Oji Holdings (TSE:3861): Assessing Valuation After a Period of Notable Share Price Strength

Oji Holdings (TSE:3861) has seen its stock quietly draw attention, with some investors wondering if the latest moves in the share price are a signal of something more beneath the surface. There has not been a headline-grabbing event this week. However, sometimes it is precisely these quieter moments that spark the biggest questions for value-focused followers. In periods where news is sparse, shifts in sentiment or expectations around fundamentals can become more significant than any single announcement.

Looking at the bigger picture, Oji Holdings’ share price has gained momentum this year, climbing over 51% in the past twelve months and nearly 20% in the past three months alone. Growth in annual net income and stable revenue figures have supported this upswing, while earlier events and industry currents continue to influence long-term conviction. With a strong five-year return and ongoing improvements in underlying performance, the stock’s consistent climb is hard to ignore.

After such a steady rally, the key question remains: is Oji Holdings now offering a bargain for future growth, or has the market already factored in what is to come?

Price-to-Earnings of 32.9x: Is it justified?

Oji Holdings is currently trading at a Price-To-Earnings (P/E) ratio of 32.9x, which suggests the market may be assigning a high premium to its current earnings. This valuation is steep not only compared to its own estimated fair P/E ratio of 20.2x but also when measured against both its Asian forestry industry peers and the broader sector.

The P/E ratio measures how much investors are willing to pay for each unit of company earnings. It is an important metric for assessing whether a stock is expensive or cheap relative to its profit generation. In capital-intensive industries like forestry, a rising P/E often signals expectations for future growth or optimism around stable cash flow. This perspective can also backfire if actual earnings do not live up to projections.

At these elevated levels, it appears the market is potentially overpricing upcoming results, possibly due to expectations of stronger long-term profit growth or recent performance momentum. However, current fundamentals indicate that Oji Holdings is more expensive than both its industry and peer group, which could point to a disconnect between market sentiment and underlying value.

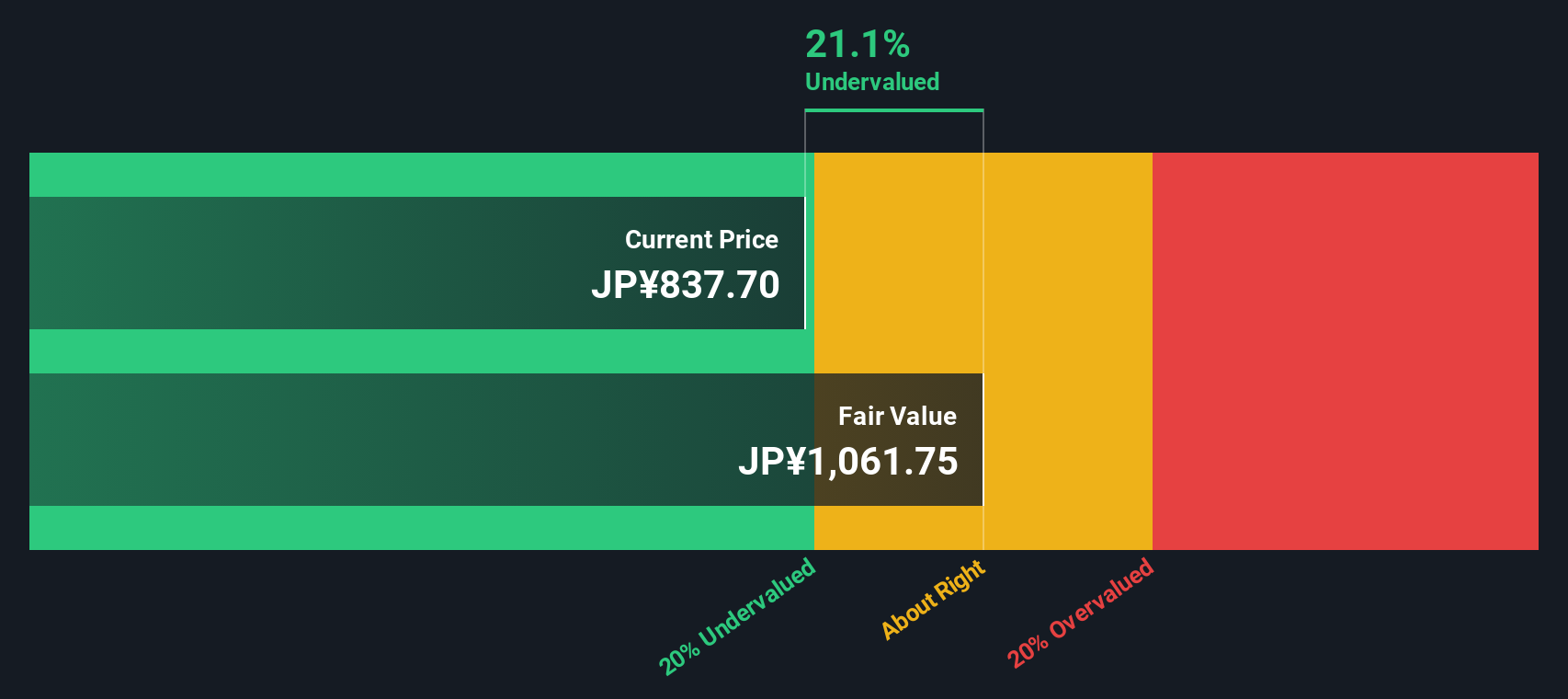

Result: Fair Value of ¥1,051.56 (UNDERVALUED)

See our latest analysis for Oji Holdings.However, slower than expected revenue growth or a sharp shift in market sentiment could quickly challenge the current optimism around Oji Holdings’ valuation.

Find out about the key risks to this Oji Holdings narrative.Another View: What Does Our DCF Model Say?

Taking a step back from market ratios, the SWS DCF model looks at Oji Holdings’ future cash flows to estimate its value. This method also signals the stock may be undervalued, which challenges the concern raised by the high earnings multiple. Could this deeper dive into fundamentals offer a more reliable picture?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Oji Holdings Narrative

If you have your own perspective, or prefer to analyse the figures yourself, you can develop your personal view of Oji Holdings in just a few minutes. Do it your way

A great starting point for your Oji Holdings research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Investment Ideas?

Expand your opportunities by checking out stocks making waves in other high-potential sectors using the Simply Wall Street Screener. Why limit your investing when smarter, sharper choices are just a click away?

- Tap into tomorrow’s breakthroughs by searching for companies at the forefront of artificial intelligence. Get started with our AI penny stocks.

- Boost your income game with picks offering stronger-than-average yields. See the full lineup through our dividend stocks with yields > 3%.

- Catch undervalued gems primed for growth before others notice by using our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal