Skyward Specialty Insurance Group (SKWD): Exploring Valuation After Recent Share Price Dip

Most Popular Narrative: 24.5% Undervalued

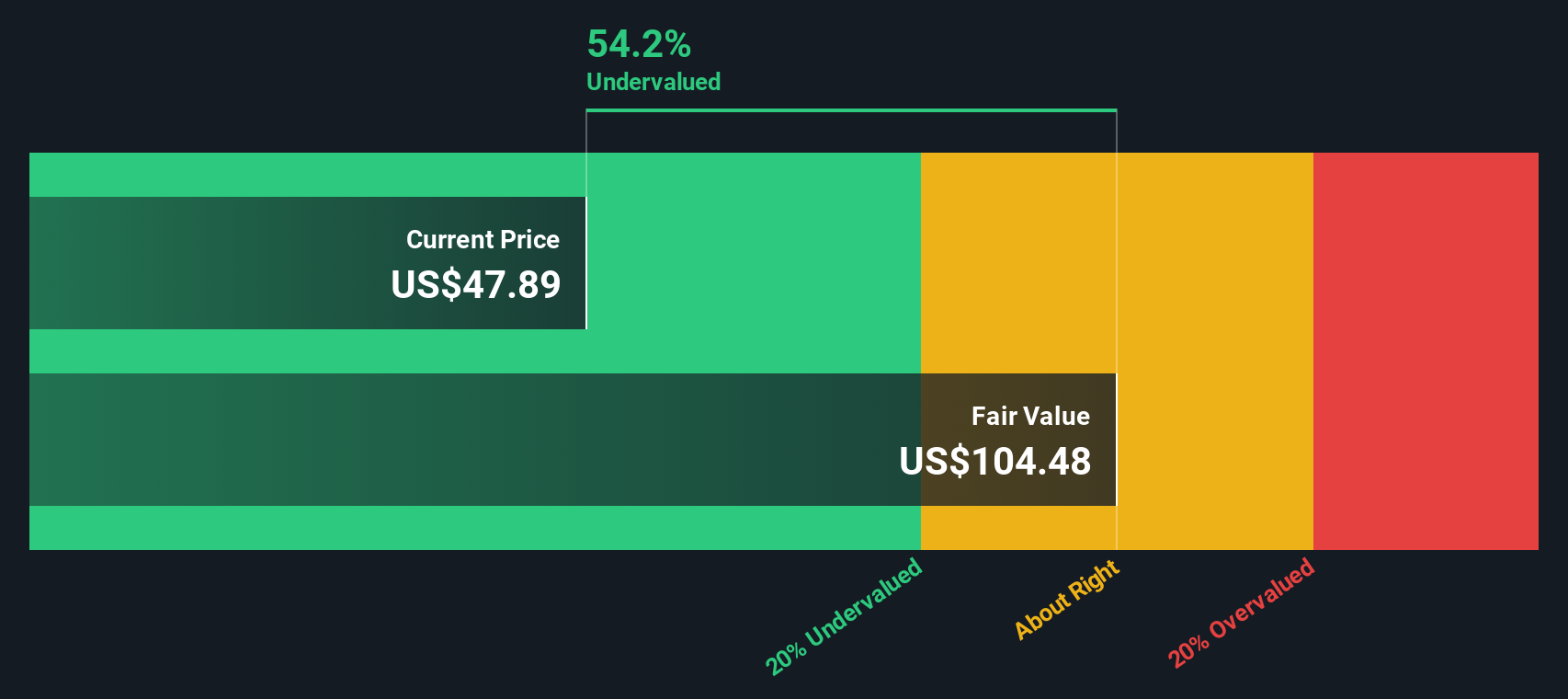

According to the most widely followed narrative, Skyward Specialty Insurance Group's shares are currently trading well below what analysts view as their fair value. This suggests meaningful upside potential for investors focused on growth and fundamentals.

The continued increase in frequency and severity of natural catastrophes is driving heightened demand for innovative, tech-enabled specialty insurance solutions and captives, particularly in underserved sectors like automotive and agriculture. This supports strong top-line premium growth and recurring revenue for Skyward going forward.

Have you ever wondered why so many are bullish on Skyward's future? The secret lies in a few bold financial forecasts, including growth rates and future profit margins, that could reshape how investors see this stock. Want to know which high-stakes numbers set this price target apart? The full narrative holds the key drivers and the assumptions even the skeptics are watching closely.

Result: Fair Value of $61.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing investment income volatility and increasing competitive pressure in specialty insurance could quickly shift expectations for Skyward's growth and profitability.

Find out about the key risks to this Skyward Specialty Insurance Group narrative.Another View: The DCF Perspective

Looking at Skyward Specialty Insurance Group through our DCF model adds a new twist. This method also points to the stock trading well below intrinsic value, which reinforces the earlier optimism. However, could the assumptions behind the DCF be masking hidden risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Skyward Specialty Insurance Group Narrative

If you find yourself questioning these conclusions or prefer building your own analysis from scratch, you can assemble a personalised narrative in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Skyward Specialty Insurance Group.

Looking for More Smart Investment Ideas?

Don’t miss the chance to uncover your next winning pick. Put your investing skills to work and tap into opportunities that others might overlook. Powerful filters on Simply Wall Street are built to help you act before the crowd.

- Strengthen your portfolio with reliable income generators by checking out dividend stocks with yields > 3% and secure stocks boasting healthy yields above 3%.

- Catch the momentum behind the artificial intelligence revolution, and access tomorrow’s AI-driven companies early through AI penny stocks.

- Spot overlooked gems. Move fast on companies undervalued by their cash flows, easily surfaced with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal