How Investors Are Reacting To Iron Mountain (IRM) Upsizing Its €1.2 Billion Senior Notes Offering

- Earlier this month, Iron Mountain completed a private offering of €1.2 billion in 4.75% Senior Notes due 2034, upsized from an initial €750 million, with proceeds allocated toward redeeming existing notes and enhancing financial flexibility.

- The increase in offering size underscores strong institutional demand and market confidence in Iron Mountain's ability to manage its debt profile and support its long-term growth initiatives.

- We'll explore how Iron Mountain’s successful refinancing and additional liquidity shape its investment narrative with a focus on future growth and debt management.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Iron Mountain Investment Narrative Recap

To be a shareholder in Iron Mountain, you need to believe in its ability to transition from legacy physical storage to capitalize on digital infrastructure and data center growth, while managing ongoing debt and capital needs. The recent €1.2 billion euro note offering increases near-term liquidity and financial flexibility, but does not substantially alter the primary short-term catalyst, which remains execution on data center expansion amid heightened competition. The biggest risk, elevated leverage, remains, especially given interest rate and refinancing sensitivities.

Among recent announcements, Iron Mountain's decision to upsize its euro-denominated Senior Notes offering to €1.2 billion directly relates to existing debt refinancing. This move helps retire upcoming GBP notes and supports repayment of revolving credit borrowings, adding some stability to the balance sheet. The offering’s strong institutional demand reflects confidence, but execution risk around large-scale capital projects continues to influence the company’s outlook.

However, investors should be aware that despite improved liquidity, Iron Mountain’s leverage remains elevated and refinancing risks continue to loom...

Read the full narrative on Iron Mountain (it's free!)

Iron Mountain's outlook calls for $8.3 billion in revenue and $775.8 million in earnings by 2028. This is based on a 9.0% annual revenue growth rate and a $734.5 million increase in earnings from the current $41.3 million.

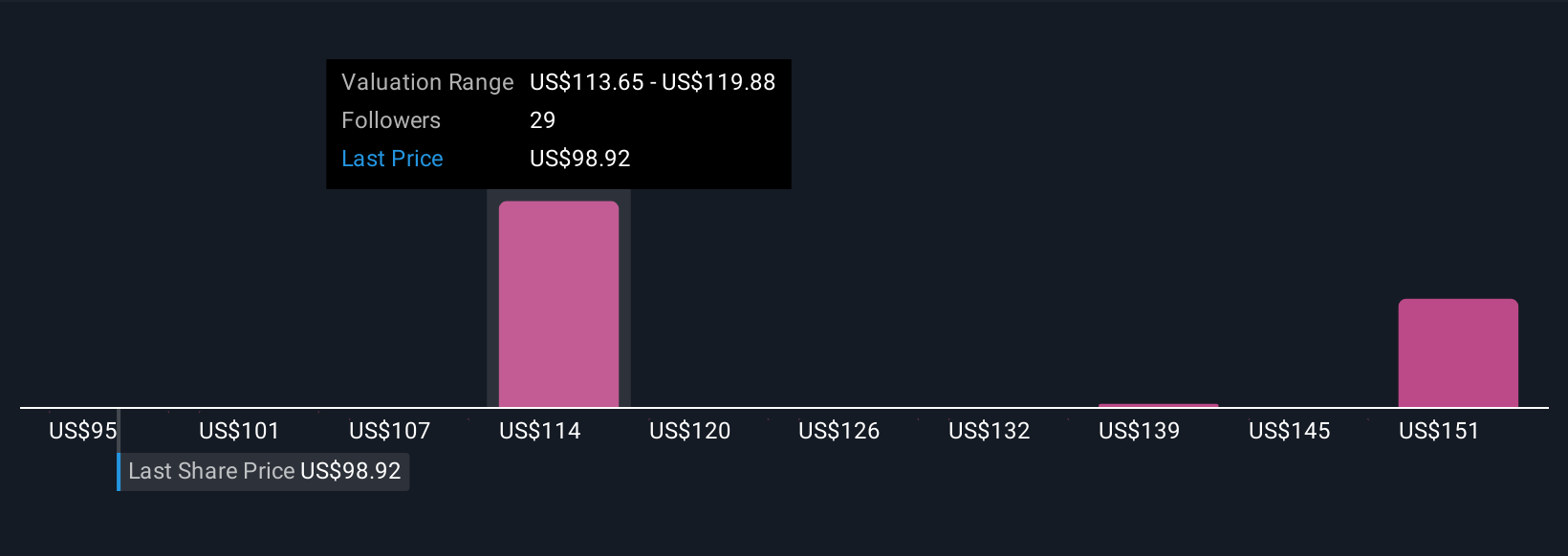

Uncover how Iron Mountain's forecasts yield a $114.50 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Six investor forecasts from the Simply Wall St Community range widely, setting fair values for Iron Mountain between US$86.26 and US$156.43. As you consider these views, remember that debt-related risks highlighted by the recent capital raise could still shape the company’s future cash flow and flexibility.

Explore 6 other fair value estimates on Iron Mountain - why the stock might be worth as much as 62% more than the current price!

Build Your Own Iron Mountain Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iron Mountain research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Iron Mountain research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iron Mountain's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal