Chubb (CB) Valuation in Focus as Investor Optimism Builds Before Earnings Release

Chubb (CB) has just recorded a strong session, jumping 2.07% while the S&P 500 only managed a 0.85% gain for the day. This outsized move comes as investor buzz builds ahead of Chubb’s upcoming earnings release, with attention focused on both its track record of outperforming expectations and some slightly more upbeat analyst forecasts. With earnings season approaching, investors are sifting through what these numbers and Chubb’s position relative to peers might mean for future returns.

Momentum in Chubb’s shares has been uneven over the past year, but the latest uptick adds a spark just as questions are swirling about its valuation. The stock has managed a modest 2% gain year to date, yet remains down about 2% over the past year, even as its longer-term performance remains positive. Subtle shifts in analyst sentiment and renewed focus on Chubb’s consistent earnings delivery have moved the spotlight back onto the insurer’s fundamentals.

After this latest move, is Chubb trading at a discount that savvy investors should consider, or is the market already factoring in the company’s steady execution and hints of future growth?

Most Popular Narrative: 12.6% Overvalued

The narrative currently views Chubb as trading above its fair value, suggesting limited upside at current prices while acknowledging a strong underlying business model.

Chubb’s business model is characterized by its diversified product offerings, global reach, strong underwriting capabilities, and commitment to customer service. By balancing risk and leveraging its extensive market presence, Chubb has established itself as a leading player in the global insurance industry.

Curious why Chubb’s robust fundamentals are not translating into a favorable valuation? The fair value assessment is based on an ambitious growth trajectory and a discount rate that reflects mounting economic uncertainties. Explore the specific assumptions that contribute to the conclusion of overvaluation. What are the narrative’s key drivers? Continue reading for the full picture.

Result: Fair Value of $247.08 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, factors like unexpected earnings volatility or an adverse shift in global insurance claims trends could quickly reshape the current view that the stock is overvalued.

Find out about the key risks to this Chubb narrative.Another View: A Discounted Cash Flow Perspective

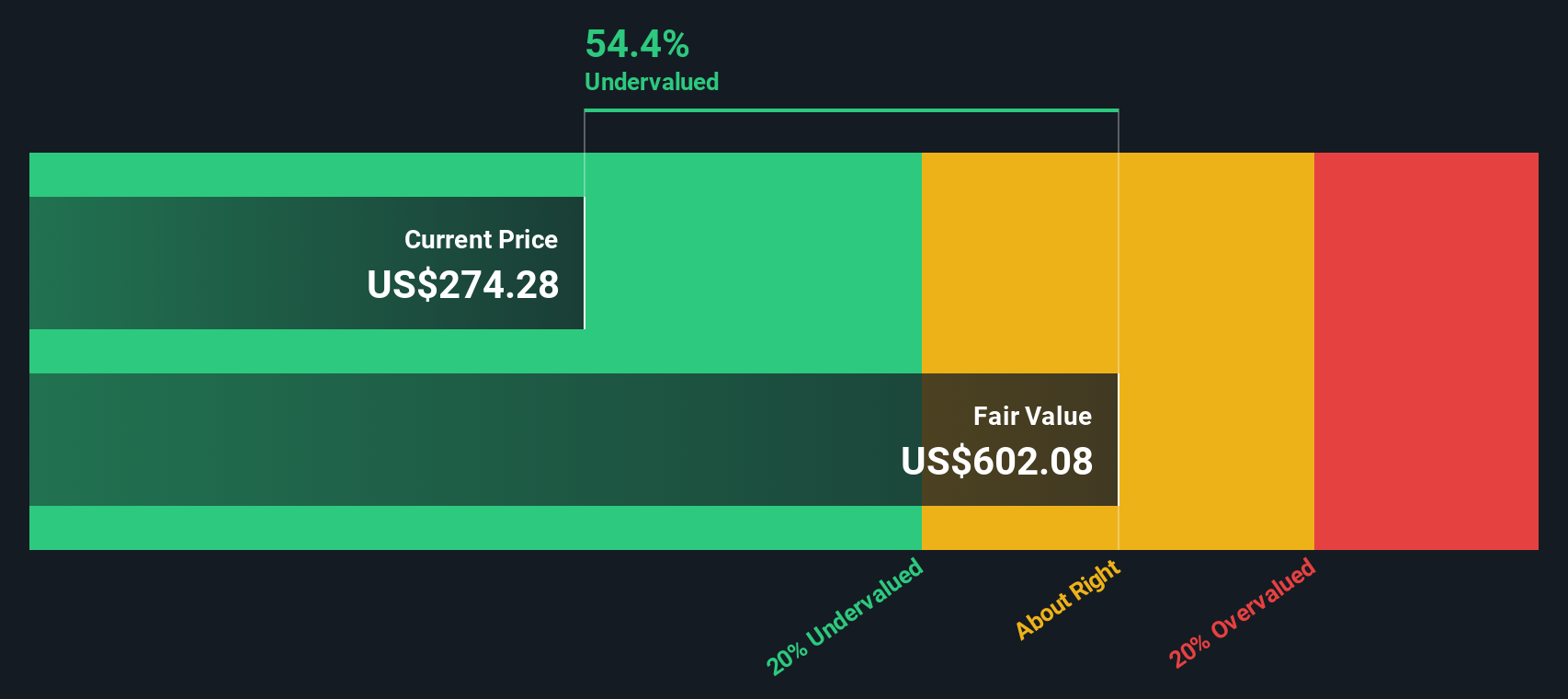

Looking at Chubb from a different angle, our DCF model offers a dramatically different result and calls the stock undervalued. This challenges the earlier conclusion and raises a key question: which approach truly captures Chubb’s potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Chubb Narrative

If you see Chubb’s story differently or want to dive into the evidence on your own terms, it only takes a few minutes to build and test your own view. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Chubb.

Looking for More Investment Ideas?

Level up your portfolio by targeting exceptional opportunities most investors overlook. Missing out means leaving potential gains on the table. Get ahead by harnessing our latest screeners for stocks that fit your strategy.

- Uncover companies revolutionizing medicine and technology by tapping into cutting-edge breakthroughs with healthcare AI stocks.

- Accelerate your path to future growth by seeking out undervalued stocks based on cash flows shaping the next wave of market winners.

- Capture steady income potential by locking in reliable dividend stocks with yields > 3% tailored for yield-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal