A Fresh Look at National Beverage (FIZZ) Valuation Following Modest Q1 Growth and Earnings Dip

National Beverage (FIZZ) Q1 Earnings: Modest Growth Raises New Questions

National Beverage (FIZZ) just dropped its first quarter earnings report, and it is already sparking conversations among investors. Sales edged slightly higher year-over-year, but there was a small dip in net income and earnings per share. This combination, with a touch of growth on the top line alongside a marginal decline in profitability, might prompt investors to reevaluate how to view the company’s progress and what lies ahead.

This latest update comes at a time when National Beverage’s stock has faced some headwinds. Over the past year, shares have fallen about 12%, with similar downward pressure seen across recent months. Longer term, the momentum looks mixed, with a modest 31% total return over five years but essentially flat three-year performance. Against this backdrop, the fresh earnings data could either reinforce existing caution or present a new angle on the company’s value.

So with growth steady but pressure on the bottom line, is this quarter’s softness already baked into the stock price, or could investors be overlooking a buying opportunity?

Price-to-Earnings of 19.7x: Is it justified?

National Beverage is currently trading at a price-to-earnings (P/E) ratio of 19.7x, which is much lower than the peer average of 55.7x. However, it is a bit higher compared to the global beverage industry average of 18.4x. This suggests that while the company offers good value relative to its direct competitors, it may appear somewhat expensive when measured against the broader sector.

The price-to-earnings ratio is a commonly used metric that measures the relationship between a company’s current share price and its earnings per share. For consumer businesses like National Beverage, the P/E helps investors gauge how much they are paying for a dollar of the company’s profits. A lower P/E compared to peers might indicate that the market is undervaluing the company’s earnings. In contrast, a higher P/E versus the wider industry prompts questions about expected growth or stability.

In this case, the market seems to be pricing National Beverage’s shares attractively relative to similar beverage makers, possibly reflecting steady earnings growth and a consistent profit profile. Being slightly above the global industry average could also indicate that investors are willing to pay a premium for the company’s specific strengths or brand loyalty. Whether this premium is sustainable will likely depend on continued earnings growth and trends within the sector.

Result: Fair Value of $39.18 (ABOUT RIGHT)

See our latest analysis for National Beverage.However, continued sluggish returns and slower net income growth could pressure the stock further if underlying performance does not improve soon.

Find out about the key risks to this National Beverage narrative.Another View: Our DCF Model Suggests More Upside

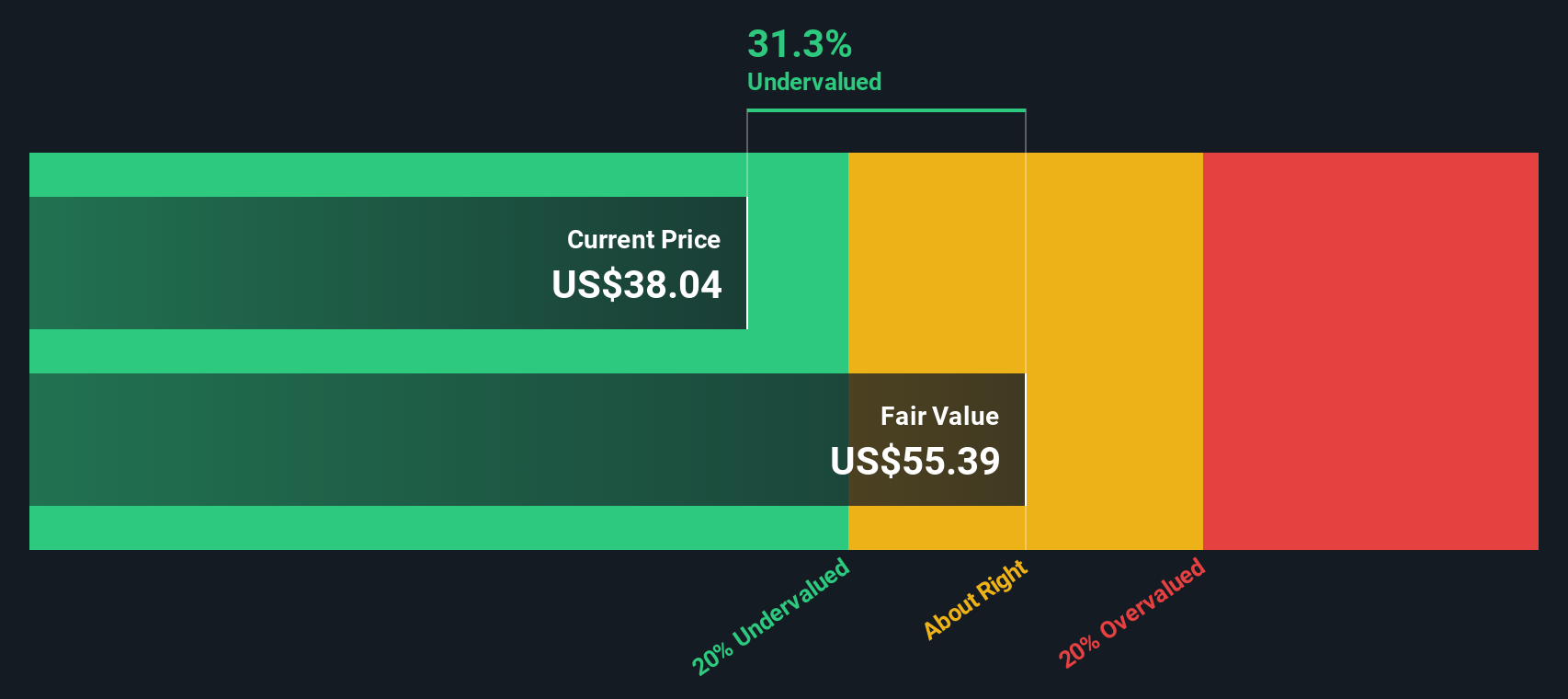

Looking at National Beverage through the lens of our DCF model shows a different story. This approach points to shares being undervalued and suggests there could be more potential than the current price reflects. Could this second lens be revealing value that others are missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own National Beverage Narrative

If you think the numbers tell a different story or want to shape your own perspective, you have the power to build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding National Beverage.

Looking for more investment ideas?

Unlock real opportunities by targeting companies that fit your strategy, so you never miss out on the next big move in the market. Get ahead by letting these smart screens be your edge.

- Turbocharge your growth search with companies at the forefront of artificial intelligence, leveraging all the breakthroughs found in AI penny stocks.

- Strengthen your portfolio by focusing on yield champions offering attractive payouts and robust track records through dividend stocks with yields > 3%.

- Spot the market’s most overlooked gems trading below their true worth by using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal