Is the AT&T Mexico Legal Dispute Altering the Investment Case for American Tower (AMT)?

- American Tower Corporation recently participated in two major industry conferences, the Goldman Sachs Communacopia + Technology Conference in San Francisco and Citi’s Global Technology, Media and Telecommunications Conference in New York, following news of a legal dispute with AT&T Mexico.

- An ongoing legal conflict with AT&T Mexico is impacting approximately US$300 million of tenant revenue, leading American Tower to establish US$10 million in reserves for the second quarter of 2025 as it faces uncertainty over additional financial costs.

- We’ll examine how the AT&T Mexico legal dispute introduces a material risk to American Tower’s future revenue and earnings outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

American Tower Investment Narrative Recap

To be an American Tower shareholder, you need faith in the long-term demand for communications infrastructure, especially as 5G development and data center expansions fuel steady leasing activity. However, the recent legal dispute with AT&T Mexico now represents the most immediate and material risk, as approximately US$300 million in tenant revenue is in question; management’s decision to reserve US$10 million for potential losses highlights that uncertainty around short-term financial impacts is significant.

Among recent announcements, the company’s updated 2025 earnings guidance remains in focus, as it now must contend with potential revenue shortfalls stemming from the AT&T Mexico situation. Investors will be watching to see how management’s US$10 million reserve and any related adjustments flow through reported results, and whether this alters longer-term growth assumptions that are tied to ongoing 5G infrastructure buildout in core markets.

By contrast, one escalating risk all investors should pay attention to is the continued uncertainty over major tenant payments in Latin America...

Read the full narrative on American Tower (it's free!)

American Tower's outlook anticipates $12.0 billion in revenue and $3.7 billion in earnings by 2028. This is based on annual revenue growth of 5.2% and an increase in earnings of $1.2 billion from the current level of $2.5 billion.

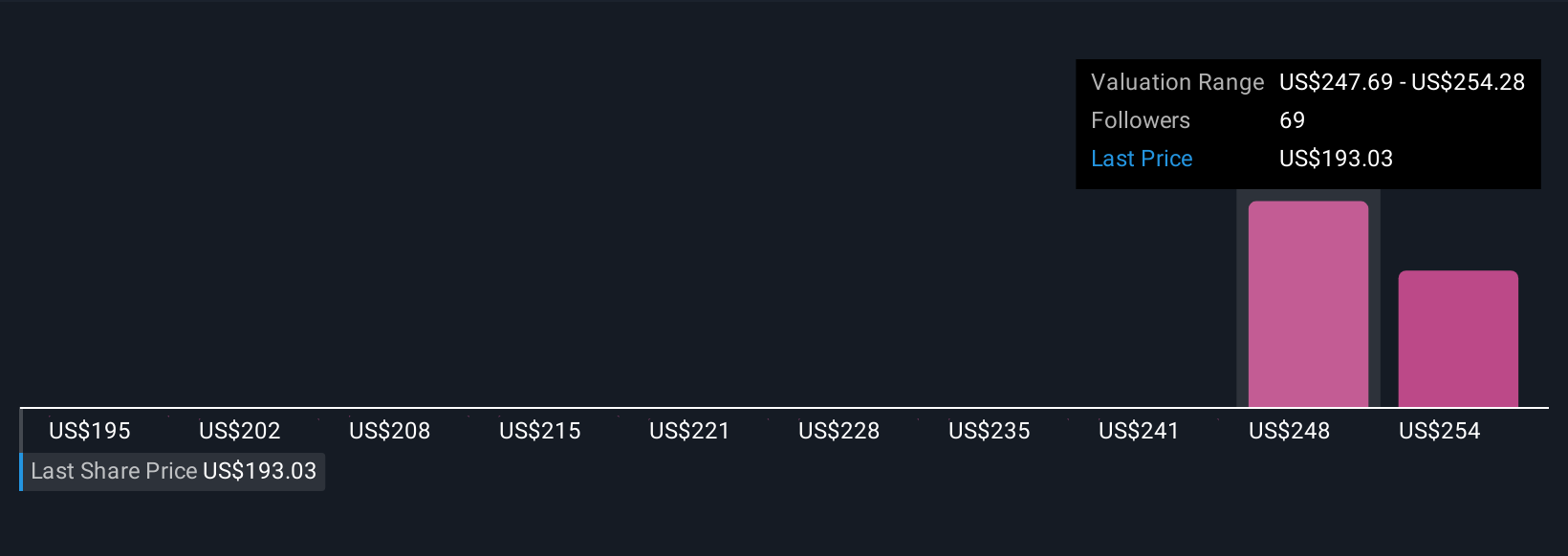

Uncover how American Tower's forecasts yield a $249.21 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Six perspectives from the Simply Wall St Community put fair value between US$173 and US$259.81 per share. Ongoing revenue risk from the AT&T Mexico legal dispute could affect future forecasts and underscores why investor opinions can vary so much, see how your view compares.

Explore 6 other fair value estimates on American Tower - why the stock might be worth 11% less than the current price!

Build Your Own American Tower Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Tower research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free American Tower research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Tower's overall financial health at a glance.

No Opportunity In American Tower?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal