A Look at National Health Investors (NHI) Valuation After Tenant Default Notice and Lease Enforcement Steps

National Health Investors (NHI) has intensified a tense situation by formally placing an affiliate of National HealthCare Corporation in default under their master lease, citing ongoing non-monetary compliance issues. The cure period has expired without resolution, so NHI is now considering all available remedies, which could involve actions with lasting effects on both parties. If you are holding or considering NHI shares, this development goes beyond a technical matter as it affects the company’s core real estate operations and potentially its financial position.

Investors have already been monitoring NHI closely following criticism earlier in the year regarding the structure of this lease and the overall relationship between the two companies. While NHI’s long-term performance has been notable, reported at 44% over three years and 64% over five, the past year has seen the stock decline by about 1%. Still, recent momentum has been positive, with a gain of 10% in the past three months and nearly 15% year-to-date, suggesting that some traders anticipate a turnaround or a re-pricing in progress.

Does this inflection point present a bargain for value-seekers, or is the market already pricing in a more challenging path ahead for NHI’s future growth?

Most Popular Narrative: 5.6% Undervalued

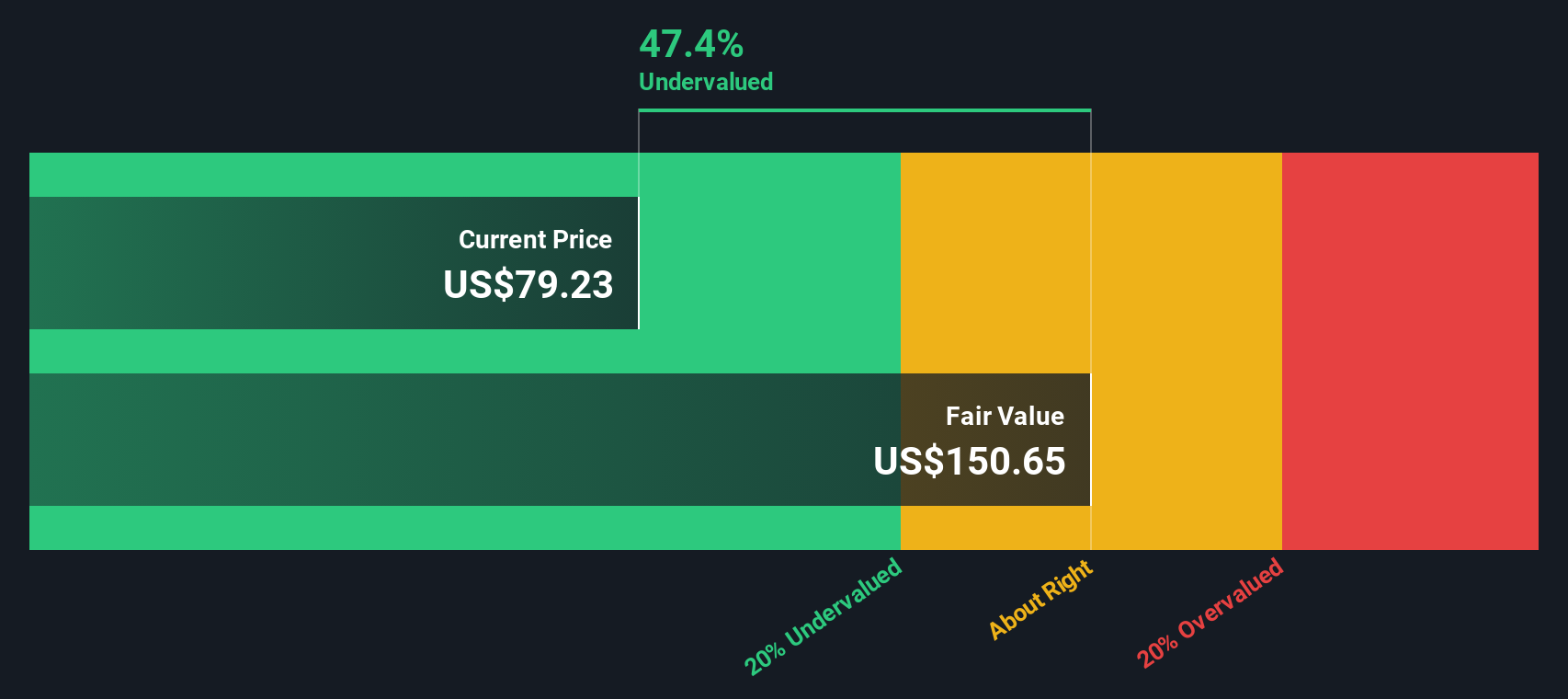

According to the leading narrative, National Health Investors is considered modestly undervalued, with a small discount to its calculated fair value based on a consensus of forward-looking analyst assumptions.

Accelerating growth in the 75+ U.S. population and increased demand for senior housing are driving higher occupancy rates and pricing power in NHI's SHOP portfolio. This is evidenced by recent quarter-over-quarter rises in both occupancy and RevPOR, which should support sustained revenue and net operating income (NOI) growth. Continued strategic shift towards outpatient and post-acute care is promoting demand for the types of facilities in NHI's portfolio. This enhances tenant stability and offers greater potential for long-term earnings and rent escalations.

Wondering how this optimistic outlook could translate into tangible returns? The narrative hints at a bold set of assumptions about revenue momentum, profit margins, and market multiples, figures that might surprise even seasoned REIT investors. Curious what underpins that fair value and how it stacks up next to peers? The full breakdown reveals the core forecasts and catalysts powering this projection.

Result: Fair Value of $83.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, near-term softness in occupancy and ongoing integration risks from new acquisitions could quickly undermine revenue momentum and challenge earnings predictability for NHI.

Find out about the key risks to this National Health Investors narrative.Another View: Looking Through the SWS DCF Lens

Shifting the focus to our SWS DCF model, we see an even deeper discount compared to the analyst consensus. This approach uses long-term cash flow projections and suggests the stock could be more undervalued than it appears. Does this signal more opportunity, or are there hidden risks behind the numbers?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own National Health Investors Narrative

If you want to dig in and shape your own view on National Health Investors, you can quickly craft a personalized assessment in just a few minutes. Do it your way

A great starting point for your National Health Investors research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Opportunities do not wait. Amplify your research by targeting stocks with unique potential only found through Simply Wall Street's world-class Screener. Challenge yourself to see what you could be missing out on next.

- Unlock new potential by tracking companies with robust financials trading at lower price points using our penny stocks with strong financials.

- Capitalize on the next frontier in medicine by finding innovators transforming patient care and diagnostics with our curated healthcare AI stocks.

- Cash in on stability and higher payouts by seeking out firms delivering generous yields right now with our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal