The Bull Case For Constellium (CSTM) Could Change Following Embraer Partnership Extension and Airware Alloy Supply

- Constellium SE recently announced the extension of its long-term partnership with Embraer, committing to supply high-performance aluminum solutions, including its proprietary Airware® aluminum-lithium alloy, for Embraer's Commercial Aviation, Executive Jets, and Defense & Security divisions.

- This partnership highlights Constellium’s important role as a trusted materials supplier for advanced aerospace applications, reinforcing its presence in critical growth sectors.

- We'll examine how Constellium's renewed agreement with Embraer supports its aerospace market leadership and long-term growth outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Constellium Investment Narrative Recap

Constellium shareholders need to believe in a sustained aerospace and defense recovery, as well as ongoing margin improvement from innovation and long-term contracts. The renewed Embraer partnership supports a key short-term catalyst, securing growth in high-value aerospace segments, but doesn't fundamentally change Constellium's primary risk: sensitivity to demand cycles in core markets, especially if aerospace shipments weaken or remain volatile.

The August 2025 announcement of a new contract with PyroGenesis to reduce emissions in aluminum remelting is directly relevant here, underscoring Constellium’s push toward greater efficiency and sustainability in high-spec metal supply, which further supports its value proposition to aerospace customers.

In contrast, investors should also be aware of how a slower-than-expected recovery in these end markets could...

Read the full narrative on Constellium (it's free!)

Constellium's outlook projects $9.9 billion in revenue and $448.3 million in earnings by 2028. This assumes a 9.3% annual revenue growth rate and an earnings increase of $416.3 million from current earnings of $32.0 million.

Uncover how Constellium's forecasts yield a $18.31 fair value, a 23% upside to its current price.

Exploring Other Perspectives

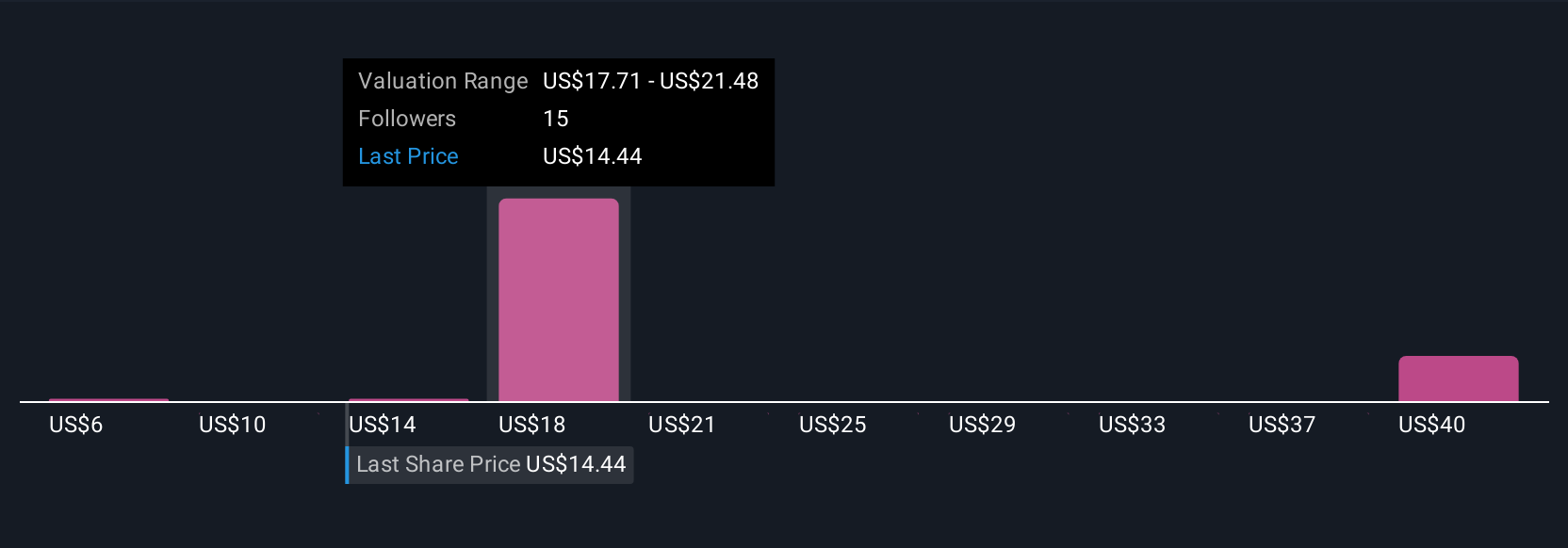

Four members of the Simply Wall St Community estimate Constellium's fair value anywhere from US$6.40 up to US$47.11 per share. While some see significant upside, most analyst forecasts highlight ongoing margin risk if aerospace demand does not accelerate as hoped, giving you plenty of alternative viewpoints to consider.

Explore 4 other fair value estimates on Constellium - why the stock might be worth less than half the current price!

Build Your Own Constellium Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Constellium research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Constellium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Constellium's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal