CarMax (KMX): Exploring the Used Car Retailer’s Valuation After Recent Share Price Volatility

CarMax (NYSE:KMX) has caught the attention of investors recently, with the stock’s movement stirring up debate about where it could head next. Sometimes price moves arrive without a specific catalyst. In these cases, investors tend to look for signs in the noise to determine whether it is the start of a trend or just another twist in a volatile market. When the used car retailer’s shares shift, it often prompts a closer look at how the market is valuing the business.

Looking at the bigger picture, CarMax has faced headwinds over the past year, with its share price declining over 24%. Shorter-term activity has not shown a major turnaround either, and even with a nearly 2% gain during the past month, momentum is far from clear. Combined with lackluster returns over longer periods, this kind of performance suggests that confidence in the company’s growth path remains shaky, regardless of the absence of a recent trigger event.

After a year of declines and the current market skepticism, is CarMax now trading at an attractive discount, or is the market already factoring in everything it knows about the company’s future?

Most Popular Narrative: 26.6% Undervalued

The prevailing narrative views CarMax shares as materially undervalued compared to their fair value, using a discount rate grounded in current analyst assumptions about future growth and risk.

CarMax's growth in digital sales channels, including an increase in omnichannel sales, positions the company to expand its market share and boost revenue in the future. The ongoing enhancements to their digital tools are expected to further integrate online and in-store sales.

Want to discover the real reason behind this big discount to fair value? The secret lies in brave analyst forecasts and a profit margin outlook that could change how you see this stock. Is CarMax’s next move hidden in bullish growth targets or undisclosed sector comparisons? Find out what analysts are betting on and why it might surprise you.

Result: Fair Value of $81.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, such as continued pressure on gross margins or rising loan losses. These factors could quickly undermine the case for a discount.

Find out about the key risks to this CarMax narrative.Another View: What Does Our DCF Model Say?

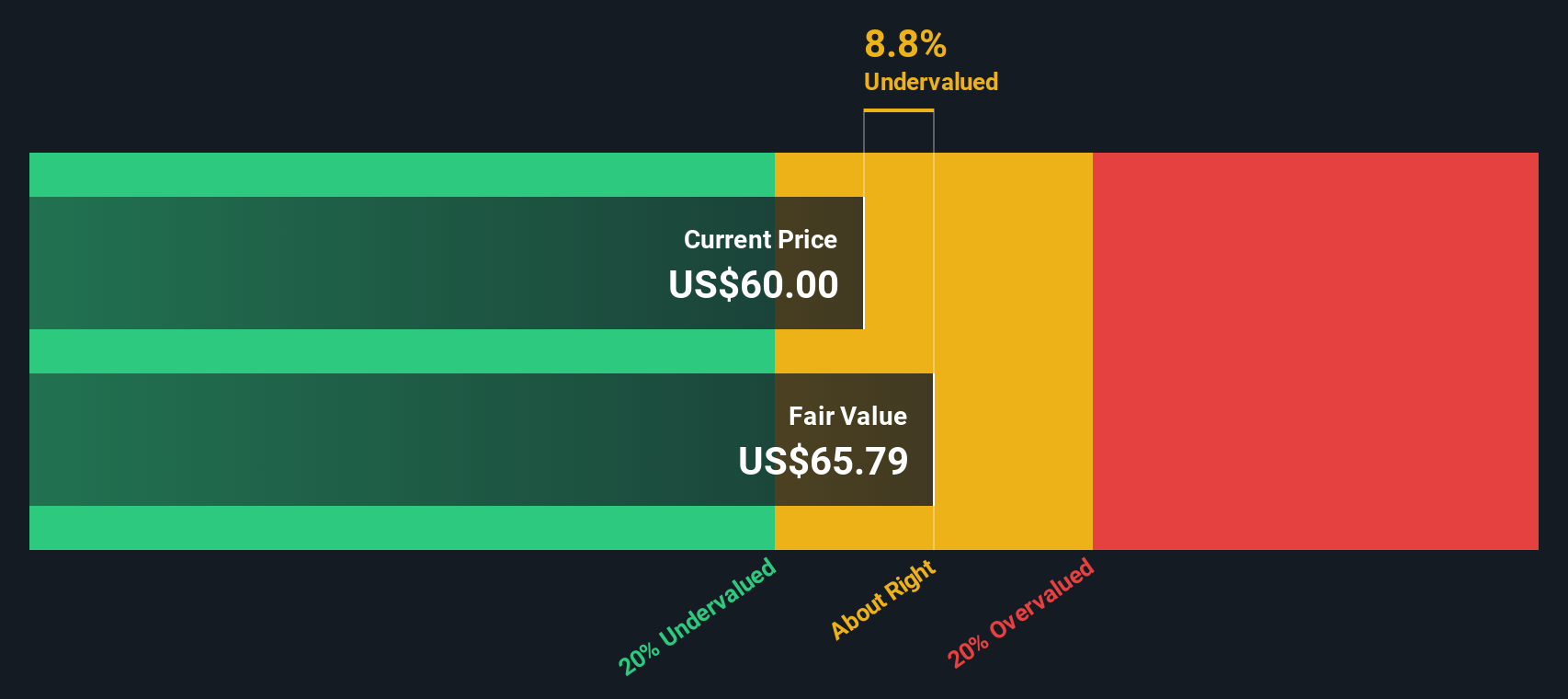

While analysts see upside based on earnings and growth expectations, our DCF model presents a more cautious perspective. This method suggests that the shares are only modestly below their intrinsic value. Could this suggest that market skeptics are more correct than they appear?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CarMax Narrative

If you want a different perspective or enjoy running the numbers on your own, it only takes a few minutes to develop your own unique view. Do it your way.

A great starting point for your CarMax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Investment Idea?

Don’t let opportunity pass you by. With the Simply Wall Street Screener, you can target new growth themes and find stocks that fit your goals instantly.

- Jump into fast-growing small-cap companies making waves in the market using our penny stocks with strong financials to spot high-potential winners early.

- Capture future value by zeroing in on stocks that the market has overlooked with our undervalued stocks based on cash flows to give your portfolio an edge.

- Capitalize on the AI-driven revolution in healthcare by searching for innovators with our healthcare AI stocks to invest where cutting-edge technology meets real-world impact.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal