Has AXIS Capital Holdings’ (AXS) Strong Earnings Growth Changed the Case for Its Capital Efficiency?

- AXIS Capital Holdings recently reported a return on equity of 14%, in line with the industry, and a five-year earnings growth rate of 38%, far ahead of the sector average.

- The company's focus on reinvesting profits has supported this earnings expansion, though analysts now express caution over the pace of future growth.

- To assess the impact on AXIS's outlook, we'll consider how its efficient capital use could reinforce the existing investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

AXIS Capital Holdings Investment Narrative Recap

To own AXIS Capital Holdings stock, investors need to trust in the company's ability to balance specialty insurance growth and disciplined capital management. The latest report of a 14% return on equity and outsized five-year earnings growth suggest solid execution; however, the news doesn't significantly alter the near-term focus on pricing pressures in core markets or the ongoing risk of claims unpredictability from social inflation, both remain central to the company’s outlook and risks.

One recent announcement that stands out is the launch of AXIS Capacity Solutions, aimed at providing multi-line portfolio capacity deals. This directly ties in with the company's efforts to expand in higher-margin, specialty lines, reinforcing the current investment thesis that efficient capital deployment and product innovation are short-term catalysts for growth.

Yet, in contrast, one lingering concern that investors should be aware of is how unpredictable U.S. litigation trends could impact future claim costs and...

Read the full narrative on AXIS Capital Holdings (it's free!)

AXIS Capital Holdings' narrative projects $7.0 billion in revenue and $1.1 billion in earnings by 2028. This requires 3.9% annual revenue growth and an earnings increase of $238.5 million from current earnings of $861.5 million.

Uncover how AXIS Capital Holdings' forecasts yield a $113.50 fair value, a 15% upside to its current price.

Exploring Other Perspectives

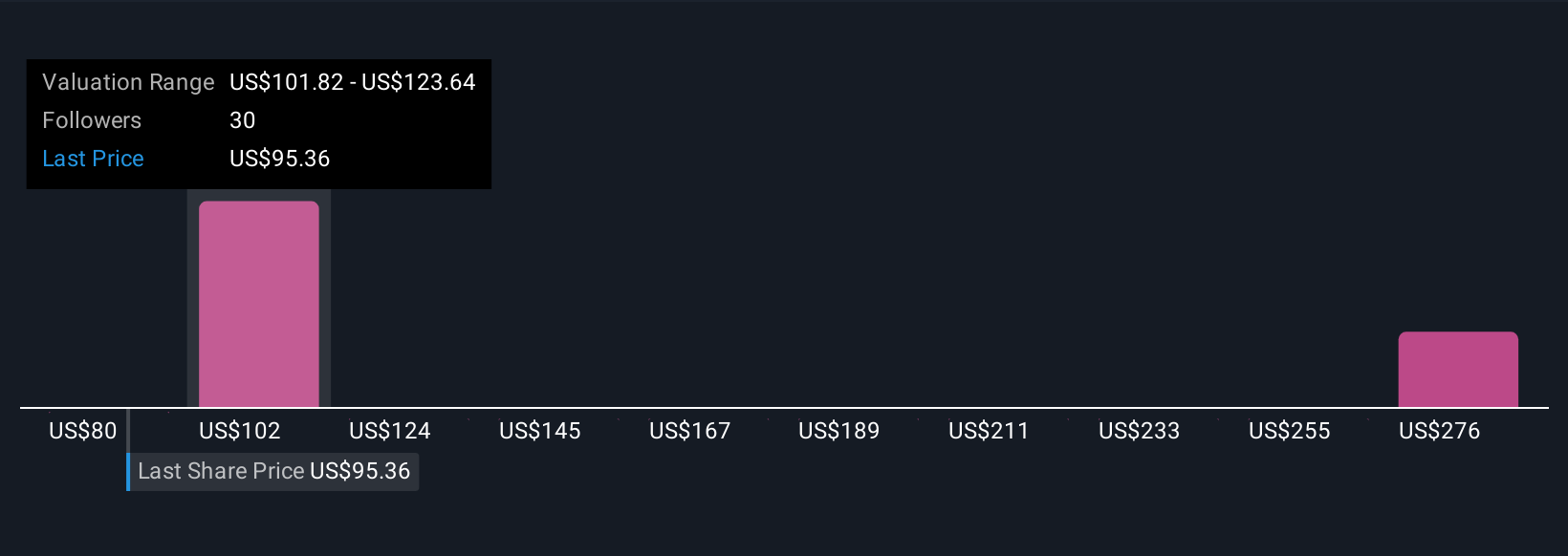

Five Simply Wall St Community members estimate fair values ranging widely from US$80 to US$298, with several viewing AXIS as deeply undervalued. Pricing pressure in property and MGA-driven lines, highlighted by analysts, continues to shape expectations about AXIS’s margin outlook, offering fresh points for you to explore further.

Explore 5 other fair value estimates on AXIS Capital Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own AXIS Capital Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AXIS Capital Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AXIS Capital Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AXIS Capital Holdings' overall financial health at a glance.

No Opportunity In AXIS Capital Holdings?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal