Willis Towers Watson (WTW): Valuation in Focus After Sompo Tech Deal and Strategic Senior Hires

Most Popular Narrative: 7% Undervalued

The prevailing narrative points to Willis Towers Watson shares trading at a discount to their estimated fair value, with analysts seeing upside based on anticipated business and earnings momentum over the next several years.

"Persistent healthcare cost inflation and aging populations are driving sustained demand for pension and health benefits consulting. This is leading to robust growth in recurring revenue streams within Health, Wealth & Career and supporting both revenue expansion and margin stability."

Curious what’s fueling this undervaluation call? The model behind this narrative combines bold growth projections for earnings, top-line expansion, and improving profitability. There is also a crucial metric used to justify a valuation figure that stands out in today’s market. Interested in the biggest financial shifts identified for WTW? The full breakdown reveals just how high expectations currently are.

Result: Fair Value of $364.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing integration challenges from recent acquisitions and increased regulatory complexity could quickly undermine the bullish growth assumptions for Willis Towers Watson.

Find out about the key risks to this Willis Towers Watson narrative.Another View: Market Signals Tell a Different Story

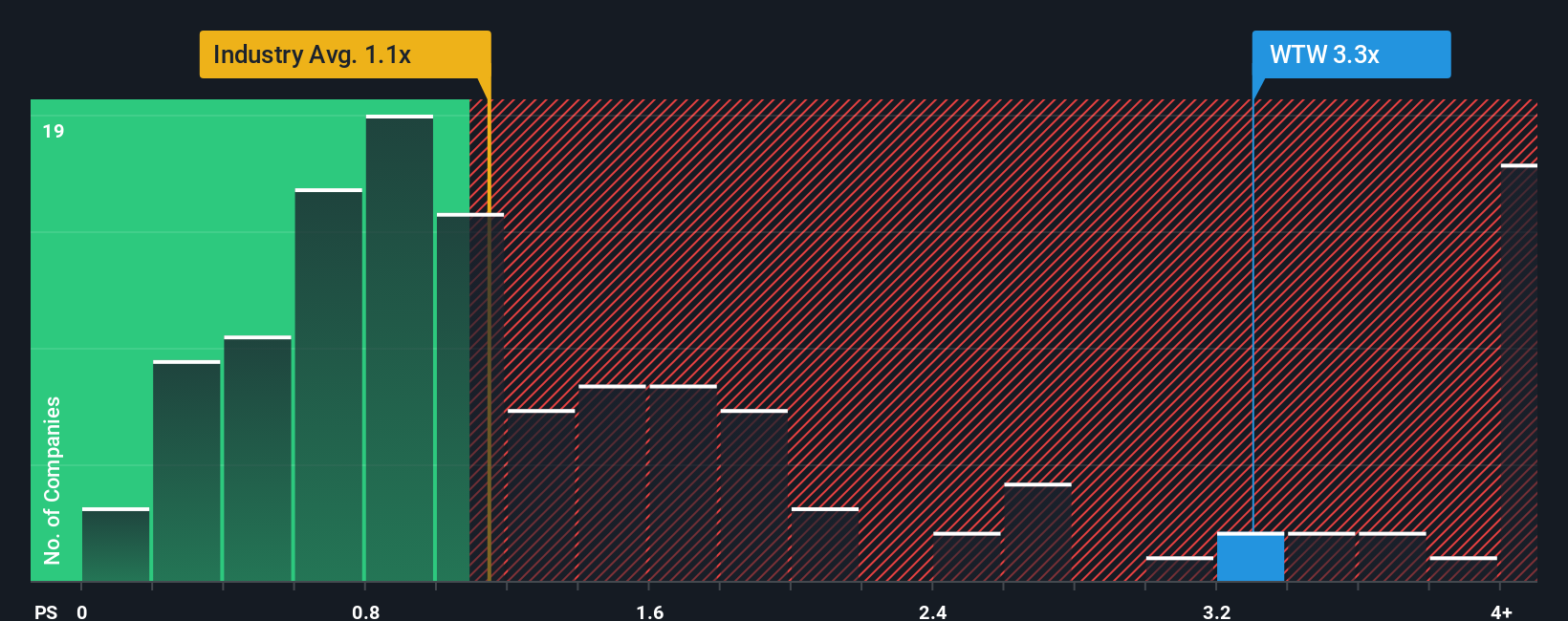

While analyst models point to WTW being undervalued based on future growth, a different look at the company’s value through its revenue multiples suggests the shares might actually be priced on the higher side compared to industry norms. Which method gives a clearer picture of true value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Willis Towers Watson Narrative

If you’re inclined to draw your own conclusions or prefer independent research, you can assemble your own narrative in just a few minutes. Do it your way

A great starting point for your Willis Towers Watson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Fresh Investment Ideas?

Smart investors never settle for just one opportunity. Broaden your investment toolkit by tracking handpicked companies leading the charge in the most exciting trends shaping markets right now.

- Capture rare growth by targeting up-and-coming companies with solid fundamentals through penny stocks with strong financials.

- Tap into the AI revolution by following groundbreaking innovators transforming industries with intelligent technology. Start with AI penny stocks.

- Boost your portfolio’s value by unlocking stocks that experts see as truly undervalued with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal