A Fresh Valuation Look at Visa After Major Sustainability Push With Ample Earth Collaboration

Visa’s latest move is catching the eye of anyone watching the payment industry. The company just announced a partnership with Ample Earth to weave sustainability data directly into digital banking and loyalty programs. With a new whitepaper outlining the vision, Visa aims to make eco-conscious commerce an everyday experience and embed ESG principles throughout its payment ecosystem. This approach could noticeably shape both customer behavior and the company’s value proposition.

This strategic step aligns with broader trends observed over the past year, as Visa has focused on digital innovation and sustainability. Despite a dip of nearly 4% over the past three months, Visa’s year-to-date return stands at nearly 8%, and its 12-month gain approaches 19%. The contrast between short-term pullbacks and longer-term momentum highlights ongoing market debates around risk and future growth prospects for the company.

Does this shift towards sustainable payments create a new entry point for investors, or is Visa’s growth story already fully reflected in the current price?

Most Popular Narrative: 40% Overvalued

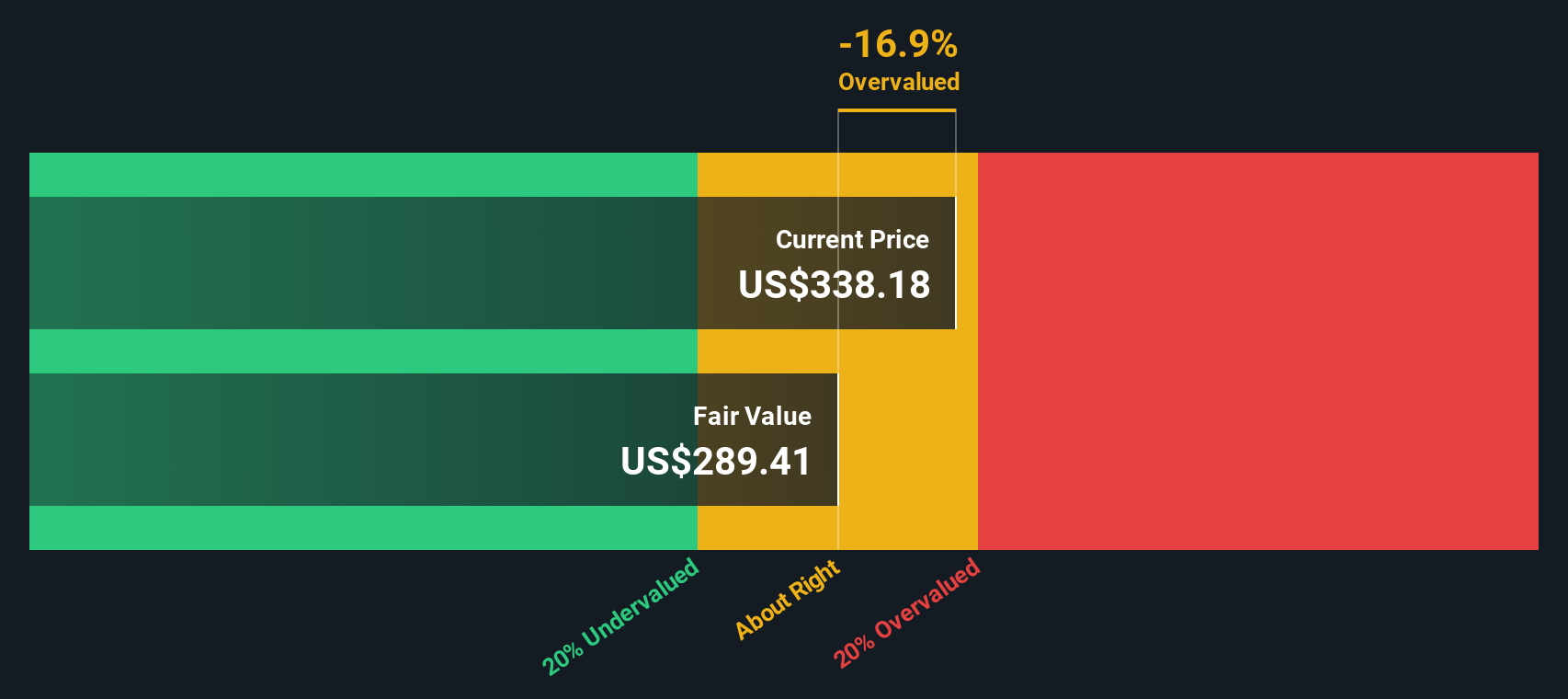

According to the narrative by Goran_Damchevski, Visa’s current price is trading at an over 39% premium to fair value, based on rigorous long-term forecasts and a discount rate of 6.9%.

“Management’s guidance and the performance thus far is fairly consistent with my forward estimates. I expect this to continue in the next 5 years, which is why I am maintaining and extending my forward estimates to 2029. Using my 22x PE and $27.8B earnings in 2029, I estimate Visa’s forward value to be around $611B. Discounted back using a 6.9% rate, I get a present value of $438B or $243 per share.”

Want to know the growth blueprint shaping this bold valuation call? The narrative teases ambitious future projections for Visa, based on aggressive revenue and margin assumptions you won’t see everywhere. Curious which forecasts make this stock look dramatically overpriced by retail standards? Keep reading to see the hidden factors behind the headline valuation.

Result: Fair Value of $243 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a stronger than expected US consumer or unexpected Fintech adoption could accelerate Visa’s growth and challenge assumptions behind the current valuation debate.

Find out about the key risks to this Visa narrative.Another View: Discounted Cash Flow Model

While the previous narrative leans on long-term growth forecasts, our SWS DCF model also points to an overvalued stock. However, both approaches have their own assumptions and limitations. Which signals should investors trust when so much depends on future growth?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Visa Narrative

If you have your own perspective or want a different take, dive into the numbers and craft your own Visa story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Visa.

Ready for More Winning Ideas?

Push your investing further. Use the Simply Wall Street Screener to spot opportunities others might be missing and give yourself an edge over the herd.

- Catch game-changing momentum among small companies with real potential by tracking penny stocks with strong financials. These businesses are disrupting the market with strong financials.

- Seize the income advantage and build steady returns with dividend stocks with yields > 3%. These options offer attractive yields above 3% for reliable, long-term growth.

- Tap into innovation at the crossroads of medicine and technology via healthcare AI stocks. Explore companies revolutionizing healthcare with artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal