Will Loews' (L) Board Addition and Dividend Reflect a Shift in Its Governance Priorities?

- Loews Corporation recently reported a 6% rise in second-quarter net income, declared a quarterly dividend, and announced the addition of Jennifer VanBelle to its board and Audit Committee.

- VanBelle’s experience from General Electric, combined with ongoing shareholder rewards, suggests Loews is emphasizing both governance and financial stability in its leadership approach.

- We'll explore how experienced board appointments may influence Loews' investment narrative in light of recent earnings growth and dividend plans.

This technology could replace computers: discover 25 stocks that are working to make quantum computing a reality.

What Is Loews' Investment Narrative?

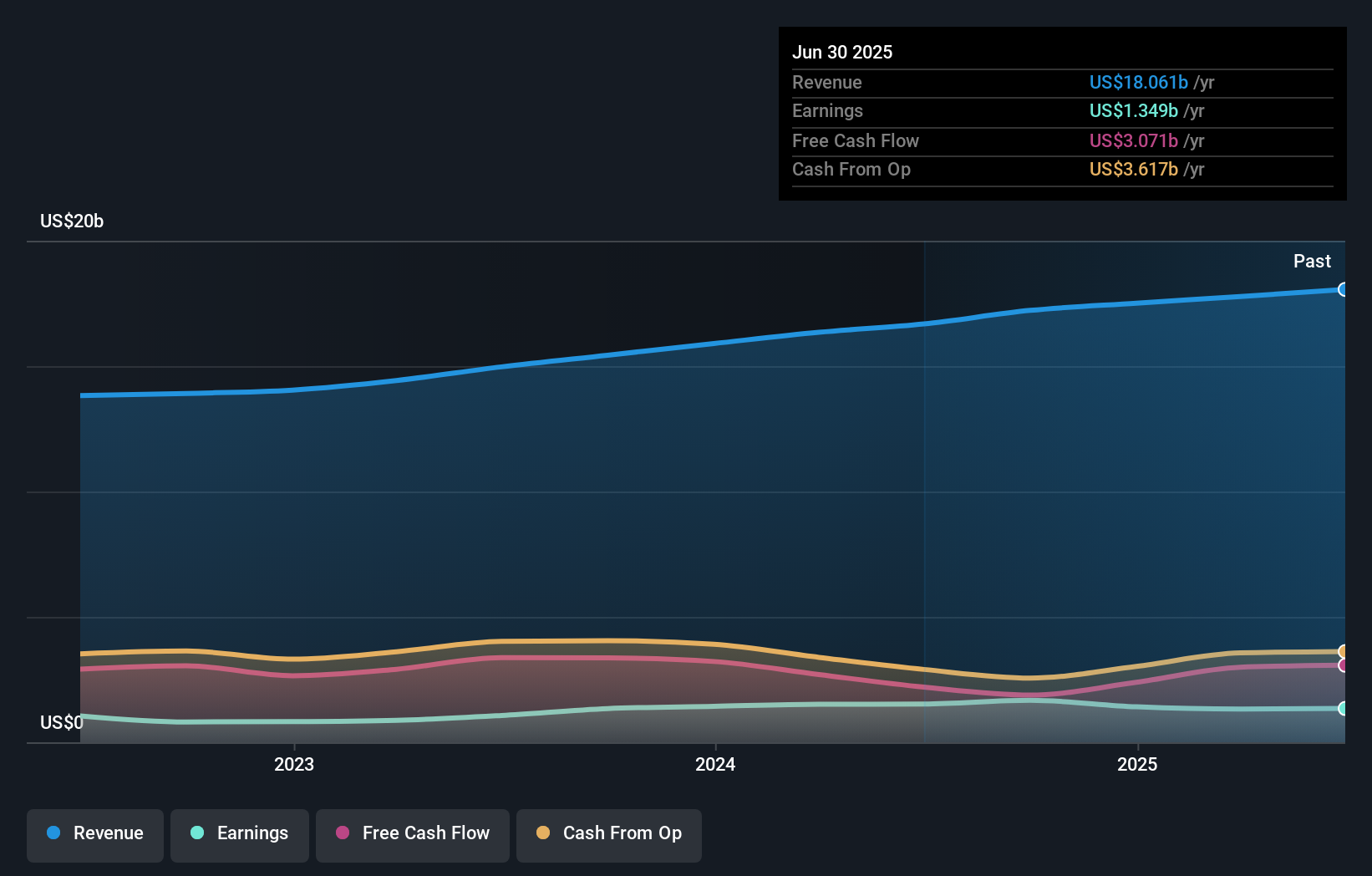

To be a Loews shareholder right now, you’d need to be comfortable with a company that combines steady dividend payments, consistent buybacks, and a management team with significant experience. The latest news, showing record-high stock prices, continuing dividend payouts, and an experienced new director from General Electric, adds more weight to Loews’ focus on stability, governance, and rewarding existing shareholders. While the 6% net income growth and the addition to the board suggest incremental positive movement, it’s unlikely that these will meaningfully shift near-term catalysts or risks for most investors. That’s because the quarterly results build on existing trends rather than signaling a step change, and the new board appointment, while further strengthening governance, doesn’t fundamentally change the biggest open questions about future profit growth or return on equity. The major risks remain around whether Loews can accelerate earnings in a way that catches up to, or surpasses, broader industry performance. However, recent executive changes may raise longer-term questions about strategic direction and consistency.

Loews' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Loews - why the stock might be worth as much as $97.38!

Build Your Own Loews Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Loews research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Loews research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Loews' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal