Oshkosh Corporation (NYSE:OSK) Might Not Be As Mispriced As It Looks

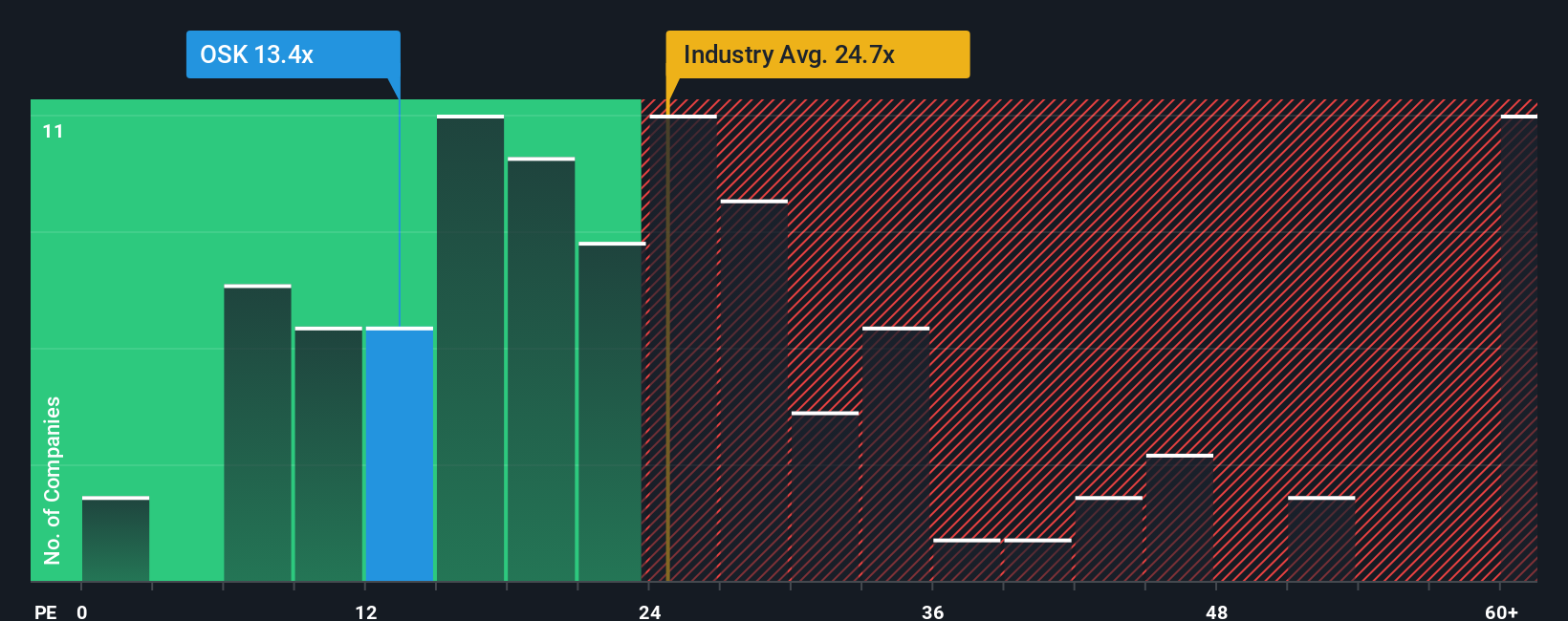

With a price-to-earnings (or "P/E") ratio of 13.4x Oshkosh Corporation (NYSE:OSK) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 20x and even P/E's higher than 34x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Oshkosh hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Oshkosh

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Oshkosh's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 3.9%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 367% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 12% per annum as estimated by the twelve analysts watching the company. With the market predicted to deliver 11% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Oshkosh's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Oshkosh's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Oshkosh's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

Before you take the next step, you should know about the 1 warning sign for Oshkosh that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal