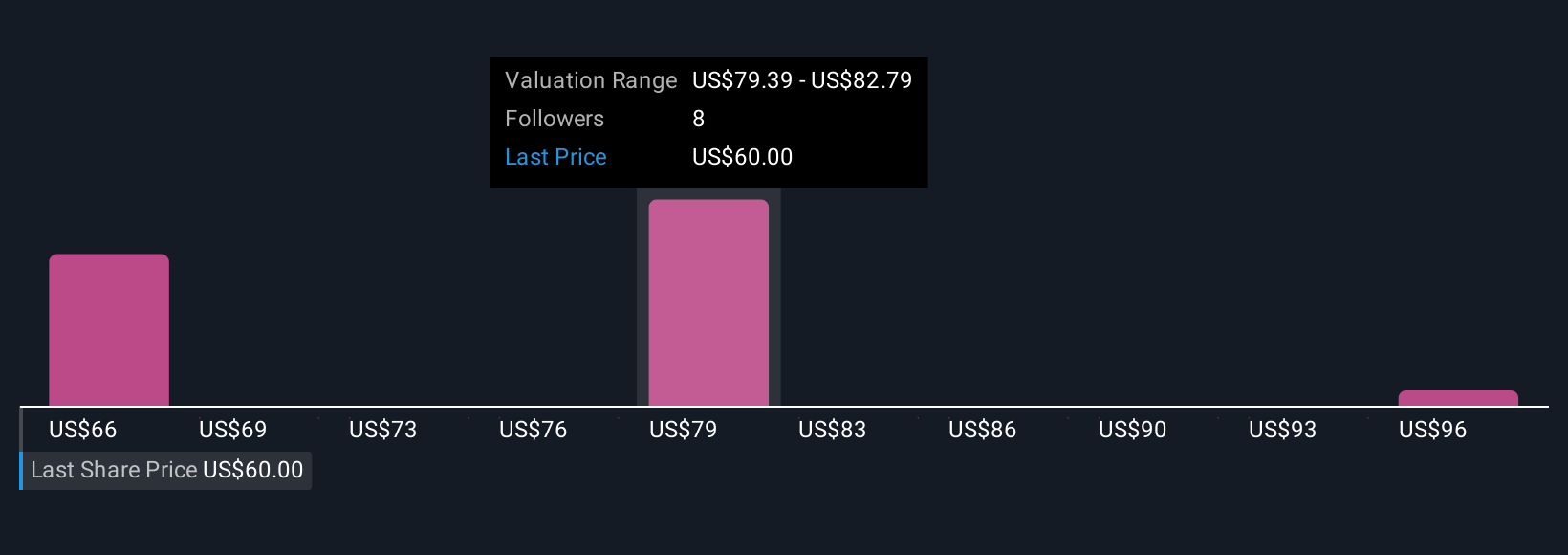

Simply Wall St Community members provided three distinct fair value estimates for CarMax, ranging from US$66.00 to US$99.80 per share. While digital sales growth remains a key catalyst, ongoing margin concerns could influence the company’s ability to capitalize on future opportunities, be sure to review the differing viewpoints before making any decisions.

Explore 3 other fair value estimates on CarMax - why the stock might be worth as much as 67% more than the current price!

Build Your Own CarMax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CarMax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CarMax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CarMax's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal