McKesson (MCK): Evaluating Valuation After Earnings Beat and New Pediatric Care Distribution Deal

If you’ve been tracking McKesson (MCK) recently, you’ve probably noticed a couple of headline-worthy developments. The healthcare giant delivered quarterly revenue that edged past analyst expectations and followed that up with news that its Medical-Surgical division has teamed up with Playhouse MD™ to distribute new pediatric care products nationwide. Both the earnings beat and a fresh distribution alliance suggest McKesson is intent on strengthening its foothold across both consumer and professional healthcare markets.

This news comes after a solid year for McKesson’s stock, which has climbed 38% over the past year and more than tripled over the past five. Despite minor volatility in the last quarter, momentum appears steady, with revenue and net income growth adding further confidence. Recent announcements, such as the exclusive e-commerce push with Playhouse MD™, show a company leveraging partnerships and new product lines to underpin its expanding role in healthcare distribution and services.

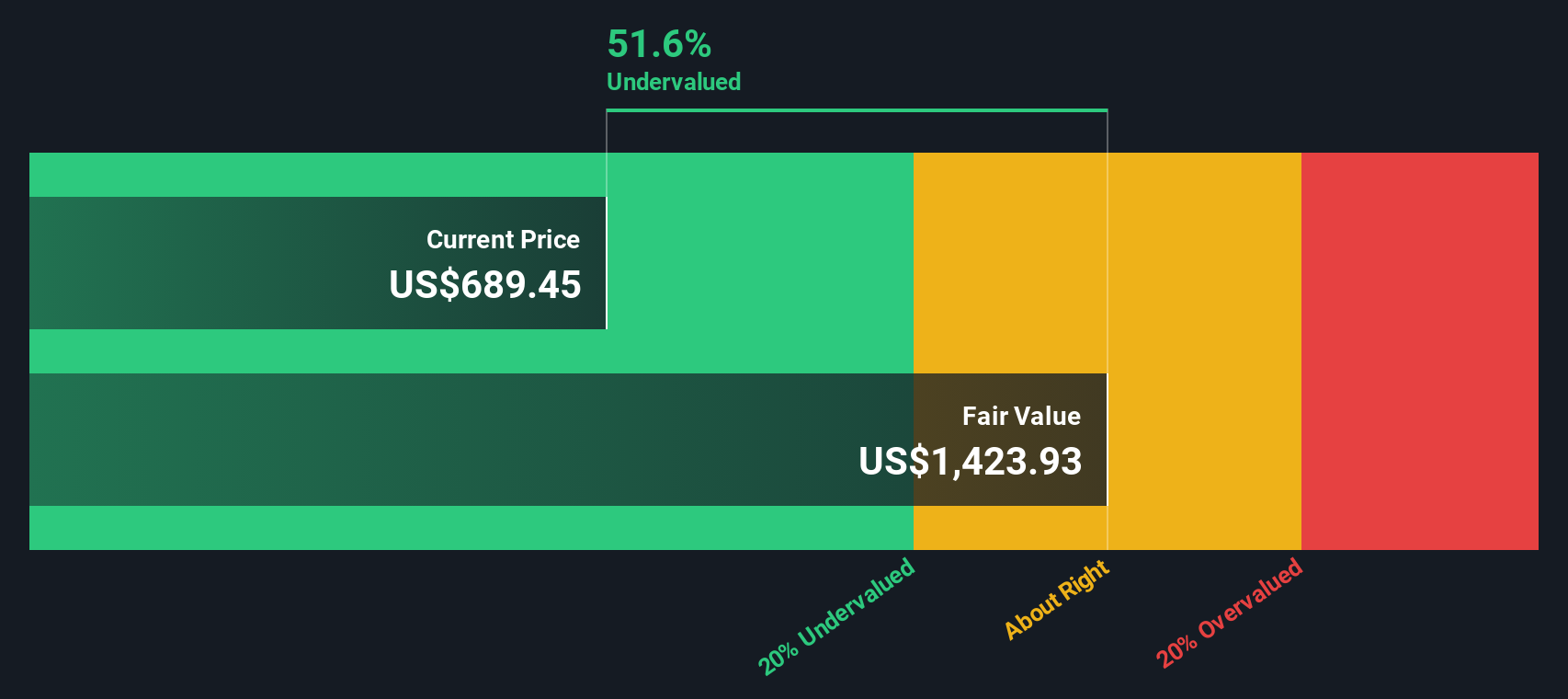

But with shares already up strongly since last year, does McKesson have more room to run, or are investors already factoring in all of its future growth potential?

Most Popular Narrative: 9.8% Undervalued

The prevailing view among analysts is that McKesson's shares are currently trading below their calculated fair value, suggesting room for further upside if projections hold true.

Increasing adoption of specialty and oncology pharmaceuticals, alongside recent acquisitions (Core Ventures and PRISM Vision) that expand the provider network and service portfolio, are improving revenue mix quality and positioning the company for higher operating margins and earnings growth.

This bullish case rests on a mix of transformative moves and bold growth assumptions. The engines behind this valuation include expectations of a rapid shift in the business model and substantial operational improvements, with one key metric hinting at a new phase for McKesson’s profit potential. Want to know which financial leap analysts are banking on to fuel that price target? The secret sauce is buried in the numbers that could send the valuation climbing even higher. Curious which ones?

Result: Fair Value of $788.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, regulatory pressure on drug pricing and industry consolidation could limit McKesson’s profit margins or disrupt its long-term revenue growth narrative.

Find out about the key risks to this McKesson narrative.Another View: Looking Beyond Analyst Targets

While analysts suggest McKesson is undervalued, our DCF model paints a similar picture using long-term cash flow forecasts. However, how reliable is the SWS DCF model when market sentiment moves faster than fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own McKesson Narrative

If you want to dig into the numbers yourself and come to a different conclusion, it’s quick and easy to form your own narrative, usually in under three minutes. Do it your way

A great starting point for your McKesson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t watch from the sidelines while others spot their next winner. Supercharge your portfolio by using our screener to find hidden gems and market-leading trends with just a few clicks.

- Capitalize on fast-growing companies at attractive valuations by checking out undervalued stocks based on cash flows. Discover businesses shaping new profit frontiers through strong cash flows.

- Boost your income stream and future-proof your holdings with dividend stocks with yields > 3%, which features consistent yields above 3% and a commitment to rewarding shareholders.

- Get ahead of the curve on tomorrow’s technology breakthroughs by browsing quantum computing stocks. See which innovators are redefining what’s possible in computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal