Jamie Dimon's Protege Unveils $4 Billion FirstBank Deal In Bid To Build Trillion-Dollar Banking Giant

The PNC Financial Services Group Inc. (NYSE:PNC) CEO Bill Demchak announced a $4 billion acquisition of Colorado-based FirstBank on Monday, marking a strategic push toward his ambitious goal of creating a trillion-dollar banking giant.

The deal positions PNC closer to joining the elite club of too-big-to-fail banks alongside JPMorgan Chase & Co. (NYSE:JPM) and Bank of America Corp. (NYSE:BAC), according to a Wall Street Journal report.

Check out the current price of PNC stock here.

“Jamie Jr.” Builds On Wall Street Legacy

In the banking world, Bill Demchak is often called “Jamie Jr.” because of his longtime ties with JPMorgan CEO Jamie Dimon. Since stepping in as CEO of PNC in 2013, he's grown the company into the eighth-largest bank in the U.S. Before that, the 63-year-old spent 15 years at JPMorgan, where he was nicknamed the “prince of darkness” for his role in building the credit-default swap market.

“This is a long game,” Demchak said in an interview. “You see good opportunities and you go after them.”

Strategic Expansion Despite Market Challenges

Despite PNC shares lagging broader banking indices with 13% gains versus the sector’s 30% rise, Demchak continues pursuing aggressive growth through acquisitions and organic expansion. The Pennsylvania-based American bank reported better-than-expected earnings earlier in July.

Regulatory Shift Fuels Consolidation Wave

The FirstBank deal points to possible consolidation in the banking sector, especially as the Trump administration shifts toward a more merger-friendly approach. Under the Biden administration, bank mergers faced tighter restrictions due to worries about branch shutdowns and less competition.

Following the acquisition, PNC’s total assets will climb to nearly $600 billion, putting it close to the size of U.S. Bancorp (NYSE:USB) and Capital One (NYSE:COF). Bill Demchak believes that smaller banks need to scale up to survive, as the largest banks continue to lead in both customer deposits and tech advancements.

The CEO has diversified PNC’s offerings through partnerships with Coinbase Global Inc. (NASDAQ:COIN) for cryptocurrency services and TCW Group for private credit lending, positioning the bank for the next phase of financial industry evolution.

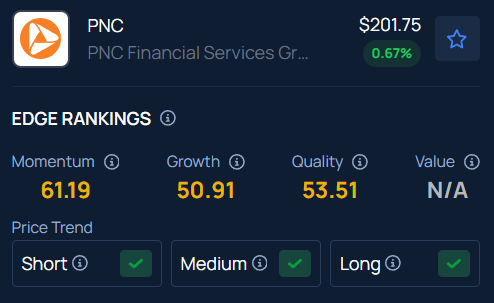

Price Action: Based on Benzinga Pro data, the banking giant closed at $201.89, up 0.74% for the day. In early trading session, the stock inched up slightly to $202.00.

Benzinga's Edge Stock Rankings indicates PNC stock has a positive price trend across all time frames. Here is how the stock fares on other parameters.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Wall Street Journal

Wall Street Journal