Hartford (HIG): Evaluating Valuation After Strong Core Earnings in Latest Quarterly Report

Hartford Insurance Group (HIG) just posted its latest quarterly results, and if you follow the stock, this one is hard to ignore. Core earnings clocked in at nearly $1 billion in the quarter, making a strong statement about the company’s ability to deliver operationally even when faced with challenging targets. True, revenues came in a bit below what analysts were looking for, but robust earnings suggest management is not just controlling costs. They are navigating headwinds more effectively than many peers. If you are watching Hartford, the results offer plenty to think about as markets digest this news.

This earnings report follows a year when Hartford’s stock quietly pushed up by 16.8%. There have been positive signals, with gains in each of the last three and twelve months and strong year-to-date momentum at more than 21%. The returns compare favorably in both the short and long term, pointing to steady growth. While the occasional revenue miss has occurred, Hartford’s earnings performance and solid management have helped keep investor confidence intact.

With shares climbing and the latest earnings revealing a strong core, some investors may be evaluating whether the market has already priced in all the recent good news for Hartford.

Most Popular Narrative: 4.5% Undervalued

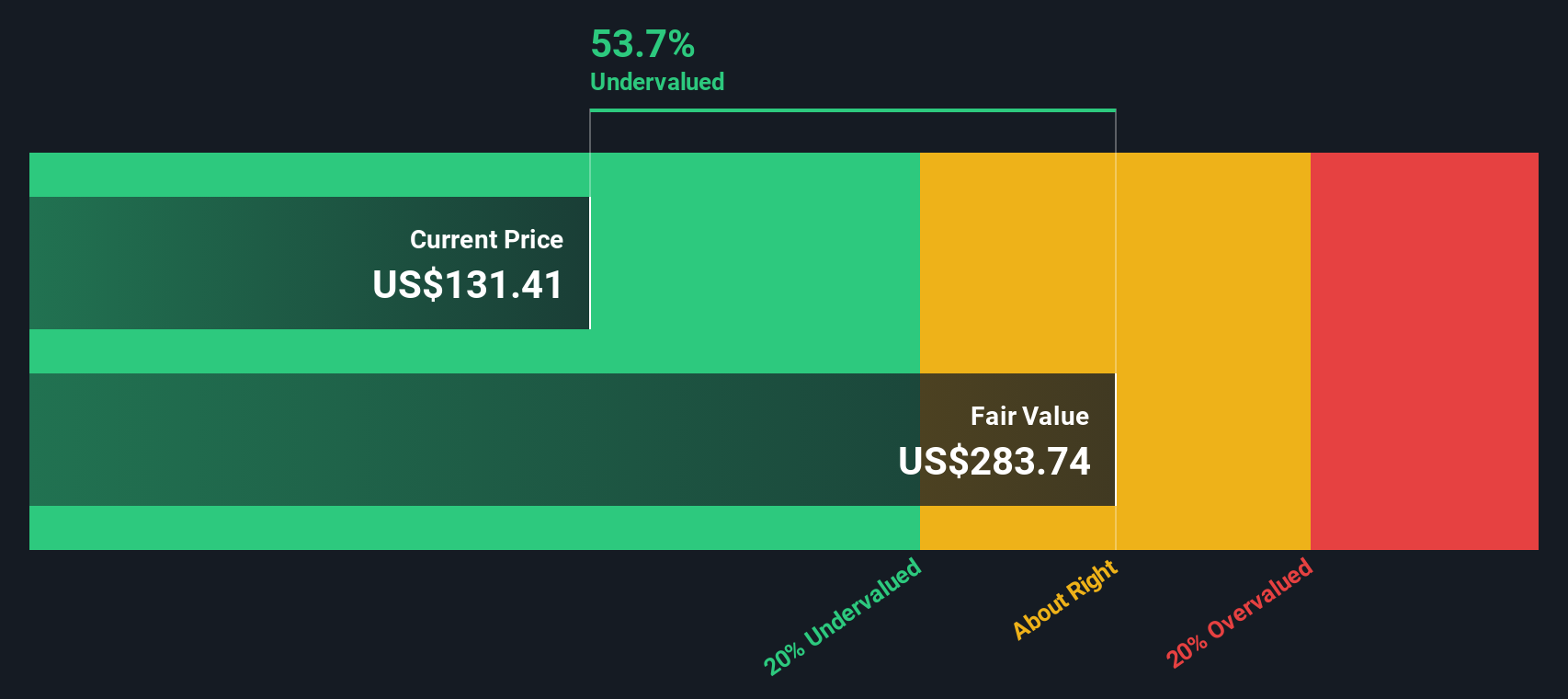

According to the most widely followed narrative, Hartford Insurance Group’s fair value estimate suggests the stock remains moderately undervalued at today’s levels.

Harnessing digital capabilities, including AI and cloud adoption, is expected to enhance efficiency and customer experience. This could potentially boost future revenues. The company's strategic investments in technology and data integration with partners like Workday may drive increased operational efficiencies and aid in improved net margins.

Want to know what’s behind this undervalued call? The narrative relies on bold profit projections, modern tech upgrades, and a future profit multiple that is not easily matched in the sector. Which financial drivers and Wall Street expectations are pushing this fair value above today’s price? Get ready for a deeper dive into the forecast that is moving the narrative.

Result: Fair Value of $138.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, elevated catastrophe losses or intensified competition in core markets could challenge Hartford’s current growth trajectory. This could potentially alter the valuation outlook.

Find out about the key risks to this Hartford Insurance Group narrative.Another View: Our DCF Model Perspective

Looking at Hartford Insurance Group through the lens of our SWS DCF model, the story also points toward undervaluation. This method considers all future cash flows and can reveal value that simple earnings multiples sometimes miss. Could this deeper analysis hint at even more potential beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hartford Insurance Group Narrative

If you have a different perspective or want to dive into the numbers on your own, you can put together your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Hartford Insurance Group.

Looking for More Investment Ideas?

Take the next step and gain an edge most investors miss. Choose what matters to you and uncover market opportunities you would never spot by just watching Hartford.

- Unlock high-yield opportunities by tapping into dividend stocks with yields > 3%. This features companies with generous returns that can supercharge your income stream.

- Catch the next wave of healthcare breakthroughs and innovation through healthcare AI stocks. This highlights forward-thinking firms revolutionizing medicine and diagnostics with artificial intelligence.

- Fuel your search for tomorrow’s biggest winners by exploring undervalued stocks based on cash flows. This is a powerful shortcut to stocks trading far below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal