Can Alcoa’s (AA) Shipment Timing Shift Reveal More About Its Long-Term Strategic Discipline?

- Alcoa recently announced that its aluminum shipments for the third quarter would be 15,000 metric tons lower than previously expected due to timing issues, along with a sequential US$70 million revenue reduction in its alumina segment linked to lower bauxite shipments.

- Despite these adjustments, Alcoa maintained its full-year guidance, highlighting that the shipment shortfall and revenue changes are related to timing and not a fundamental shift in business conditions.

- We will explore how Alcoa's shipment timing adjustments and steady full-year outlook may influence the company's long-term investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Alcoa Investment Narrative Recap

To be an Alcoa shareholder, one must believe in the long-term fundamentals of aluminum, driven by decarbonization trends, growing demand from electric vehicles and infrastructure, and Alcoa's push for low-carbon products. The recent adjustment in quarterly shipment timing and revenue guidance appears immaterial to these core drivers or to the most pressing near-term risk: persistent aluminum price volatility and possible supply disruptions, both of which could directly impact earnings and free cash flow.

A particularly relevant recent announcement is Alcoa's ongoing commitment to pay a quarterly dividend of US$0.10 per share. This move underscores the board's confidence in near-term cash flow resilience even amid shipment timing adjustments, while also aligning with investor expectations for reliable shareholder returns, which can often serve as a catalyst supporting share price stability around interim operational fluctuations.

By contrast, investors should be mindful of the risk that further delays in securing mining approvals could materially affect...

Read the full narrative on Alcoa (it's free!)

Alcoa's narrative projects $13.6 billion in revenue and $592.1 million in earnings by 2028. This requires 2.0% annual revenue growth and a $396.9 million decrease in earnings from the current $989.0 million.

Uncover how Alcoa's forecasts yield a $33.55 fair value, in line with its current price.

Exploring Other Perspectives

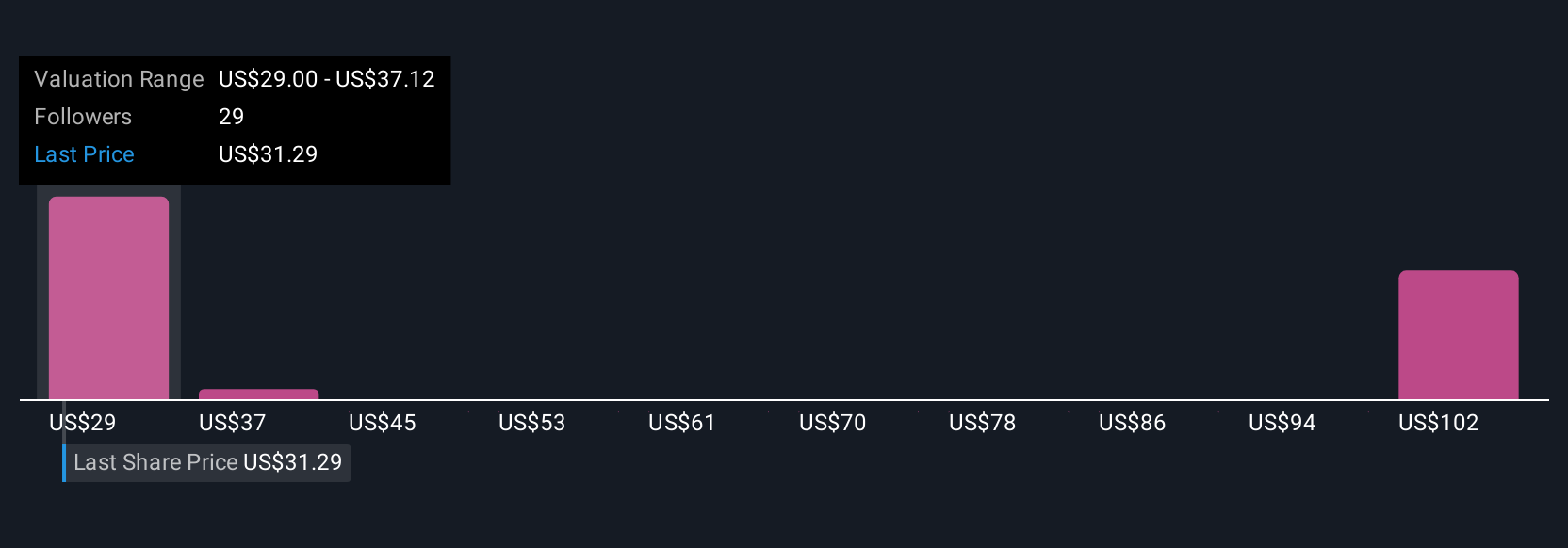

Five members of the Simply Wall St Community estimated Alcoa’s fair value between US$29 and US$143, with analyses spanning US$114,000,000, giving an unusually wide diversity of opinion. While you consider this variability, keep in mind that any sustained delays in new mining approvals could expose the company to higher production costs and operational setbacks, potentially influencing all such valuation assumptions, explore several alternative viewpoints before forming your own.

Explore 5 other fair value estimates on Alcoa - why the stock might be worth over 4x more than the current price!

Build Your Own Alcoa Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alcoa research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Alcoa research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alcoa's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal