Gemini Upsizes IPO To Raise $425 Million, Winklevoss Twins-Founded Crypto Exchange Targets $3 Billion Valuation

Cryptocurrency exchange Gemini raised $425 million in an initial public offering, pricing its shares above the expected range, according to an announcement made late Thursday.

Gemini Potentially Worth Over $3.2 Billion

The company, founded by billionaire twin brothers Cameron and Tyler Winklevoss, sold approximately 15.178 million shares at $28 each. This exceeded the initially projected range of $24 to $26 per share.

This values the company, listed as Gemini Space Station in SEC filings, at $3.32 billion on a non-diluted basis, based on the 118,783,069 outstanding shares previously disclosed.

Gemini is expected to begin trading on Nasdaq under the ticker “GEMI” on Friday. Goldman Sachs Group Inc. (NYSE:GS) and Citigroup Inc. (NYSE:C) are the lead underwriters.

See Also: Ethereum Consolidates Below $4,500: Is A New All-Time High Run Coming Soon?

Gemini Joins Coinbase, Bullish

The successful IPO comes after a series of significant events for the cryptocurrency company. Just days before the IPO, Gemini secured a strategic investment from Nasdaq, which committed to purchasing $50 million worth of shares at the time of the IPO.

Gemini, despite reporting a net loss of $282.5 million in the first half of 2025, filed to go public on Nasdaq, joining the surge of digital-asset firms moving onto U.S. stock exchanges. Gemini’s offering would make it the third publicly traded crypto exchange, alongside Coinbase Global Inc. (NASDAQ:COIN) and Bullish (NYSE:BLSH).

Its business spans over-the-counter trading, a cryptocurrency-backed credit card, and support for major tokens, including Bitcoin (CRYPTO: BTC), Ethereum (CRYPTO: ETH) and stablecoins.

Price Action: Coinbase shares, meanwhile, closed up 2.73% at $323.95, while Bullish closed 2.60% higher at $53.99 during Thursday’s regular trading session, according to data from Benzinga Pro.

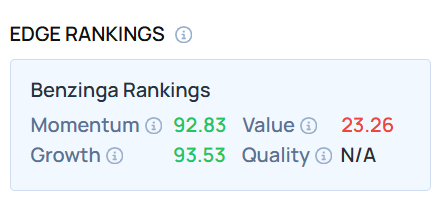

As of this writing, COIN demonstrated a very high Momentum and Growth score. Visit Benzinga Edge Stock Rankings to see how it compares with BLSH stock.

Read Next:

Photo Courtesy: Primakov on Shutterstock.com

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Wall Street Journal

Wall Street Journal