Evaluating Essential Utilities (WTRG) Valuation After New Data Center Water Plant Deal in Pennsylvania

If you are looking at Essential Utilities (WTRG) right now, you are probably aware of the fresh buzz swirling around its latest move. The company just unveiled a new partnership with International Electric Power III, LLC, which will see Essential design, build, and operate an expansive water treatment plant catering to a massive 1,400-acre data center project in Pennsylvania. For investors, this signals a strategic play into the infrastructure supporting the ongoing boom in data centers, blending water and gas expertise in a way that sits right at the intersection of utility demand and digital transformation.

This news follows gradual but clear momentum in Essential Utilities’ share price over the past year, with the stock rising just under 2% and gaining more ground since January. While the company has not posted a dramatic jump in its price, returns have been steady rather than spectacular. It has kept up a respectable pace considering broader sector pressures. The latest deal, added to leadership changes and other business expansions, suggests Essential is sharpening its focus on innovation and long-term growth, rather than just playing it safe with traditional operations.

With all of this in mind, how should investors view Essential Utilities today? Is its stock undervalued given its expanding role in powering digital growth, or has the market already accounted for this future potential?

Most Popular Narrative: 17.3% Undervalued

The most widely followed narrative values Essential Utilities at a notable discount to its fair value, suggesting room for upside if analyst expectations play out. The consensus hinges on robust infrastructure investment, population-driven demand, and steady regulated growth, contributing to views that the stock has not fully priced in its future potential.

Ongoing and anticipated infrastructure investment, $1.4 billion planned for 2025 and a multi-year CAGR of 6-8% in regulated rate base, positions Essential Utilities to capitalize on expanding, long-term demand for water and wastewater services due to population growth and urbanization. This supports reliable revenue and cash flow growth. Growing regulatory emphasis on water quality (for example, PFAS compliance) and aging infrastructure creates acquisition opportunities as municipalities struggle to meet new standards. Essential's scale, patented PFAS solution, and capital resources should enable accelerated top-line growth and margin expansion via strategic acquisitions.

Want to know which bold assumptions push Essential Utilities far above its current price? Discover the key financial levers and the unexpected metrics that make analysts bullish. The drivers behind this valuation will surprise you. Tap into the story for the full breakdown and find out what’s fueling these projections.

Result: Fair Value of $46.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising regulatory scrutiny on rate increases, along with slower customer growth in key markets, could easily challenge the optimistic case for Essential Utilities.

Find out about the key risks to this Essential Utilities narrative.Another View: What Does Our DCF Model Say?

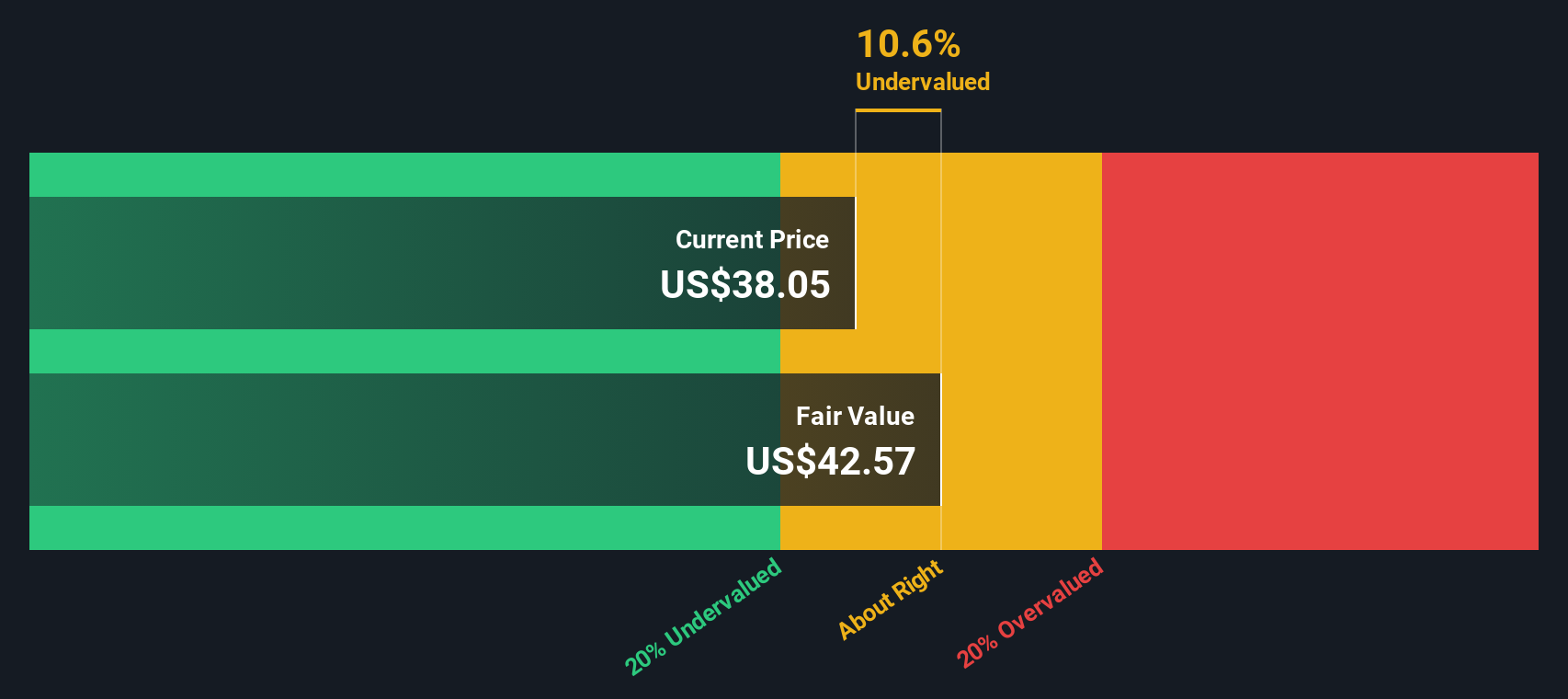

Looking at Essential Utilities from a different angle, our DCF model also suggests the shares are trading below fair value. This method weighs future cash flows. Could these findings signal an overlooked opportunity for investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Essential Utilities Narrative

If you see things differently or want to investigate the numbers on your own, you can shape a personal valuation story in just a few minutes. Do it your way

A great starting point for your Essential Utilities research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Standout Opportunities?

Missing out on the next breakthrough is too easy if you stick to just one stock. Take charge of your investment journey and find fresh momentum with these powerful tools:

- Unlock steady income streams by checking out dividend stocks with yields > 3%, featuring companies offering robust dividends above 3%. This is essential for any yield-focused portfolio.

- Spot tomorrow’s disruptors by scanning AI penny stocks and stay ahead with firms making waves in artificial intelligence and automation.

- Supercharge your search for hidden value with our handpicked undervalued stocks based on cash flows. These opportunities could be exactly what others are missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal