Does VICI Properties' (VICI) Dividend Growth Reflect Enduring Confidence or Strategic Caution?

- VICI Properties recently announced that its Board of Directors approved a 4% increase in its regular quarterly cash dividend to US$0.45 per share for the third quarter of 2025, payable on October 9 to shareholders of record as of September 18.

- This dividend hike underscores the company’s confidence in its recurring income model and long-term commitment to delivering shareholder returns through reliable cash distributions.

- We'll explore how the recent dividend increase further strengthens VICI Properties' investment case as a resilient income provider in the experiential real estate sector.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

VICI Properties Investment Narrative Recap

For me, the core belief behind owning VICI Properties centers on the predictability of income from its long-term, inflation-protected leases with leading gaming and experiential brands. The recent 4% dividend increase shows ongoing cash flow strength, but it does not fundamentally alter the major short-term catalyst, which is continued revenue consistency from its flagship tenants, nor does it materially change the biggest risk, VICI's reliance on a concentrated group of gaming operators for rent payments and occupancy stability.

Mizuho's recent adjustment of its price target for VICI Properties to US$35, noting the security of earnings growth driven by tenant diversification and long lease agreements, is particularly relevant. Such analysis signals confidence in the income profile, especially as the company's dividend rises, but the main risk, tenant concentration, remains front of mind for shareholders seeking sustained income over time.

However, it's important for investors to remember that unlike the reliability projected by rising dividends, concentrated exposure to a few tenants means ...

Read the full narrative on VICI Properties (it's free!)

VICI Properties' narrative projects $4.3 billion revenue and $2.8 billion earnings by 2028. This requires 3.4% yearly revenue growth and no change in earnings from the current $2.8 billion level.

Uncover how VICI Properties' forecasts yield a $36.73 fair value, a 11% upside to its current price.

Exploring Other Perspectives

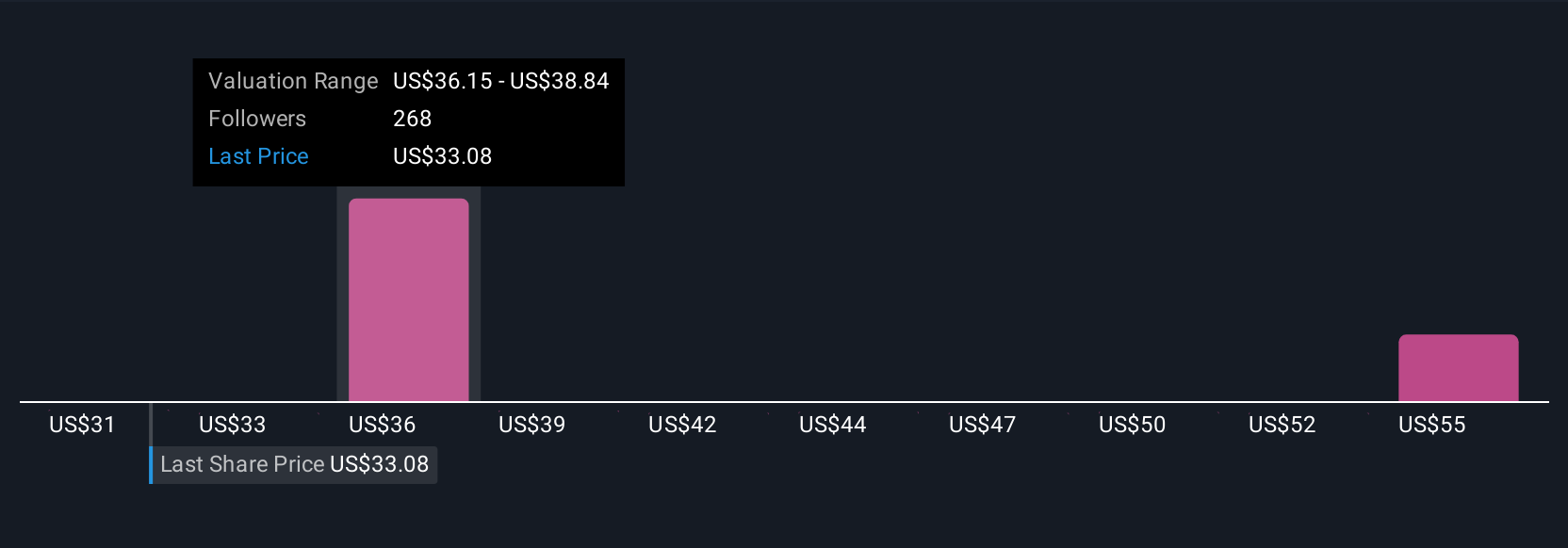

Simply Wall St Community members estimate VICI Properties’ fair value between US$30.78 and US$57.54, with 11 perspectives included. Despite this broad span, the company’s revenue reliability and tenant concentration shape much of its outlook, explore several viewpoints to see how expectations compare.

Explore 11 other fair value estimates on VICI Properties - why the stock might be worth as much as 74% more than the current price!

Build Your Own VICI Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VICI Properties research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free VICI Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VICI Properties' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal