Boston Properties (BXP): Evaluating Valuation After Dividend Cut and Strategic Capital Shift

If you own or are watching BXP (BXP), the company’s latest move is impossible to ignore. At its recent Investor Day, the management announced a significant 29% cut to its quarterly dividend. This decision is designed to bolster its finances by freeing up around $50 million each quarter. While dividend cuts typically raise concerns, BXP’s strategy is to funnel that cash into fresh development projects and tighten up its balance sheet, aiming for stronger long-term prospects rather than just short-term payouts.

This strategy shift comes after a relatively calm stretch for BXP shares. Over the past year, the stock’s total return has hovered at 2%, with only modest changes in the past month and year-to-date. The market reaction to the announcement, visible in the stock’s recent bounce over the past month, suggests that investors are weighing whether BXP’s disciplined capital allocation could drive future growth, even if it means less cash today.

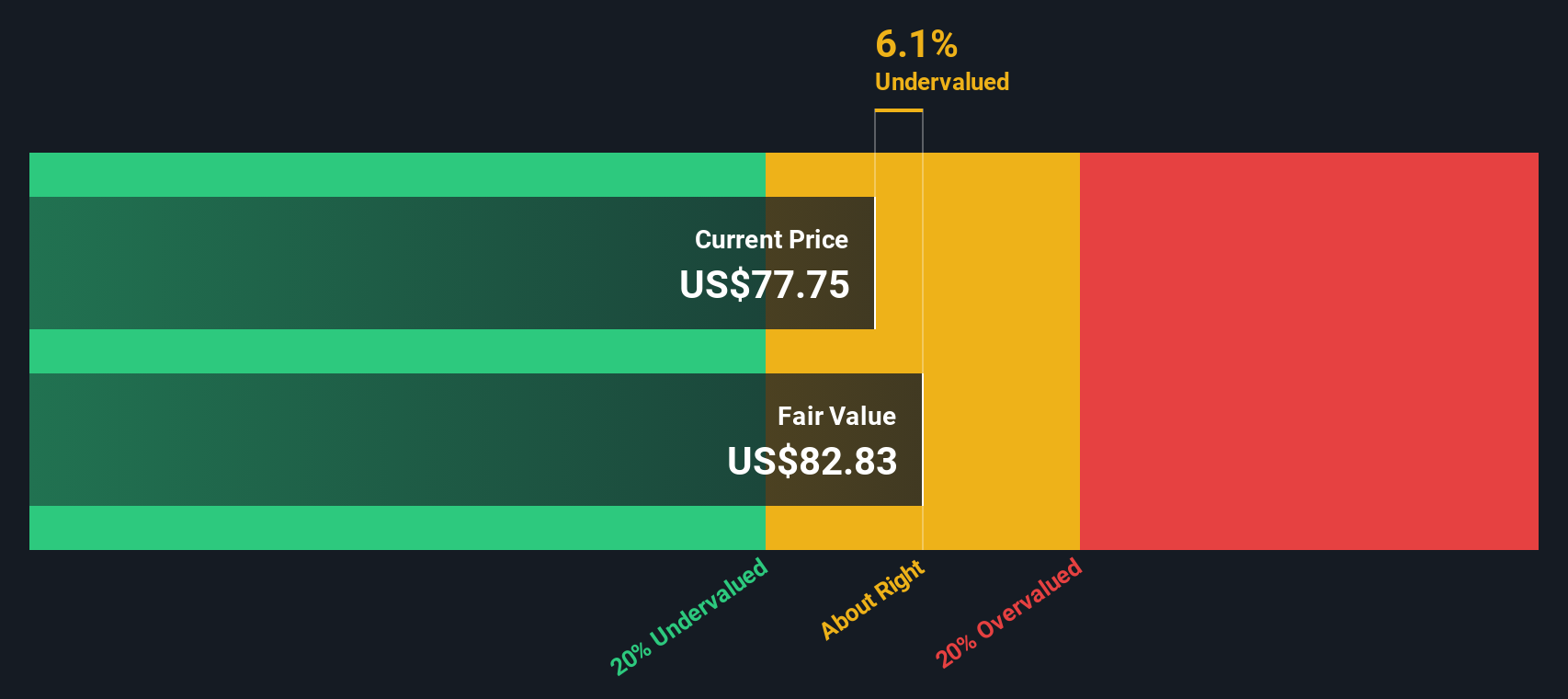

With BXP shaking up its capital strategy and shares showing signs of momentum, the question is whether the current price reflects hidden value, or if investors are already factoring in any upside from these changes. Is this the right time to buy or simply to wait and see?

Most Popular Narrative: 4.2% Undervalued

According to the most widely followed narrative, BXP’s shares are trading at a modest discount to fair value, reflecting optimism around the company's ambitious growth and capital allocation strategies.

BXP's aggressive capital recycling and asset sales strategy (targeting $600 million in non-core dispositions), along with redevelopment and adaptive reuse of assets for mixed-use and multifamily, is expected to unlock higher-yielding income streams, fortify net margins, and provide non-dilutive funding for growth, supporting future FFO and earnings resilience.

Curious what’s driving this bullish view? There is a pivotal factor in play: expectations of rising profits and margin improvements that rival the sector’s best. Want the details behind these confidence-boosting projections? Discover which financial leaps analysts are baking in and why they think BXP’s future results could surprise to the upside. What is the secret ingredient steering BXP’s value call? Take a closer look at the daring math inside the narrative itself.

Result: Fair Value of $77.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent soft leasing or delayed project stabilization could pressure occupancy and earnings, which may cast doubt on the upbeat scenario for BXP’s next phase.

Find out about the key risks to this BXP narrative.Another View: The Cash Flow Perspective

While the analyst consensus focuses on projected earnings, our SWS DCF model evaluates the company’s future cash flows to assess fair value. Its conclusion: The stock is still undervalued, but are cash flows telling the full story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own BXP Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own perspective and craft a personal outlook in just a few minutes. Do it your way

A great starting point for your BXP research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let potential winners pass you by. Put your strategy in motion and use our tools to uncover standout stocks in sectors where momentum and value could be surging right now.

- Unlock impressive yield potential and start growing your passive income stream with dividend stocks with yields > 3%.

- Catch the wave of innovation shaping tomorrow’s technology landscape by selecting tomorrow's leaders in AI penny stocks.

- Spot value plays hiding in plain sight and reach for greater upside with our powerful search for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal