A Fresh Look at Caterpillar (CAT) Valuation as Investor Focus Shifts to Fundamentals

Most Popular Narrative: 30.7% Overvalued

According to the most popular narrative, Caterpillar shares are considered significantly overvalued compared to the narrative's assessment of fair value. This view is based on a comprehensive update of company segment forecasts and revised valuation methodology.

Sales and revenues for Q4 of 2023 were $17.1 billion, up 3% compared to $16.6 billion in the fourth quarter of 2022. This brings full year revenues to $67.1 billion, up 13% from the prior year. These results have flown in the face of my assumptions. I expected the macroeconomic conditions to have weighed heavier on CAT’s performance, but evidently, domestic construction remained more buoyant due to government infrastructure investment. While I did indicate that inflationary pressures could artificially increase revenues, it does seem that underlying construction performance is greater than my forecasts.

Curious how this narrative projects big earnings yet still claims Caterpillar is overpriced? The explanation lies in cautious profit growth, conservative revenue forecasts, and margin assumptions that may surprise you. Want to uncover the full financial story and see why this scenario still triggers an overvaluation call? Dive deeper to explore the data-driven numbers that anchor this bold stance.

Result: Fair Value of $312.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Caterpillar’s scale and capital give it room to catch up technologically. Essential infrastructure spending could boost demand despite headwinds.

Find out about the key risks to this Caterpillar narrative.Another View: A Different Take on Valuation

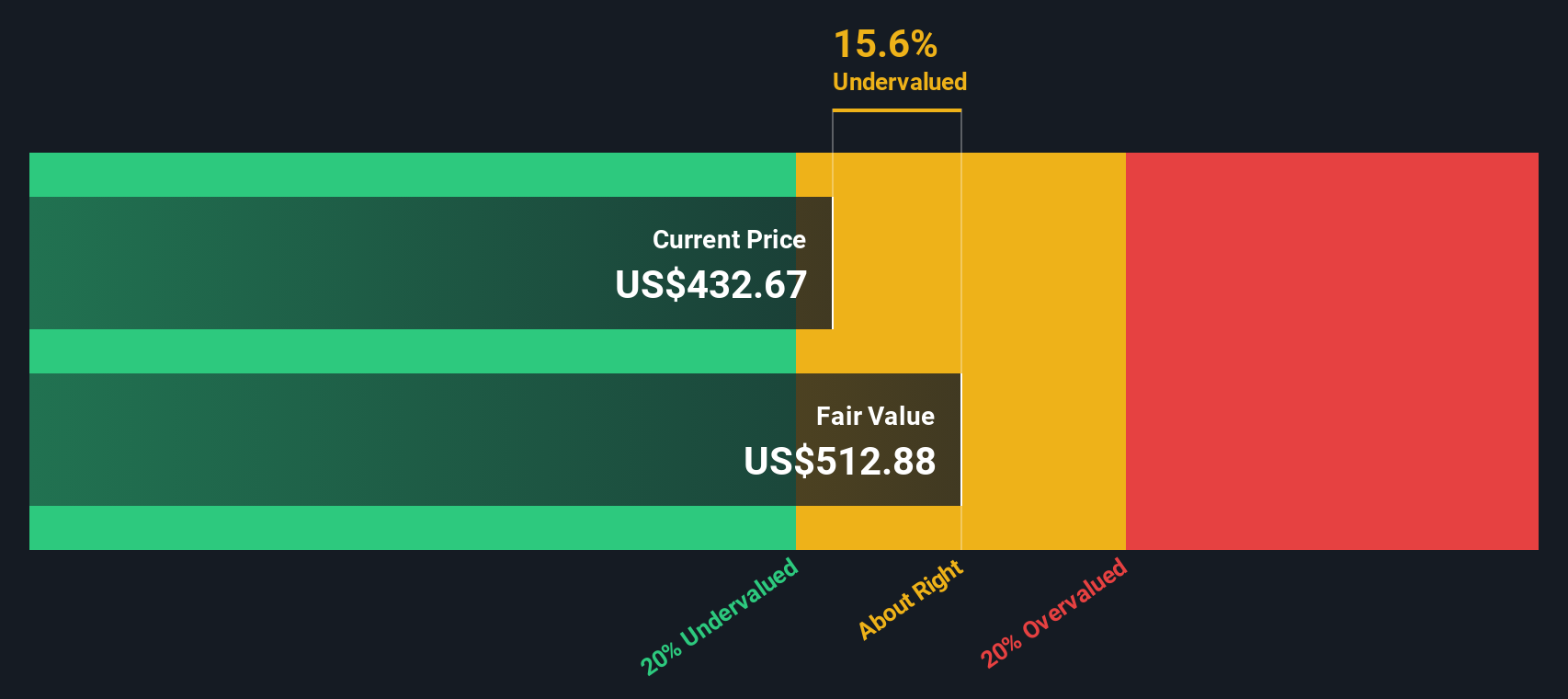

While the most popular narrative calls Caterpillar significantly overvalued, a fresh perspective challenges that assumption. Our DCF model paints a contrasting picture and suggests the shares may actually offer value at current levels. Which method gets closer to the truth?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Caterpillar Narrative

If you want to dig into the numbers firsthand and arrive at your own perspective, you can craft a custom narrative in just a few minutes. Do it your way

A great starting point for your Caterpillar research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock your next great investment by checking out some of the most promising opportunities Simply Wall Street’s tools have uncovered. Move with confidence and don’t let these insights pass you by.

- Spot tomorrow’s tech giants early by scanning for innovation leaders in artificial intelligence using AI penny stocks.

- Give your portfolio a steady boost with stocks paying generous yields above 3% with guidance from dividend stocks with yields > 3%.

- Seize undervalued opportunities hiding in plain sight and let data-driven analysis point out undervalued stocks based on cash flows before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal