Century Aluminum (CENX) Completes US$395 Million Debt Financing

Century Aluminum (CENX) demonstrated a notable 28.7% gain over the last quarter. Contributing factors included a business expansion with plans to restart a production line in South Carolina, expected to boost U.S. aluminum production significantly. Simultaneously, the company completed a $395 million debt financing, potentially enhancing financial flexibility. Although the general market trends showed mixed results with the Dow Jones slipping and the Nasdaq hitting record highs, Century's initiatives might have fortified its position. The broader market rose 1.8% over the same period, indicating that internal developments likely provided additional momentum to CENX's stock performance.

The recent developments at Century Aluminum, such as the restart of the Mt. Holly line and the debt financing, could significantly reinforce the company's position amid fluctuating market conditions. Over the past three years, Century Aluminum's shares have appreciated by 231.35%, showcasing a very strong total return, which comprises dividends and share price gains. This robust performance contrasts with its one-year return, where it outperformed the US Metals and Mining industry, which returned 35.8%.

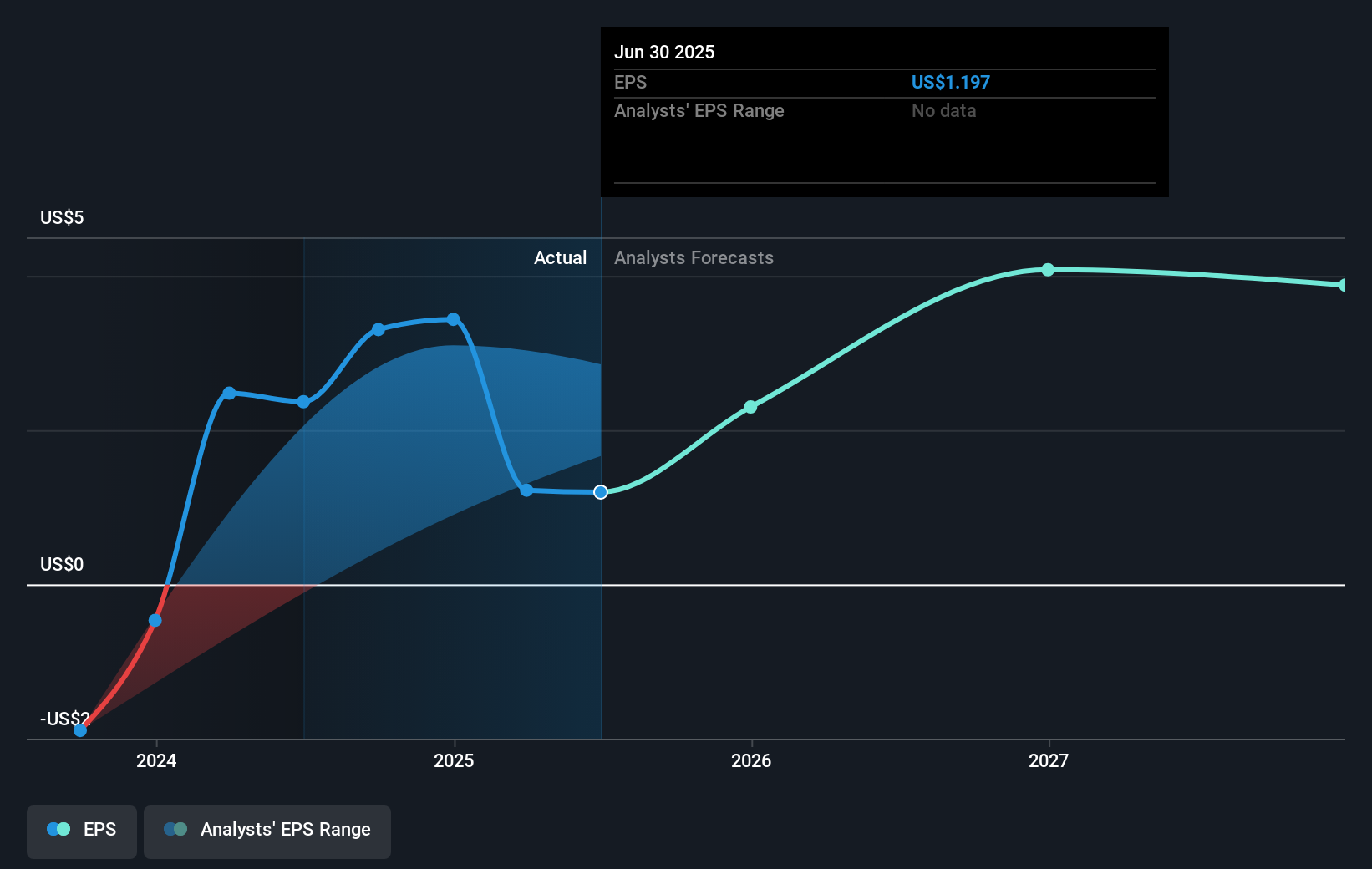

The announced business expansions and improved operational efficiencies are likely to drive revenue and earnings growth. Analysts forecast an annual revenue growth of 7.6% over the coming years, bolstered by increased domestic aluminum production and government support. Currently, Century Aluminum is trading at $24.52 with a price target of $27. This implies a potential upside, suggesting optimism about achieving projected earnings of $479.3 million by 2028. Investors will closely watch how these initiatives impact the company's revenue and earnings trajectories in the long term.

Jump into the full analysis health report here for a deeper understanding of Century Aluminum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal