Lamar Advertising (LAMR): Evaluating Valuation Following Recent Double-Digit Gains

Most Popular Narrative: 1.7% Undervalued

The most widely followed narrative on Lamar Advertising suggests its shares are trading about 1.7% below fair value. The valuation hinges on projections for both growth and margin improvement, supported by key trends shaping the company's financial outlook.

Accelerating expansion of Lamar's digital billboard portfolio, as shown by the addition of 325-350 new digital units expected this year and a strengthening second-half outlook, positions the company to capitalize on rising demand for dynamic, high-impact ad solutions. This supports both revenue growth and net margin expansion through premium inventory and dynamic pricing.

Curious about what is fueling this calculated valuation? Behind these numbers are bold growth targets, operational shifts, and a blueprint for profit expansion often seen in faster-moving tech names. Want a closer look at the specific financial expectations that support this compelling price target? Discover the full breakdown to see which strategic moves are expected to reshape Lamar's value story.

Result: Fair Value of $130.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, such as ongoing contract renewals and softer advertiser demand. These factors could quickly challenge the positive outlook and future growth expectations.

Find out about the key risks to this Lamar Advertising narrative.Another View: Discounted Cash Flow Perspective

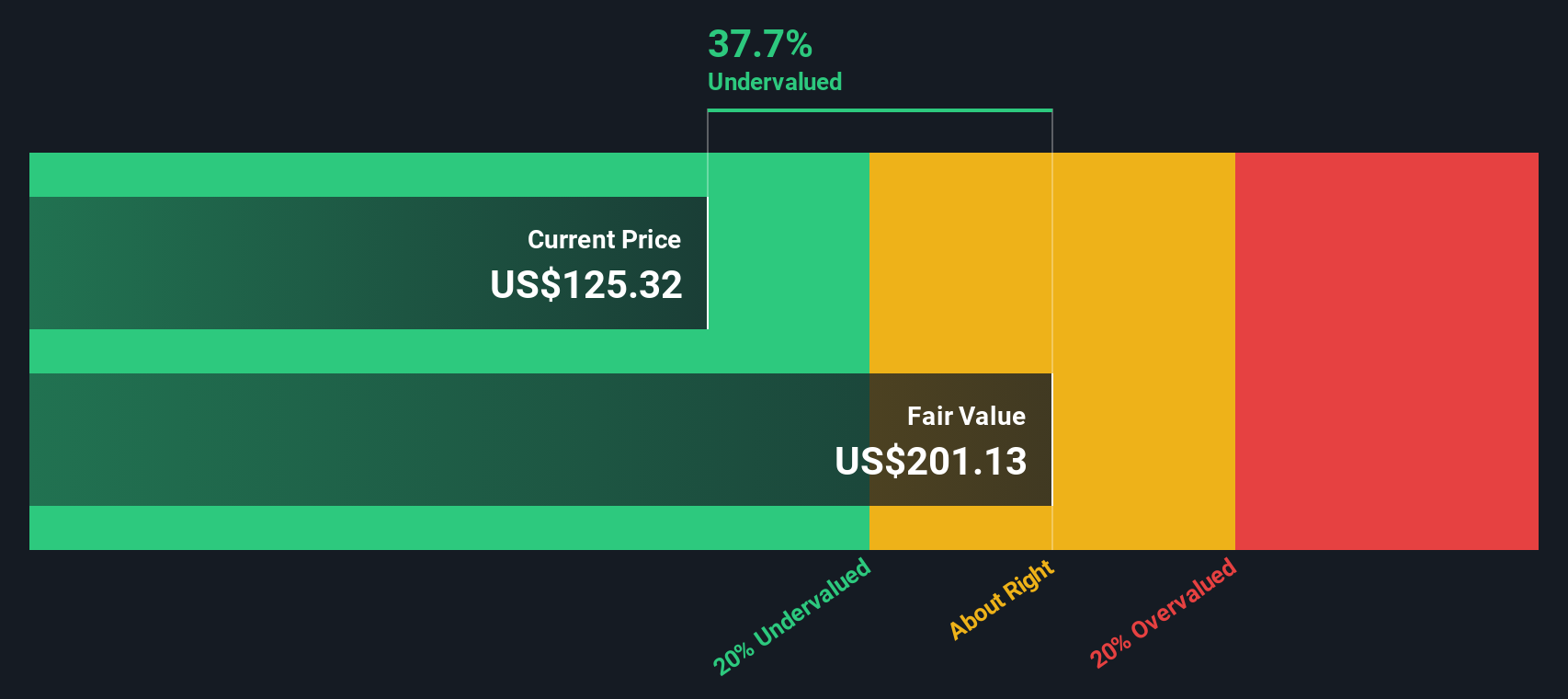

Looking at things from another angle, our SWS DCF model arrives at a different verdict and suggests Lamar Advertising trades at a significant discount to its intrinsic value. Could this point to a deeper opportunity, or is the market right to be cautious?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lamar Advertising Narrative

If you would rather examine the numbers firsthand or take a different approach, you can craft your own narrative for Lamar Advertising in just a few minutes. Do it your way

A great starting point for your Lamar Advertising research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye open for their next opportunity. Use these tailored screeners to find stocks that match your ambitions and could change the way you invest. Miss these, and you might just miss the leaders of tomorrow.

- Boost your search for steady income by checking out companies offering reliable dividend stocks with yields > 3% to strengthen your portfolio.

- Jump into next-generation breakthroughs with top innovators leading the charge in quantum computing stocks and see where quantum tech is heading.

- Seize your chance to spot value gems with potential for price growth by screening for stocks that are undervalued stocks based on cash flows right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal