Materion (MTRN): Assessing Valuation After Surge in Analyst Optimism and EPS Upgrades

Materion (MTRN) is capturing the spotlight after climbing to the top tier of analyst recommendations, landing both a Zacks Rank #1 and a broad 'Strong Buy' consensus from brokers. This wave of optimism is likely driven by recent upward shifts in earnings estimates and a consistent track record of outperforming Wall Street’s profit expectations. For investors eyeing the stock, such recognition can fuel speculation about what’s next, especially as the market starts to pay closer attention.

Looking at the bigger picture, Materion’s stock has been building momentum lately, rising around 35% over the past three months and up nearly 8% for the year. That recent surge stands out when compared to its steadier, long-term performance, which has also delivered solid returns over three and five years. The buzz around the company’s prospects is not entirely new, but the latest run continues to shift risk perceptions and inject some energy into the valuation debate.

With shares moving higher and enthusiasm building, the pressing question remains: is Materion trading at an attractive price for future growth, or is the market simply catching up with the fundamentals that are already in play?

Most Popular Narrative: 11.6% Undervalued

The most widely followed narrative sees Materion as undervalued, reflecting strong growth projections and expectations for a higher fair value compared to the current share price.

Accelerating demand in the semiconductor sector, driven by increasing wafer starts, growth in data storage and communication devices, and the recent acquisition of Konasol (expanding footprint in Asia), positions Materion to capture a higher share of a rapidly expanding global market. This is seen as supporting sustained top line revenue growth over the next several years as new capacity ramps by 2026.

Curious about the bold assumptions powering this undervalued call? The real story lies behind ambitious sales forecasts, surging profitability predictions, and a future price multiple that stands out from the norm. What financial leaps are they betting on? Explore the full narrative for the number that changes everything.

Result: Fair Value of $124.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing global trade tensions or weaker demand from the semiconductor sector could quickly challenge the bullish narrative and undermine recent optimism.

Find out about the key risks to this Materion narrative.Another View: Market Ratio Tells a Different Story

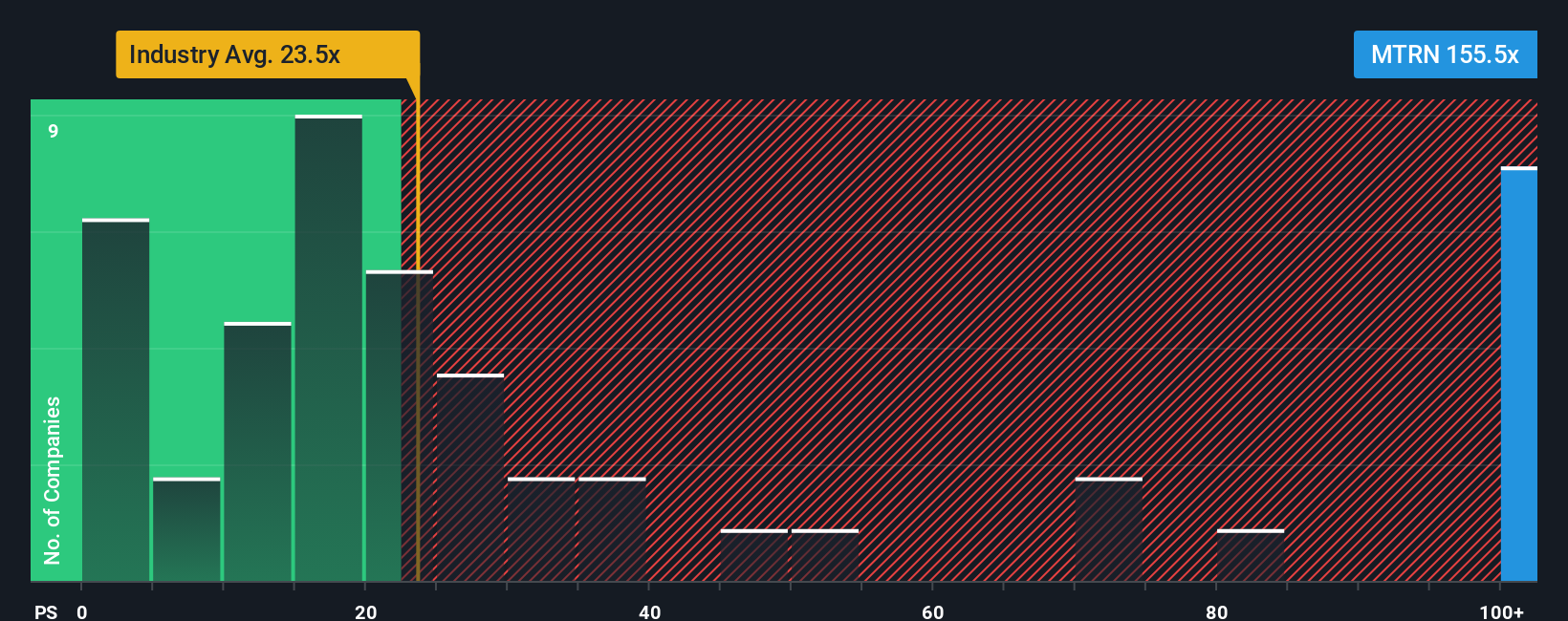

While earnings-based forecasts suggest Materion looks undervalued, a glance at one key ratio compared to the industry shows the stock appearing much pricier than its sector peers. Could the market be overestimating future upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Materion Narrative

If you see things differently or want to carve out your own investment thesis, the tools are at your fingertips. You can build a custom narrative in under three minutes. Do it your way

A great starting point for your Materion research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Unlock your potential as an investor by exploring new themes and opportunities. Don’t let today’s gains be your only win; tomorrow could offer even more possibilities.

- Tap into steady income streams by finding companies delivering dividend stocks with yields > 3% and building wealth with robust yields.

- Catch the next tech wave by tracking innovation and fast movers among AI penny stocks that are pushing boundaries in artificial intelligence.

- Unearth hidden gems primed for value growth by scouring undervalued stocks based on cash flows for shares trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal