Assessing DigitalBridge (DBRG): Is the Current Valuation Justified After Recent Share Price Moves?

DigitalBridge Group (DBRG) has caught some investor attention recently as its share price continued to move, even without a clear event driving the story. The lack of a specific trigger usually raises questions: is the current action simply the market repositioning itself, or is there more underneath the surface that investors should pay attention to? For anyone thinking about what to do with DigitalBridge right now, it makes sense to take stock of what’s influencing its valuation before making any moves.

Over the past 3 months, DigitalBridge Group’s share price has climbed around 17%, building up some positive momentum after a choppier year that saw the stock decline 14% overall. Despite steady revenue and net income growth reported in the latest annual figures, longer-term performance remains mixed, with returns over five years barely in positive territory and three-year returns still negative. It is a stock that has seen both optimism and caution depending on the timeframe you choose.

So after this year’s ups and downs, is DigitalBridge now cheap relative to its true worth, or is the market already assuming the next phase of growth? Let’s dig into the valuation details next.

Most Popular Narrative: 26.9% Undervalued

According to the most widely followed narrative on DigitalBridge, the stock appears materially undervalued at current levels, with a fair value estimate suggesting significant upside if key growth drivers deliver as expected.

The explosion in AI workloads and hyperscale/cloud CapEx is driving unprecedented demand for data centers and power, fueling a substantial multi-year leasing and development pipeline for DigitalBridge. This supports long-term revenue, FEEUM, and EBITDA growth as the company monetizes these trends through new asset deployment and leasing.

Curious how DigitalBridge’s high-stakes bet on tomorrow’s digital infrastructure could unlock a valuation jump? The future price tag depends on a dramatic turnaround in profitability and rapid revenue growth, hinging on trends reshaping entire industries. Want to know which financial drivers are built into this narrative? The details behind this bold target just might surprise you.

Result: Fair Value of $16.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent competition and shifting technology trends could undercut DigitalBridge’s growth. This may challenge its ability to sustain margins and predictable earnings over the long term.

Find out about the key risks to this DigitalBridge Group narrative.Another View: What About the Market Comparison?

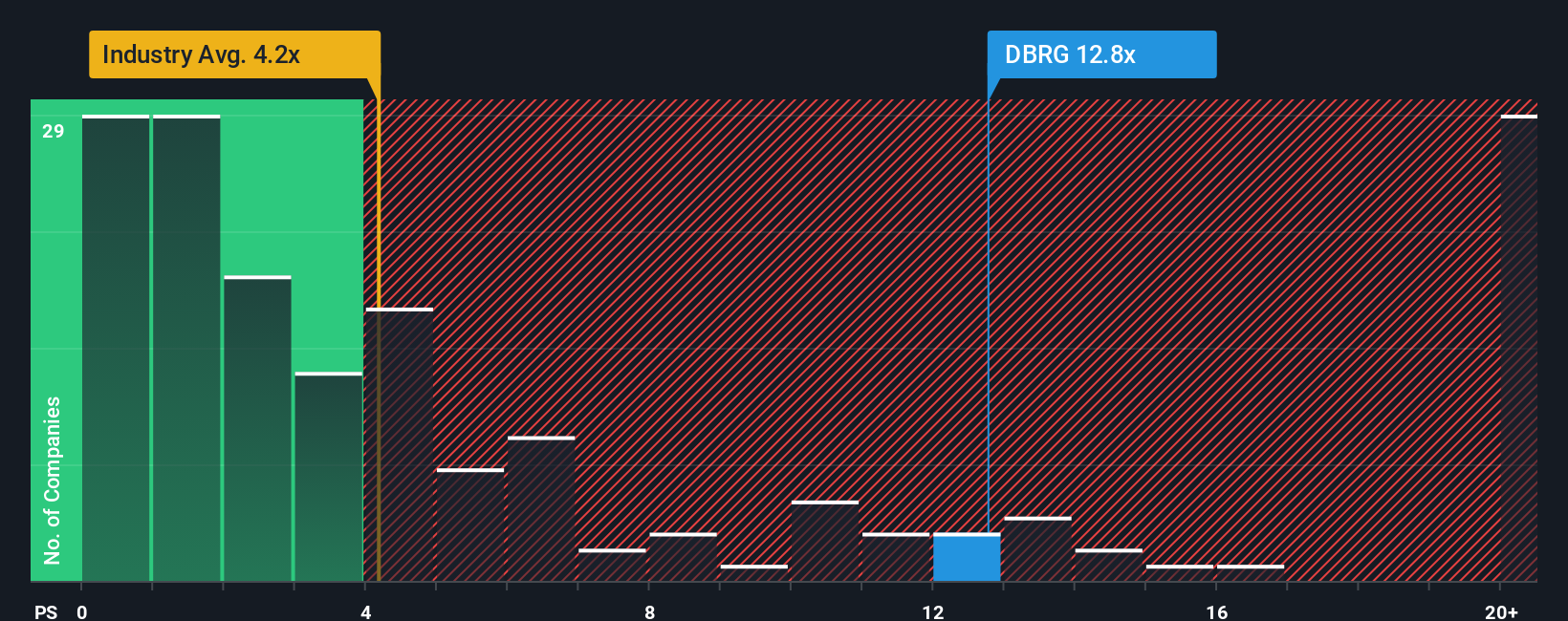

Looking through a different lens, a simple industry-based comparison suggests DigitalBridge is actually pricey compared to similar companies in its sector. Could the market be overestimating future growth, or is something missing from this view?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DigitalBridge Group Narrative

If this perspective does not fully align with your view, or you prefer to investigate the numbers first-hand, you can shape your own narrative in just minutes using Do it your way.

A great starting point for your DigitalBridge Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Why limit your strategy to just one stock when you can spot game changers across the market? Unlock opportunities by pursuing tomorrow’s success stories before everyone else does. Here’s where your next smart move could start:

- Accelerate your search for growth by uncovering penny stocks with breakthrough financial health and market momentum through the penny stocks with strong financials screener.

- Tap into Wall Street's favorite theme and seize the rise of artificial intelligence by reviewing powerful contenders in the AI penny stocks collection.

- Boost your portfolio’s value with truly compelling opportunities by checking out stocks currently overlooked by the market via our undervalued stocks based on cash flows tool.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal