A Fresh Look at Alexander's (ALX) Valuation After Recent Steady Share Price Gains

What’s Behind the Buzz Around Alexander's Stock?

If you’ve been following Alexander's (NYSE:ALX), you might be wondering what’s fueling the stock’s recent moves. Though there’s no single major event or AI announcement to credit, the steady uptick over the past month is hard to ignore. With investors scanning for signals in a market that seems to be rewarding stability and yield, Alexander's might be catching some attention without grabbing headlines.

The stock has climbed 10% in the past month and is now up 14% over the past year. That’s a decent run, especially in light of annual revenue and net income figures showing slight contraction. Short-term momentum has picked up lately, but over the long haul Alexander's has delivered a 33% return over three years and 32% over five years. This performance appears steady rather than spectacular in the crowded real estate sector.

As shares continue their quiet climb, the question remains whether investors are overlooking an undervalued opportunity or if the recent momentum has already factored future growth into the current price.

Price-to-Earnings of 32.5x: Is it justified?

Based on its current price-to-earnings (P/E) ratio of 32.5x, Alexander's appears expensive relative to both industry and peer averages, which are lower. This suggests that the market is assigning a higher value to the company’s current earnings than is typical for the sector.

The P/E ratio compares a company’s share price to its earnings per share. It serves as a widely used tool for assessing whether a stock is over or undervalued. In the case of real estate investment trusts (REITs) like Alexander's, it helps investors gauge how much they are paying for each dollar of a company’s earnings compared to similar firms.

With a P/E multiple notably above the industry and fair value benchmarks, the market may be overpricing Alexander's anticipated profitability based on current fundamentals. This high multiple does not appear justified by superior growth prospects or recent earnings trends, which have shown declines rather than acceleration.

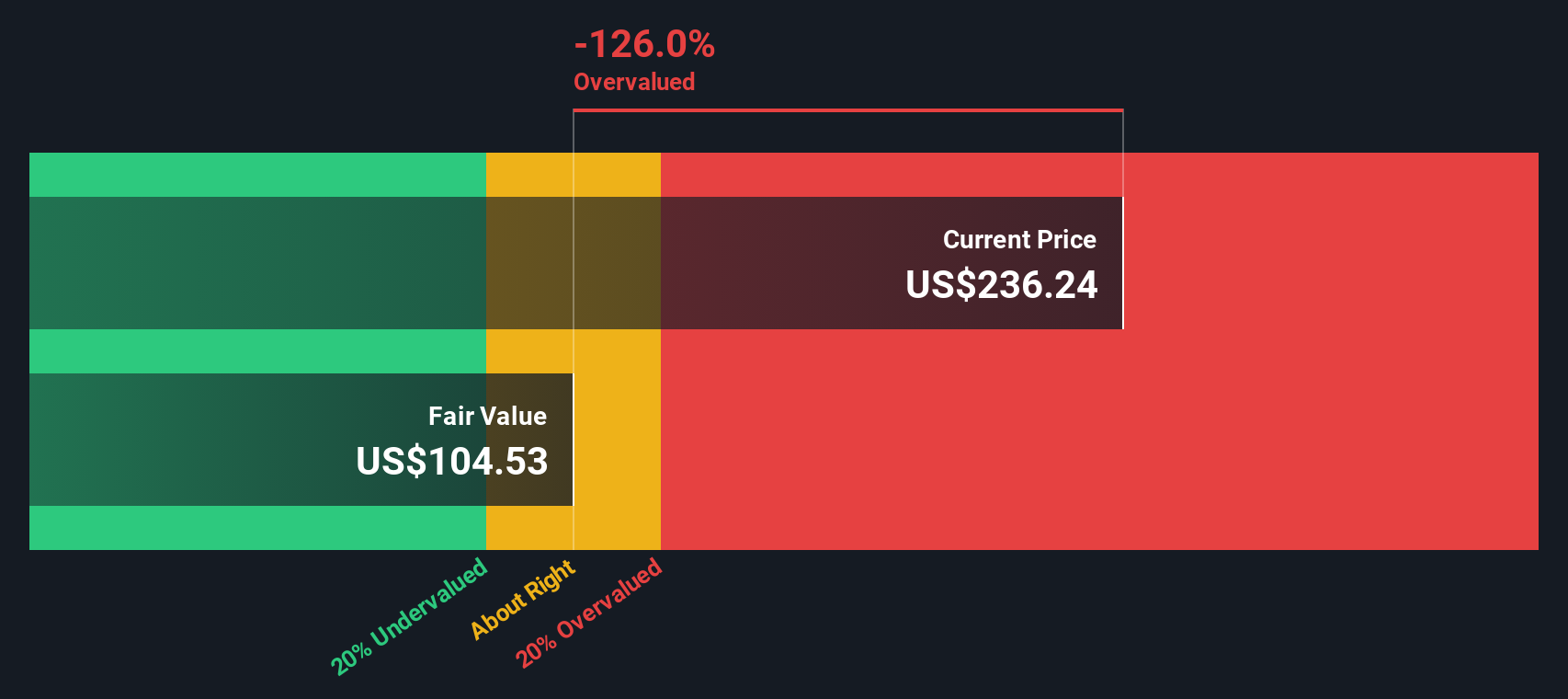

Result: Fair Value of $105.08 (OVERVALUED)

See our latest analysis for Alexander's.However, persistent declines in revenue and net income growth, combined with a substantial discount to analyst targets, could quickly shift current sentiment.

Find out about the key risks to this Alexander's narrative.Another View: What Does the SWS DCF Model Say?

Taking things a step further, our DCF model paints a similar picture. It suggests the current share price is still above what fundamentals would support. Does this agreement between methods signal an important warning?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Alexander's Narrative

If you have a different angle or want to dig through the numbers independently, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your Alexander's research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t let your search stop here, because even smarter options are waiting for you. Expand your portfolio by checking out these distinct market angles today.

- Unlock potential gains with undervalued stocks based on cash flows, featuring companies the market has yet to fully appreciate and could be prime for a turnaround.

- Tap into breakthrough trends by using healthcare AI stocks to spot innovators transforming healthcare with advanced artificial intelligence.

- Spot promising early-stage companies with strong balance sheets through penny stocks with strong financials, and uncover gems that might soon be the market’s next big story.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal