Should Arch Capital Group's (ACGL) Expanded US$3 Billion Buyback Authorization Prompt Investor Action?

- On September 4, 2025, Arch Capital Group announced it had increased its share repurchase authorization by US$2.00 billion, raising the total buyback authorization to US$3.00 billion.

- This substantial increase in share buybacks highlights management's confidence in the company's long-term outlook and its commitment to capital return.

- With this expanded US$3.00 billion buyback plan, we'll examine how capital management shapes Arch Capital Group's investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Arch Capital Group Investment Narrative Recap

For me, the core belief behind being a shareholder in Arch Capital Group centers on trusting the company's disciplined cycle management and its ability to allocate capital efficiently, even during periods of market uncertainty or heightened catastrophe risk. The recently announced US$2.00 billion increase in share buyback authorization is unlikely to shift the most important short-term catalyst, premium growth across casualty lines, or fully offset the outsized risk from natural disasters impacting the Property and Casualty segment. The company’s July 2025 update showed ongoing buyback activity, with more than 4.3 million shares repurchased since December 2024, totaling US$383.76 million. This capital allocation move is directly relevant to current buyback plans and reinforces the role of capital management, but it doesn’t eliminate the pressing risk posed by catastrophe losses, which could still weigh on margins and earnings. Yet, despite this confidence, the threat of significant catastrophe losses is something every investor should keep in mind because...

Read the full narrative on Arch Capital Group (it's free!)

Arch Capital Group's outlook forecasts $19.3 billion in revenue and $4.0 billion in earnings by 2028. This scenario assumes a -0.2% annual decline in revenue and a $0.3 billion increase in earnings from the current level of $3.7 billion.

Uncover how Arch Capital Group's forecasts yield a $108.31 fair value, a 17% upside to its current price.

Exploring Other Perspectives

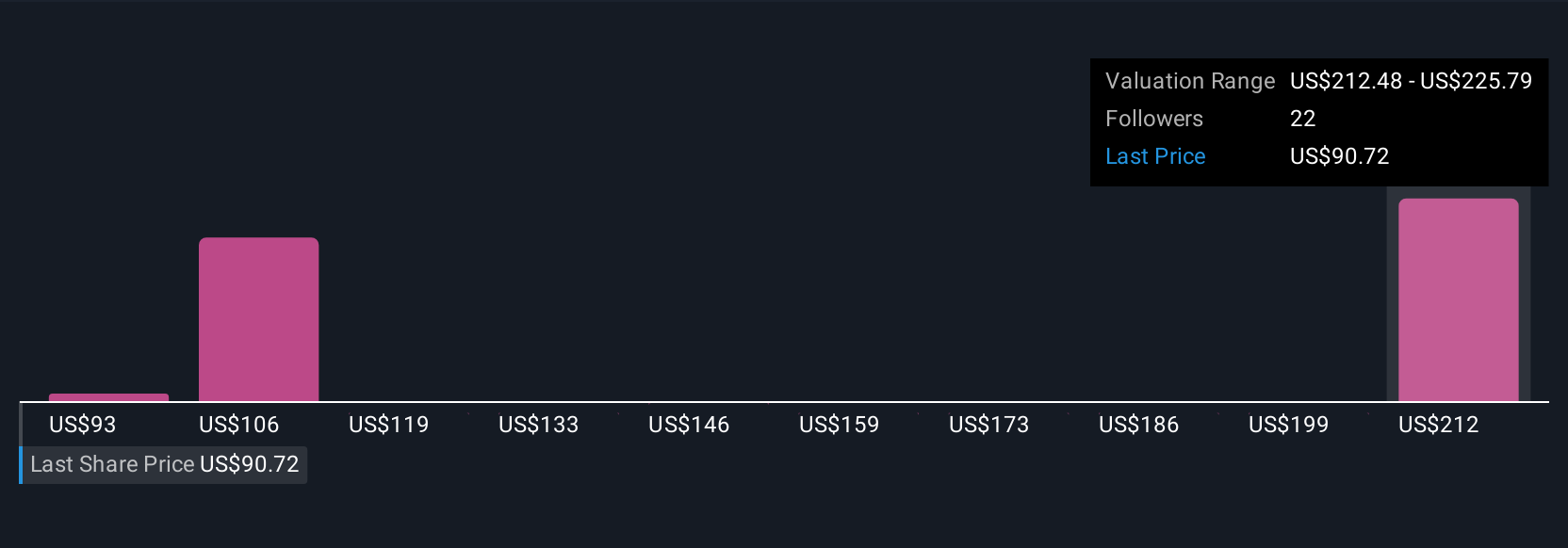

Six members of the Simply Wall St Community estimate Arch Capital's fair value from US$92.64 up to US$221.98 per share. These opinions reflect wide-ranging expectations, while ongoing catastrophe risk remains a key factor shaping future results.

Explore 6 other fair value estimates on Arch Capital Group - why the stock might be worth just $92.64!

Build Your Own Arch Capital Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arch Capital Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Arch Capital Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arch Capital Group's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal