Universal Technical Institute (UTI): Evaluating Valuation After New San Antonio Campus Launch and Leadership Appointment

If you’ve been following Universal Technical Institute (UTI), the company’s latest announcement might catch your attention. UTI has just unveiled the launch of its new San Antonio campus, dedicated fully to skilled trades training, and welcomed Christopher Finn as its Campus President. This move sits squarely within the company’s North Star growth strategy, with an eye on meeting the strong local demand for career-ready technicians in fields like aviation, welding, and HVACR.

The new campus is more than just a ribbon-cutting moment. It signals UTI’s ongoing expansion efforts and commitment to capturing regional opportunities. Over the past year, shares have climbed 62%, driven in part by these kinds of strategic rollouts, while recent months show a mixed picture with slight gains in the past month but a dip from earlier three-month highs. The company’s annual revenue grew by 9% even as net income slipped nearly 5%, prompting some to wonder whether the current momentum can be sustained as the new facility comes online.

After such a big year for the stock, does this latest move point to an undervalued opportunity for new investors, or is the market already pricing in much of UTI’s future growth?

Most Popular Narrative: 27.7% Undervalued

According to the most widely followed narrative, Universal Technical Institute appears to be trading at a meaningful discount to its estimated fair value. Analysts suggest the stock is undervalued by more than a quarter, based on future earnings expectations and revenue forecasts.

Strategic investments in campus expansion, new program rollouts—particularly in HVAC, aviation, and allied health—and digitization efforts are expected to support top-line expansion. Additionally, the consolidation of core systems should facilitate operating efficiencies, which could drive long-term margin improvement following the near-term investment cycle.

What is pushing UTI’s fair value so much higher than the current share price? There is a “growth puzzle” at the center of this narrative, built on bold targets for both the top and bottom lines. Want to know which ambitious assumptions are making Wall Street so bullish, and why the stock’s valuation rivals much larger industry players? Dive in to uncover the exact metrics and see if you agree with the case for this big price target.

Result: Fair Value of $37.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent reliance on legacy auto programs or unexpected regulatory shifts could undercut UTI’s projected growth and long-term margin improvements.

Find out about the key risks to this Universal Technical Institute narrative.Another View: How the Market Prices UTI

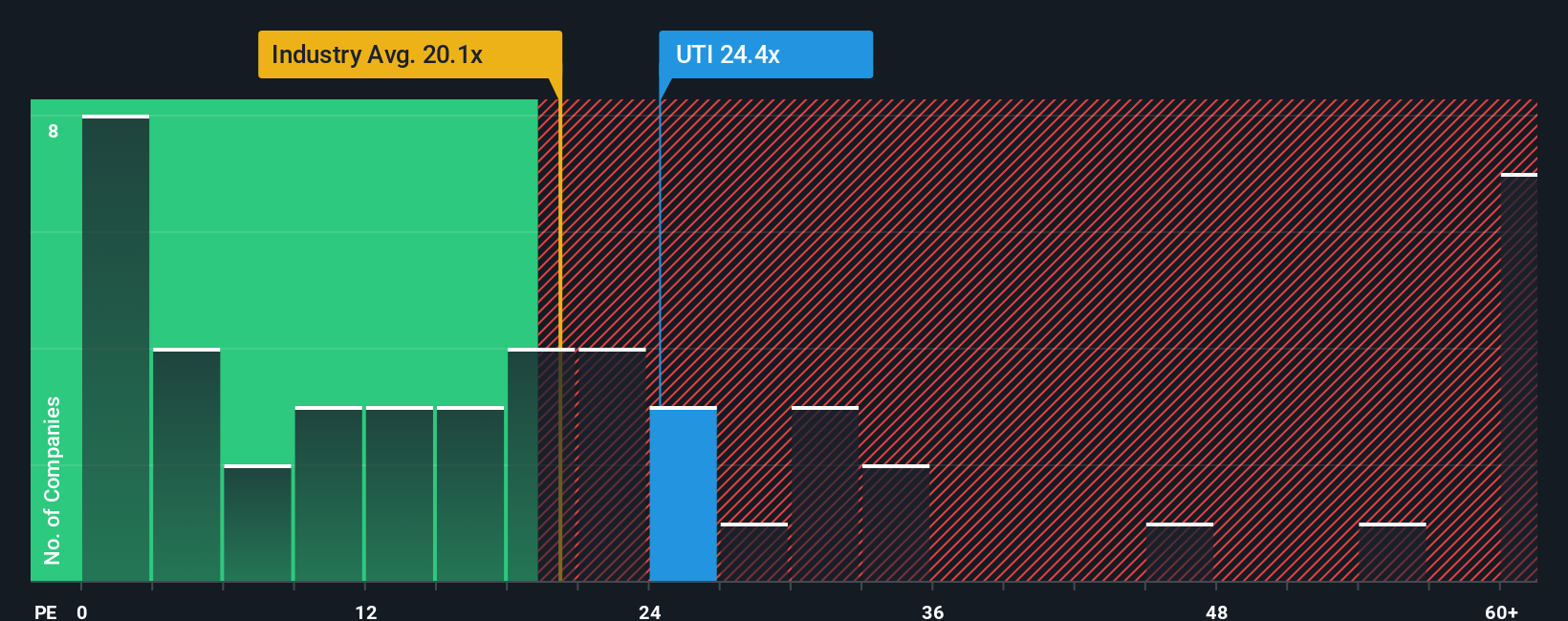

While analyst forecasts suggest Universal Technical Institute is undervalued based on growth prospects, another perspective shows the stock is priced above the average for its industry. The question remains whether this higher valuation reflects enduring quality or investor over-optimism.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Universal Technical Institute Narrative

If you see things differently or want to dig into the numbers firsthand, take the data for a spin and shape your own conclusions. Creating a narrative could take just a few minutes. Do it your way

A great starting point for your Universal Technical Institute research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Level up your investment strategy by harnessing the power of the Simply Wall Street Screener. These handpicked themes could be your next big move. Seize fresh opportunities before others do and get ahead in the evolving market.

- Supercharge your returns by tapping into penny stocks with strong financials linked to real revenue growth and financial rigor using penny stocks with strong financials

- Ride the AI wave and pinpoint pioneers at the forefront of artificial intelligence disruption with our focus on AI penny stocks

- Maximize value with stocks trading below their intrinsic worth, guided by our keen search for undervalued stocks based on cash flows

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal