Constellium (CSTM) Extends Partnership With Embraer for High-Performance Aluminum Solutions

Constellium (CSTM) announced an extension of its long-term partnership with Embraer on September 9, reinforcing its commitment to provide advanced aluminum solutions in the aerospace sector. This development reflects the company's ongoing engagement with prominent industry players. Over the last month, Constellium's share price moved 1.85%, aligning closely with market trends where the S&P 500 hit record highs. The announcement likely added weight to broader market moves, epitomizing the positive sentiment surrounding companies with strategic aerospace ties during a period of generally favorable market performance.

The recent extension of Constellium's partnership with Embraer could enhance the company's narrative of leveraging sustainability-driven demand and innovation in high-margin sectors like aerospace. This partnership could bolster Constellium's position in the aerospace market, potentially expanding shipment volumes and improving pricing power, thus positively influencing its revenue and earnings forecasts. Given that Constellium's shares have delivered a 56.56% total return over five years, this strategic alliance may further support investor confidence.

Over the past year, Constellium underperformed both the US market, which saw a 20.5% return, and the US Metals and Mining industry, which experienced a 36.4% return. Despite this relative underperformance, the recent news could act as a catalyst for future growth, aligning with analyst forecasts of substantial earnings growth over the next few years. Analysts project Constellium's revenue to increase annually, although at a slightly slower pace than the broader market, which underscores the potential impact of targeted partnerships on revenue generation.

Currently, Constellium's share price stands at US$13.73, significantly below the analyst consensus price target of US$18.31. This indicates potential upside, assuming the company continues on its projected growth trajectory. If Constellium can leverage its strategic aerospace ties while successfully executing operational improvements, there may be a case for the shares to approach the upper ends of analyst expectations. However, investors should weigh these prospects against the inherent risks outlined in the broader narrative.

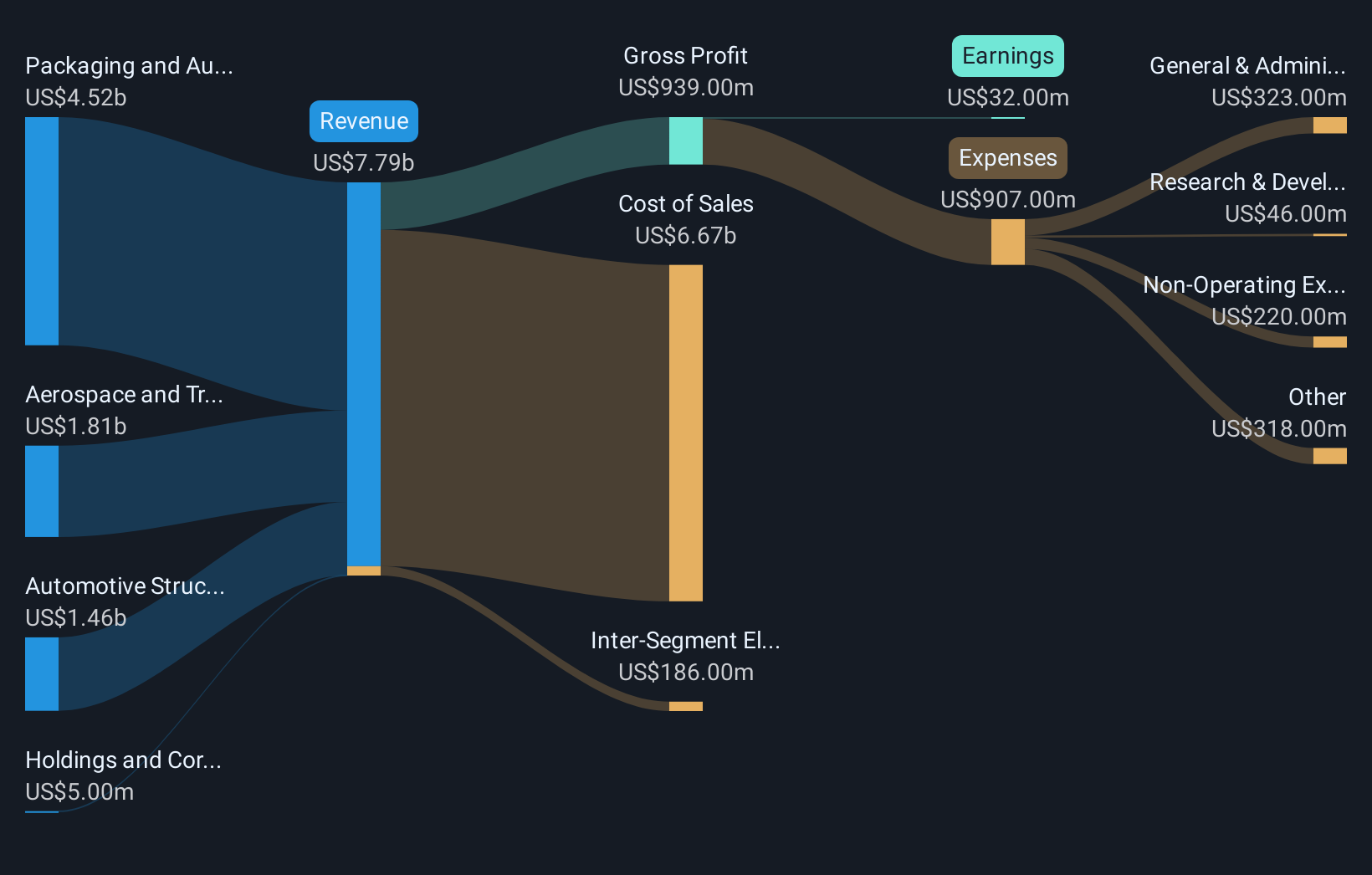

Click to explore a detailed breakdown of our findings in Constellium's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal