Are Rising Liability Insurance Costs Reshaping Marsh McLennan’s (MMC) Approach to Managing Long-Tail Risks?

- Earlier this week, Marsh released a report highlighting steep rises in medical professional liability insurance rates, with some hospital clients experiencing premium increases between 10% and 50% in the first half of 2025, despite new entrants to the market adding only limited capacity.

- An interesting development is Marsh's increased emphasis on insurance archaeology services, which help organizations uncover valuable legacy insurance assets to manage complex long-tail liabilities that are growing in importance for clients.

- We'll explore how these rising liability insurance costs and Marsh's specialized solutions may influence Marsh & McLennan Companies' investment narrative.

This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

Marsh & McLennan Companies Investment Narrative Recap

To be comfortable as a Marsh & McLennan Companies shareholder, you need to believe in the company’s ability to grow fee-based revenue from specialized risk and insurance services, even as the industry faces ongoing premium volatility and complex market conditions. The recent surge in medical professional liability insurance rates is significant, but despite the near-term impact on client demand and potential margin pressure, it does not appear to materially alter the company’s biggest catalyst, growing demand for risk management expertise, nor its most important risk, which remains potential margin contraction from pricing and litigation trends.

The most relevant recent announcement is Marsh's report on double-digit increases in medical professional liability insurance premiums for hospital clients, an area now under considerable cost pressure. This aligns with ongoing litigation-driven risks and underscores the company’s emphasis on new offerings such as insurance archaeology, which directly target evolving client needs amid rising claims costs and regulatory complexity.

On the other hand, investors should be aware of the persistent risk that litigation-driven price increases could...

Read the full narrative on Marsh & McLennan Companies (it's free!)

Marsh & McLennan Companies' outlook anticipates $30.7 billion in revenue and $5.3 billion in earnings by 2028. This implies a 5.9% annual revenue growth rate and a $1.2 billion increase in earnings from the current $4.1 billion.

Uncover how Marsh & McLennan Companies' forecasts yield a $232.42 fair value, a 15% upside to its current price.

Exploring Other Perspectives

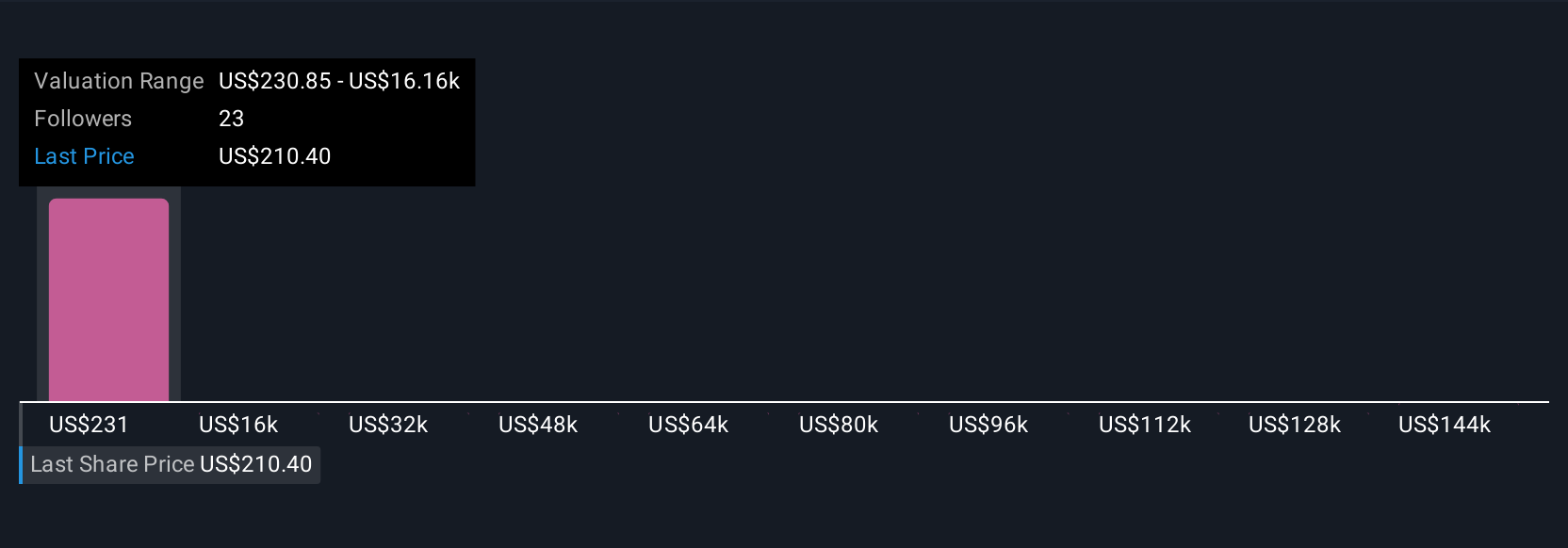

Three members of the Simply Wall St Community have estimated Marsh & McLennan’s fair value, with opinions spanning from US$232 to over US$159,000 per share. While many see opportunity in the demand for risk advisory services, the sizable spread reminds you that market participants weigh ongoing liability cost risks quite differently, compare these views to your own and explore more perspectives.

Explore 3 other fair value estimates on Marsh & McLennan Companies - why the stock might be worth just $232.42!

Build Your Own Marsh & McLennan Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marsh & McLennan Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Marsh & McLennan Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marsh & McLennan Companies' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal