How OPENLANE's (KAR) AI-Powered Audio Boost Feature Could Shape Dealer Trust and Platform Efficiency

- Earlier this month, OPENLANE, Inc. introduced Audio Boost AI, a new feature on its US marketplace that uses AI to analyze engine recordings, highlight potential issues, and provide benchmark audio samples to help dealers evaluate vehicles more efficiently.

- This launch leverages a proprietary database of more than 1.2 million engine recordings, reinforcing OPENLANE's focus on innovative technology that enhances trust and transparency for wholesale buyers and sellers.

- We'll examine how embedding AI-powered engine analysis directly into condition reports could influence OPENLANE's outlook for platform efficiency and dealer confidence.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

OPENLANE Investment Narrative Recap

To own OPENLANE stock, investors must believe in the ongoing transformation of wholesale vehicle auctions from traditional formats to AI-driven, digital marketplaces. The launch of Audio Boost AI builds on this premise, strengthening value for dealers and buyers through smarter, more transparent vehicle evaluations, yet its impact on the most immediate catalyst, accelerated dealer-to-dealer digital adoption, is incremental for now. Major risks, such as competitive threats from digital-first entrants and margin pressure, remain unchanged, with technology innovation acting as a counterweight.

Among OPENLANE’s recent product announcements, the January 2024 release of Visual Boost AI is the most comparable to Audio Boost AI. Both tools use proprietary data to embed AI insights directly in condition reports, supporting the thesis that leadership in digital automation could yield operational gains and a more defensible platform, especially where competition is intensifying.

However, investors should be alert to the potential for margin compression if...

Read the full narrative on OPENLANE (it's free!)

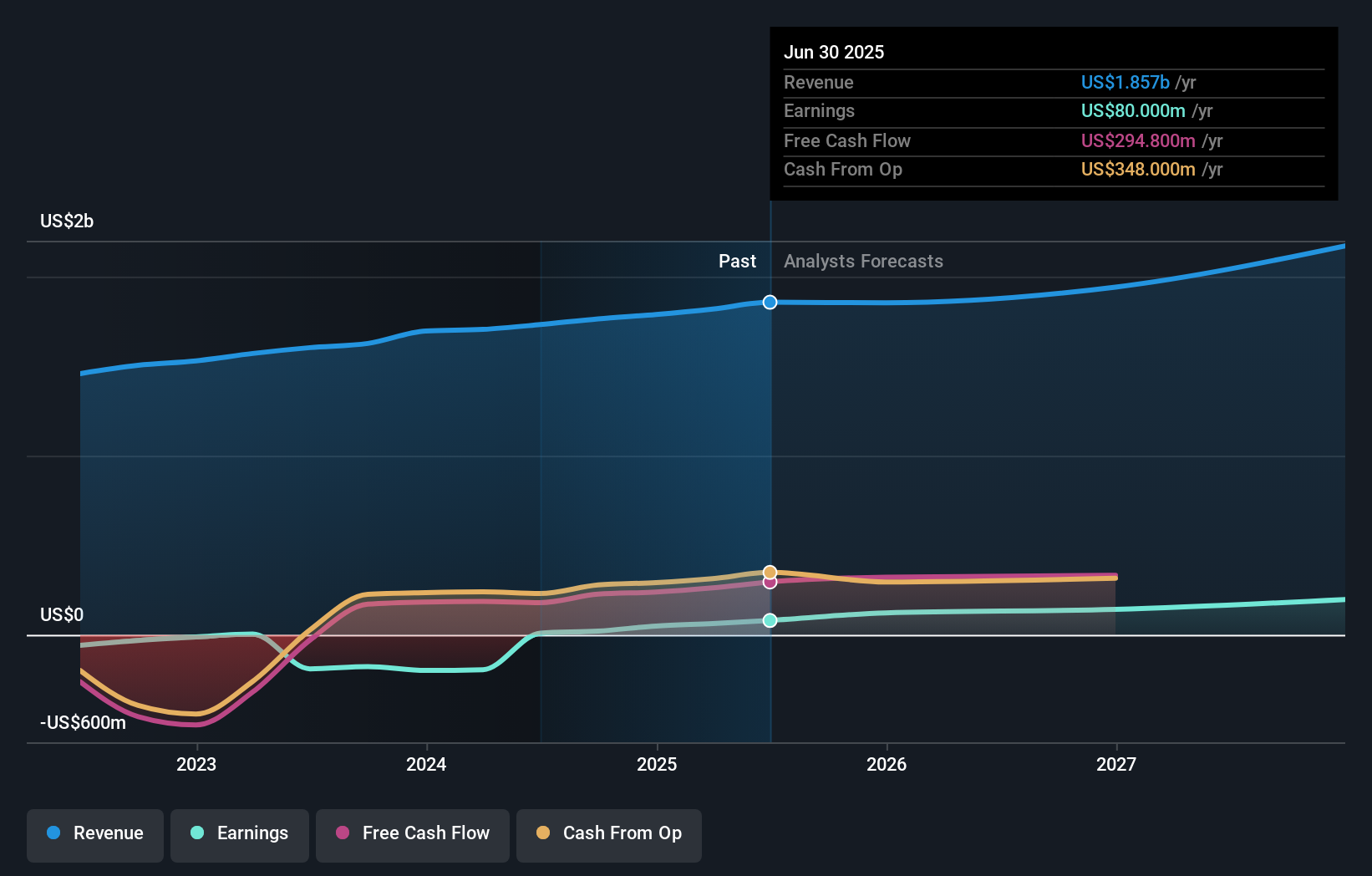

OPENLANE's outlook anticipates $2.2 billion in revenue and $230.6 million in earnings by 2028. This projection is based on a 5.0% annual revenue growth rate and represents a $150.6 million increase in earnings from the current figure of $80.0 million.

Uncover how OPENLANE's forecasts yield a $30.50 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Only one Community fair value estimate of US$71.07 is available, indicating strong conviction among participating Simply Wall St Community members. This aligns with optimism over AI-powered process improvements, but consider if competitive and margin pressures could influence future earnings.

Explore another fair value estimate on OPENLANE - why the stock might be worth over 2x more than the current price!

Build Your Own OPENLANE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OPENLANE research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free OPENLANE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OPENLANE's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal