Autodesk (ADSK): Assessing Valuation After Strong Q2 Results and Upbeat Guidance

Autodesk (ADSK) just delivered its second quarter results, and the headlines are worth your attention if you’re weighing what to do with the stock. The company posted increased revenue and earnings compared to the same period last year, reinforcing a picture of steady growth. Management reinforced this momentum by projecting higher numbers for the upcoming quarter and full fiscal year, suggesting confidence in Autodesk’s direction and the resilience of its core business.

This update is part of a broader year that has seen Autodesk’s share price move up by 28% over the past twelve months, outpacing what many software peers have managed. Recent months have also featured events like continued share repurchases and new product integrations, but the revenue and earnings beat, combined with more optimistic guidance, set this moment apart as a potential shift in how the market values Autodesk. Momentum feels like it is building, not fading.

After a year of outperformance and higher guidance, the question becomes whether there is still room for further upside. Is Autodesk undervalued, or is the market already anticipating continued growth?

Most Popular Narrative: 9% Undervalued

The most popular narrative suggests Autodesk is undervalued by 9% based on analysts’ growth forecasts and core business trends.

"Accelerating adoption of cloud-based platforms, such as Autodesk Construction Cloud and Fusion 360, and ongoing rollout of subscription and SaaS models are increasing recurring revenue, improving revenue visibility, and enhancing net margin stability due to higher operating leverage and sales efficiency improvements."

Want to know the bold growth assumptions fueling this "undervalued" call? The narrative leans on future expansion in both revenue and earnings, plus margin gains that outpace many rivals. Wondering which key metrics analysts are betting on? Discover the detailed projections and the potent earnings estimates that could shape Autodesk’s next chapter.

Result: Fair Value of $358.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, increased adoption of open-source alternatives or regulatory challenges could undermine Autodesk’s pricing power and disrupt its projected growth trajectory.

Find out about the key risks to this Autodesk narrative.Another View: What About the Market's Usual Approach?

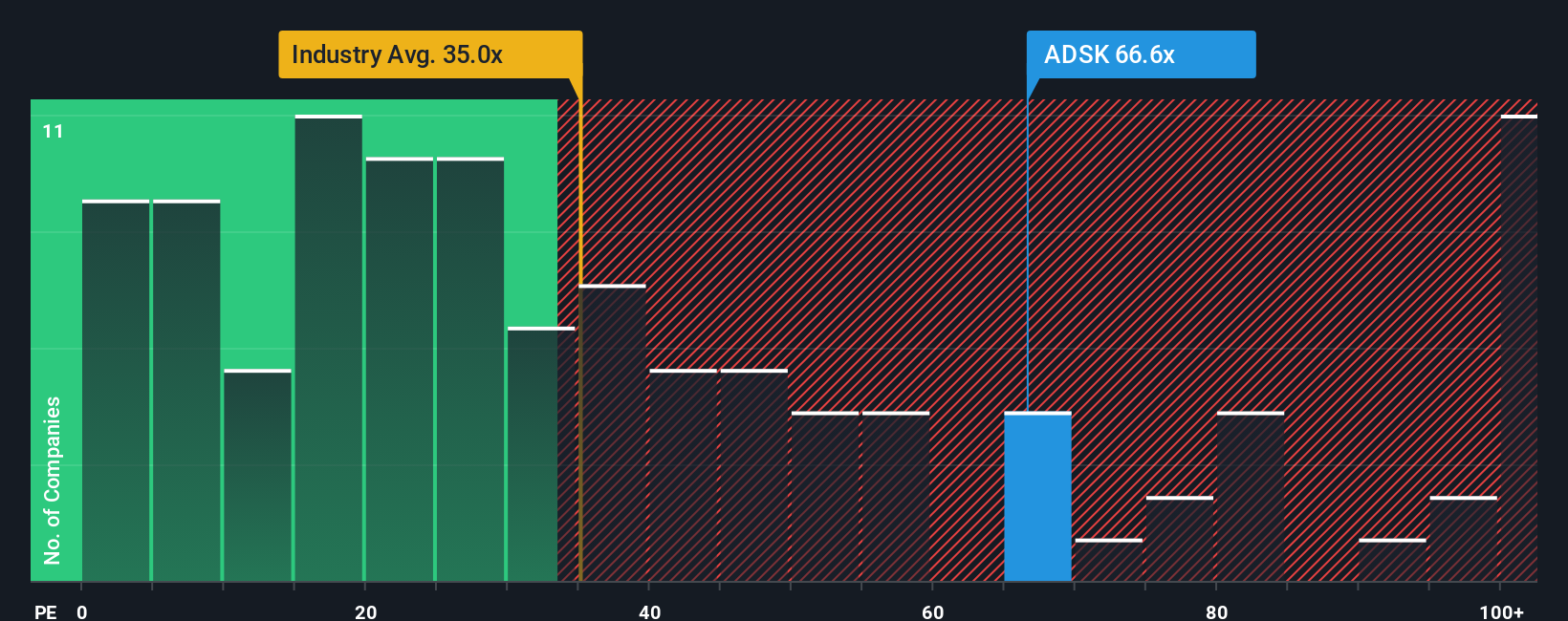

While the analyst narrative points to Autodesk being undervalued, a look at its price-to-earnings ratio tells a different story. Autodesk appears more expensive than the software industry average by this measure. Which method best captures the real opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Autodesk Narrative

If you’d rather dig into the numbers firsthand or want to craft a unique take, building your own perspective is quick and straightforward. Do it your way.

A great starting point for your Autodesk research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Staying ahead means keeping an eye on opportunities others are missing. Use these handpicked screens to spark your next move and uncover stocks you might regret overlooking.

- Spot tomorrow’s tech disruptors early by scanning for strong financials among penny stocks with strong financials that are shaking up the market’s expectations.

- Tap into the cutting edge as artificial intelligence transforms industries with a quick look through leading AI penny stocks that are making big waves in automation and data-driven growth.

- Unlock hidden value and set yourself up for smart returns by targeting companies that stand out as undervalued stocks based on cash flows based on their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal