Will Compa Partnership and Real-Time Pay Data Reshape Willis Towers Watson's (WTW) Long-Term Strategy?

- On September 8, 2025, Compa and Willis Towers Watson announced a partnership to deliver combined real-time offer data and global pay benchmarks, aiming to equip compensation teams with both agility and structure amid changing labor market conditions.

- This collaboration marks a move toward hybrid data strategies in compensation, offering organizations a more complete and defensible framework for pay decisions in the face of growing pay transparency and market volatility.

- We’ll explore how integrating real-time compensation data with validated global benchmarks could influence Willis Towers Watson’s broader investment outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Willis Towers Watson Investment Narrative Recap

To be a Willis Towers Watson shareholder, you need to believe in the company’s ability to evolve its advisory and data offerings fast enough to maintain pricing strength and operating margins as consulting and insurance broking services face pressure from digitization and increased competition. The recent partnership with Compa enhances WTW's data capabilities for compensation consulting, but its impact on near-term revenue catalysts may be limited; the greatest risk remains margin pressure if differentiation slips against major peers.

Among recent developments, WTW’s affirmation of its regular quarterly dividend at US$0.92 per share stands out as a relevant signal of financial stability. Reliable dividend payments may appeal to investors seeking consistent income, especially as WTW pursues new tech-powered growth initiatives like the Compa partnership, which supports efforts to keep pace with changing client needs.

Yet, against these signs of stability, investors should be aware that persistent price and fee compression risks from digital automation and intensifying peer competition could still threaten revenue...

Read the full narrative on Willis Towers Watson (it's free!)

Willis Towers Watson's narrative projects $10.9 billion in revenue and $2.5 billion in earnings by 2028. This requires 3.7% yearly revenue growth and a $2.36 billion increase in earnings from $137.0 million today.

Uncover how Willis Towers Watson's forecasts yield a $364.50 fair value, a 11% upside to its current price.

Exploring Other Perspectives

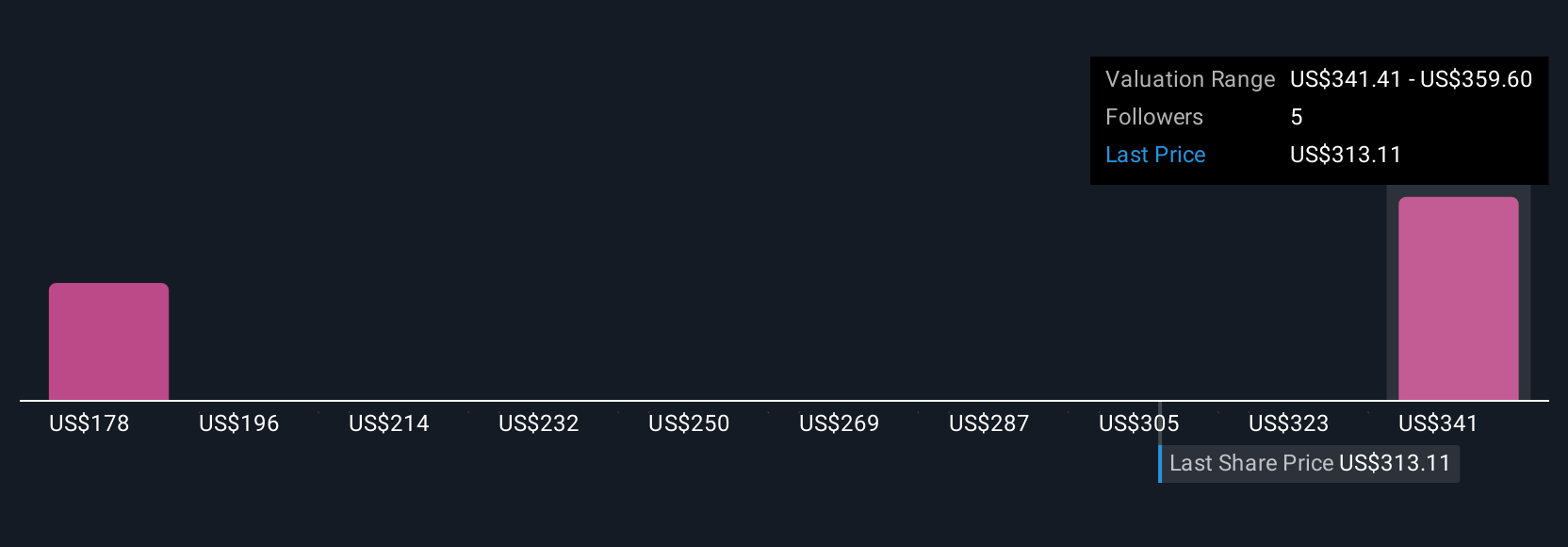

Simply Wall St Community members provided two fair value estimates for WTW, ranging between US$364.50 and US$384.08 per share. While these investor perspectives vary, the company’s growing reliance on hybrid data solutions highlights how adapting quickly to client demands may shape future profitability and growth expectations.

Explore 2 other fair value estimates on Willis Towers Watson - why the stock might be worth as much as 17% more than the current price!

Build Your Own Willis Towers Watson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Willis Towers Watson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Willis Towers Watson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Willis Towers Watson's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal